pool ads

pool adsDid Jeff Bezos Get the Message from Warren Buffet?

A year ago, investors were complaining that Jeff Bezos, although a maverick and a great leader, had no interest in corporate profits. The argument was that revenue growth did not translate into earnings, and therefore did not itself enhance shareholder value. Even Warren Buffet admitted that he did not understand the value proposition last year.

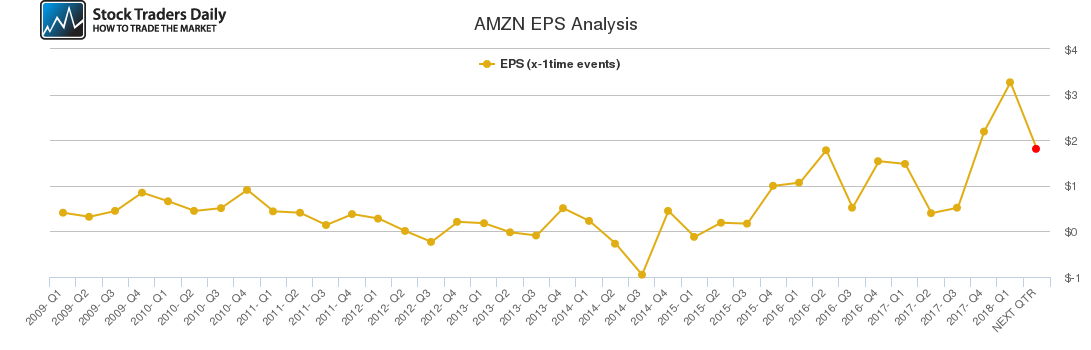

However, somewhere along the line the message got through. The most recent quarterly earnings result for Amazon (NASDAQ: AMZN) proved that; quarterly EPS grew by 120% in Q1 2018 vs Q1 2017. This trend is also expected to continue. If analysts are right about their estimates, AMZN will better last year’s quarterly result by 352%.

Quickly, the concerns that Amazon could not bring revenues to the bottom line, or that Bezos did not care about earnings, are being quieted.

Of course, the acquisition of Whole Food Market has an influence on these results, and some might still argue that the bulk of the revenue, which comes from online retail, does not bring anything to the bottom line. This is true, but that also gives AMZN the power to make acquisitions. We cannot discount the eyeballs that come from the retail side of the business even though that segment may lose money.

With earnings from Whole Foods finally starting to show up in the earnings results, we expect Trailing 12-Month (TTM) results to look excellent for a while. Our Quarterly TTM Growth Estimates suggest 22% quarterly earnings growth in Q2 2018 vs Q1 2018 too. That is a massive change in one short quarter, and it exemplifies the significance of TTM observations.

Analysts who use TTM growth models are going to see exceptional and eye-popping growth from AMZN for a while, but what happens afterwards?

After the earnings from Whole Foods Market are digested into earnings will ongoing comps continue to look as good? Or, will earnings growth simply stagnate again like they had before?

Although the immediate Earnings Growth Trend looks great, it is not coming from the company’s core business and main revenue source, online retail. The ability of AMZN to sustain growth rates going forward should therefore be questioned, but we doubt anyone is going to care right away.

Immediately, the focus is going to be on the eye-popping results, but once the TTM comps include earnings from Whole Foods Market that is going to change. Be ready for it.

Review our Fundamental Charts and Trading Plans for AMZN on our website.

Support and Resistance Plot Chart for AMZN

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial