pool ads

pool adsAmerican Eagle $AEO is Strong on a Midterm and Long Term Basis, Shown in Charts and Graphs

American Eagle (NYSE: AEO) is Strong on a Midterm and Long Term Basis, Shown in Charts and Graphs below. Important: Check the date of this report and update it as needed. The data changes over time.

Technical Summary

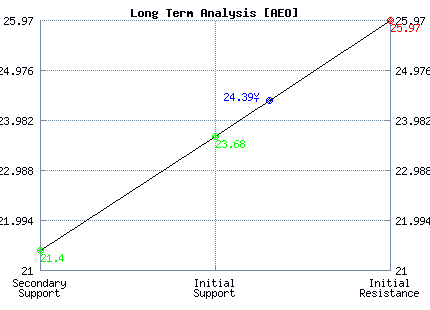

| Term → | Near | Mid | Long |

|---|---|---|---|

| Rating | Neutral | Strong | Strong |

| P1 | 23.29 | 21.75 | 21.40 |

| P2 | 24.04 | 23.79 | 23.68 |

| P3 | 24.55 | 25.80 | 25.97 |

Support and Resistance Plot Chart for AEO

Long Term Trading Plans for AEO

June 21, 2018, 8:36 am ET

The technical Summary and associated Trading Plans for AEO listed below will help you make important timing decisions for your trades. This data is based on our proprietary analysis for AEO. In addition we offer Market Timing Models and Stock Filters in the links above which may increase the proficiency of the decisions you make.

AEO - (Long) Support Plan

Buy over 23.68 target 25.97 stop loss @ 23.42.

The technical summary data tells us to buy AEO near 23.68 with an upside target of 25.97. This data also tells us to set a stop loss @ 23.42 to protect against excessive loss in case the stock begins to move against the trade. 23.68 is the first level of support below 24.39 , and by rule, any test of support is a buy signal. In this case, support 23.68 is being tested, a buy signal would exist.

AEO - (Short) Resistance Plan

Short under 25.97 target 23.68 stop loss @ 26.23

The technical summary data is suggesting a short of AEO as it gets near 25.97 with a downside target of 23.68. We should have a stop loss in place at 26.23 though. 25.97 is the first level of resistance above 24.39, and by rule, any test of resistance is a short signal. In this case, if resistance 25.97 is being tested, a short signal would exist.

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial