pool ads

pool adsBlackBerry Ltd (NASDAQ:BBRY) Price Target Maintained

On February 2, 2016, when shares of BlackBerry Ltd (NASDAQ:BBRY) were trading under $7 per share, Stock Traders Daily placed a Strong Buy Rating on the stock. Since then the stock has increased by approximately 16%. BBRY is now approaching our target levels, so this article serves as an update to the Strong Buy Recommendation.

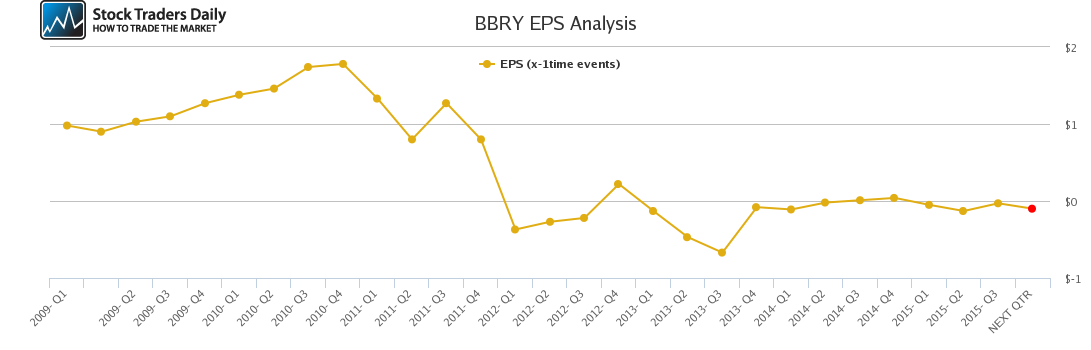

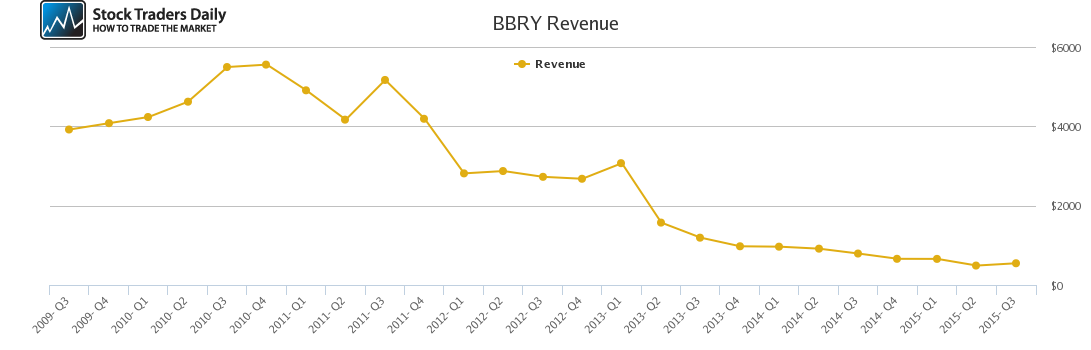

With all of the focus on AAPL recently, it's easy to forget that BBRY is the leader in mobile security, and it is due to its positioning that BBRY remains viable. As a pure phone play, BBRY is less relevant of course, but as a mobile security company, BBRY is putting together a nice vertical channel.

