pool ads

pool adsBrexit Opens the Door for a Market Crash: QID, SPY, DIA

Brexit is a huge deal, but the real impact may not be spearheading the knee jerk reactions and the initial news headlines. On Wednesday, I published an article that suggested the financial costs of Brexit would far outweigh the benefits, and in my opinion we will soon see that become a reality.

Not unlike other observers who are happy to vocalize their opinion now that the cat is out of the bag, I suggested on Wednesday that property values would likely decline quite aggressively if the UK left the EU. The opinion of the layman is that would make prices more affordable, but the reality is that the property bubble that exists currently has also helped to spur the economy and when that bubble bursts, which seems imminent now, the economy in the UK will get hit squarely and those people who might otherwise be potential buyers might find it much more difficult to do during recessionary or depression era environments. Recession is exactly what I am expecting in the UK, but it could be worse.

The exodus of financial companies from London is also something that I think will happen soon as London loses its standing as the financial hub for the EU, and that exacerbates the problem that currently exists in the risks perceived by the financial markets immediately, but again these are not the most important repercussions of this Brexit decision.

Instead, the catalyst that is Brexit could likely be the turning point that will trigger a financial market crash in the United States and in global markets in parallel.

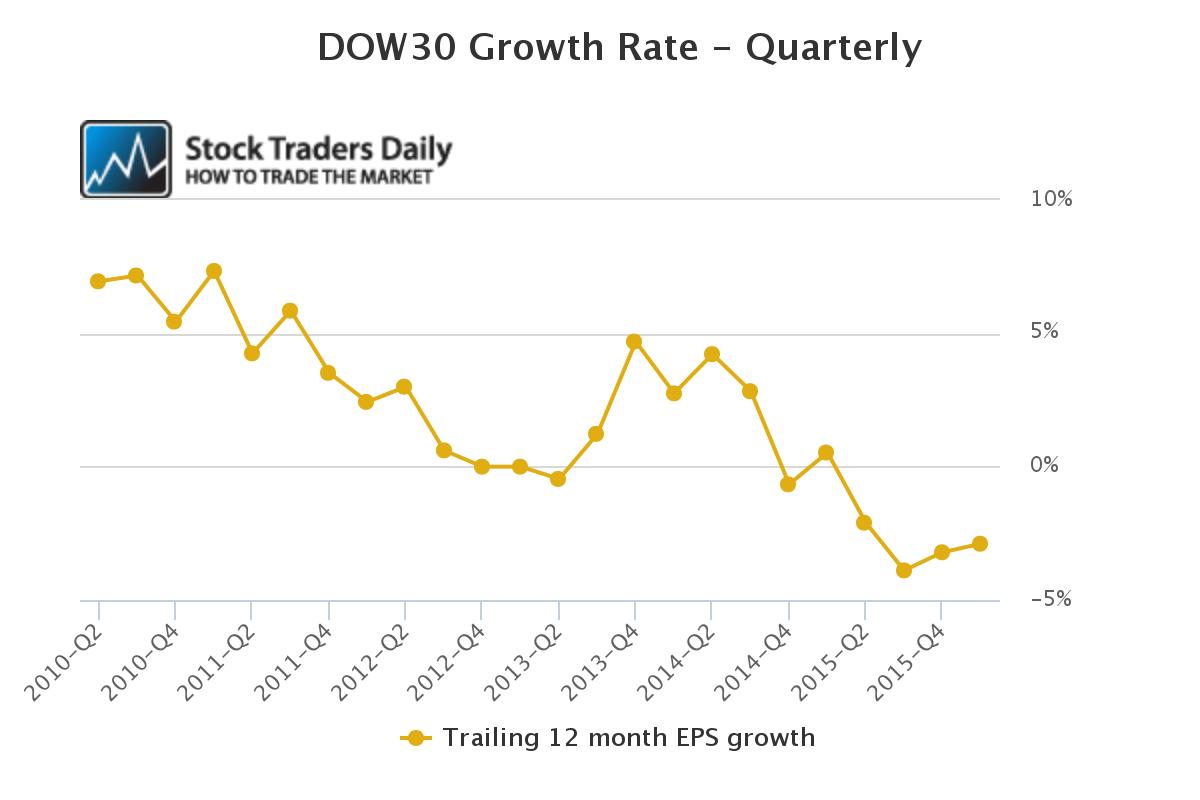

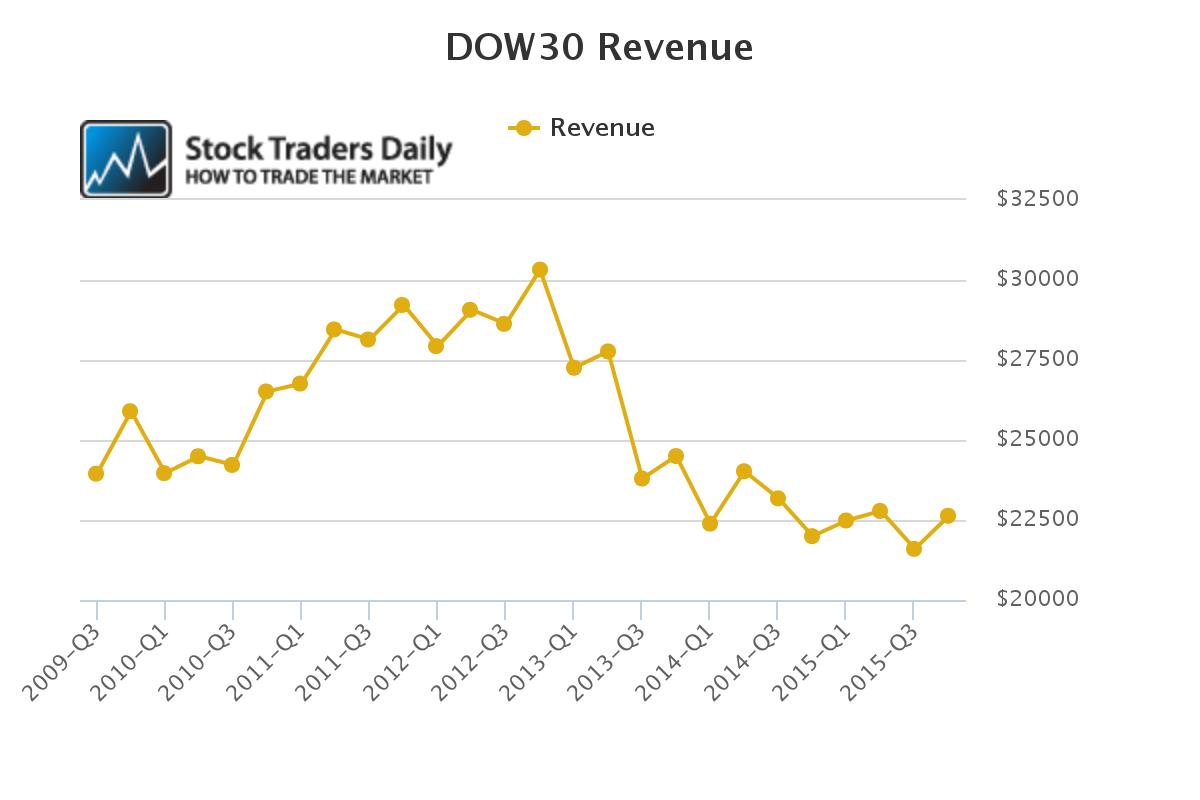

I have spoken of the excess valuation levels in our markets many times in the past, I have demonstrated that the dow Jones industrial average has had a steady decline in revenue and earnings, yet the market has pressed higher and multiples have expanded, and the multiple currently levied on the dow Jones industrial average is about 17x, which corresponds to the multiple on the S&P 500, 19x. Check DIA and SPY for confirmation.

These high multiples exist in an environment where earnings are weak and likely to continue to be weak, which begs the question, why are buyers buying?

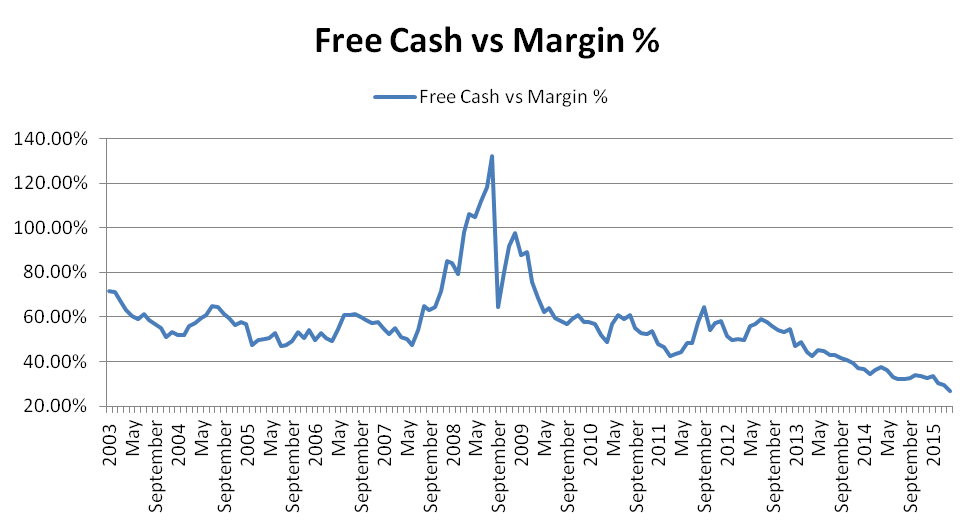

The answer stems back to last year, which was the third year of a second presidential term, and the markets had NEVER been down in history in that environment. We cannot be sure if this was the reason, but we do know that institutions piled on margin debt last year, and the cash – margin debt ratio on the NYSE was pressed to all-time lows, suggesting that investors had less cash as a percentage of margin debt than at any time before in history. In my opinion, they did this expecting the market to be solid last year, but they were wrong. Still, that buying influenced multiple expansion in the face of very bad earnings and revenue.

Since then, margin debt has only been reduced slightly, but here we are with the same multiples. No one has really worried to much about the multiples because they didn’t really have to, there were no catalyst for long lasting concern, and although we cannot call them sanguine, investors were rather patient in the face of that, because they could be.

However, as I have warned, the moment that changes, the moment institutions perceive longer lasting risks, they will start to reduce margin debt exposure considerably.

In my opinion, Brexit can be that catalyst, and probably will be when the dust settles 18 months from now, but we won’t be sure until after he fact.

Brexit will probably be identified as the turning point.

If that is true, and multiples contract to a level that is more reasonable, and more in line with earnings growth rates, which currently are negative by the way, we could easily see a 12-13 multiple on the S&P, and it is 19x today. Do the math, and that’s a 32% decline, without any material change to the business environment.

However, Brexit will have repercussions in the business environment too, so it is coming from all sides. The most important though, without a doubt, is the influence Brexit has over investors who have until now ignored valuation; their attention to improperly valued markets will cause multiple contractions, asset rebalancing, and set the stage for a market crash.

Stock Traders Daily offers proactive strategies that can work in any market, and our LETS strategy was holding QID going into this. For details about LETS and our other proactive strategies please inquire on our website.

Support and Resistance Plot Chart for

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial

Fundamental Charts for :