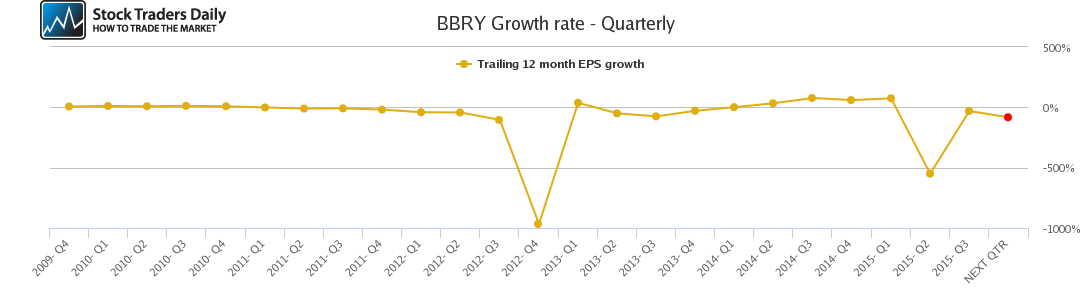

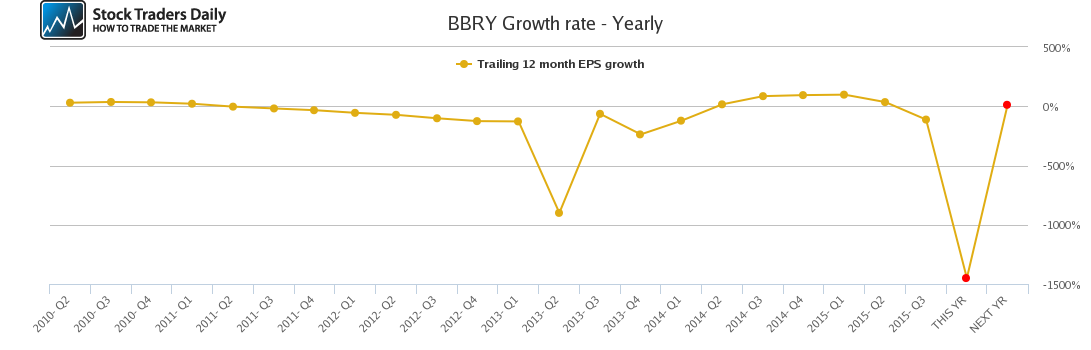

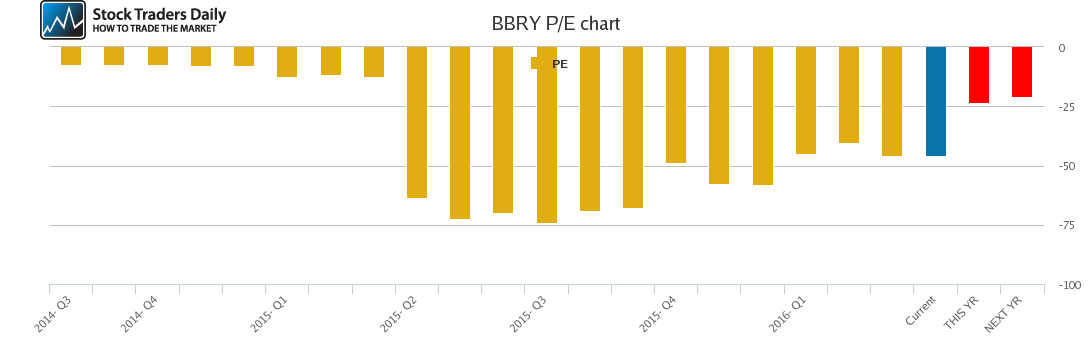

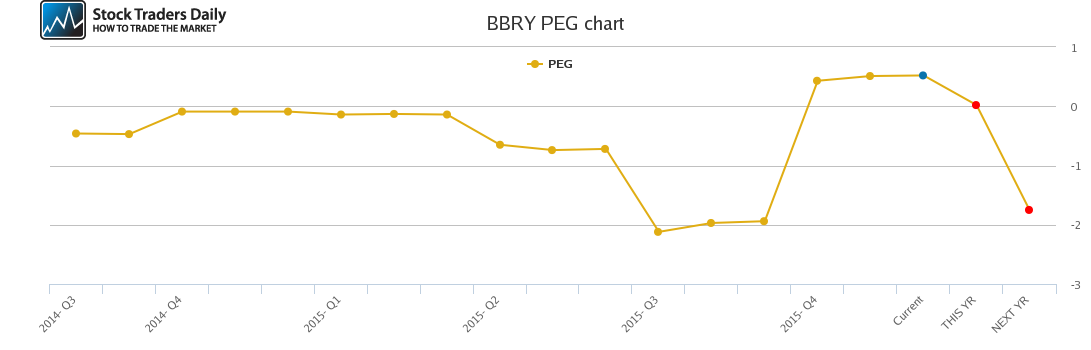

Clearly the above is a general observation, but a general understanding is all that is needed when trading stocks like this. Looking at BBRY from a valuation standpoint, the stock was trading virtually on par with Revenue (Revenue and market cap were almost the same), at the beginning of February, while revenue was expected to increase too. That told us BBRY was a value and a viable opportunity.

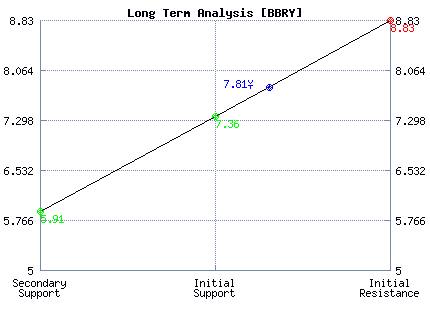

Now he stock is approaching our resistance levels. In our longer term observations, resistance is LT P3, a level that will update periodically as the stock moves. As we get closer o that level we will be more compelled to recommend taking profits.

Technical Summary

| Term → | Near | Mid | Long |

|---|---|---|---|

| Rating | Strong | Strong | Neutral |

| P1 | 7.54 | 5.42 | 5.91 |

| P2 | 7.99 | 6.92 | 7.36 |

| P3 | 0 | 8.38 | 8.83 |

Support and Resistance Plot Chart for BBRY

Long Term Trading Plans for BBRY

March 4, 2016, 10:26 am ET

The technical Summary and associated Trading Plans for BBRY listed below will help you make important timing decisions for your trades. This data is based on our proprietary analysis for BBRY. In addition we offer Market Timing Models and Stock Filters in the links above which may increase the proficiency of the decisions you make.

BBRY - (Long) Support Plan

Buy over 7.36 target 8.83 stop loss @ 7.1.

The technical summary data tells us to buy BBRY near 7.36 with an upside target of 8.83. This data also tells us to set a stop loss @ 7.1 to protect against excessive loss in case the stock begins to move against the trade. 7.36 is the first level of support below 7.81 , and by rule, any test of support is a buy signal. In this case, support 7.36 is being tested, a buy signal would exist.

BBRY - (Short) Resistance Plan

Short under 8.83 target 7.36 stop loss @ 9.09

The technical summary data is suggesting a short of BBRY as it gets near 8.83 with a downside target of 7.36. We should have a stop loss in place at 9.09 though. 8.83 is the first level of resistance above 7.81, and by rule, any test of resistance is a short signal. In this case, if resistance 8.83 is being tested, a short signal would exist.

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial