pool ads

pool adsDownside Risk Defined for Bitcoin (BTC)

Our ongoing analysis of Bitcoin (BTC) and the associated trading recommendations we have provided to clients currently reveal additional downside risk.

Listen to the Audio Version of this Article

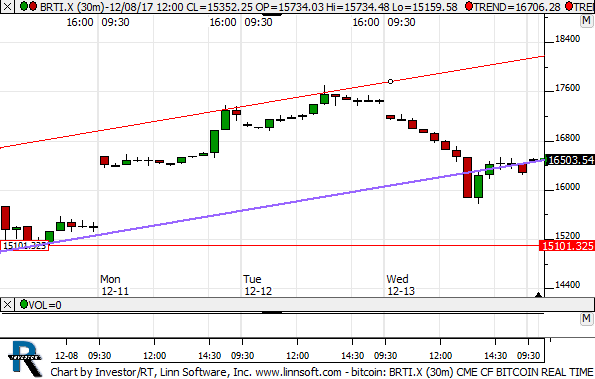

On a near-term basis Bitcoin had developed a near term upward sloping channel, but on Wednesday that channel began to break. Currently the price is right on the upward sloping trendline but the upward sloping trendline has already broken slightly and that makes it vulnerable.

According to our observations the immediate downside risk for Bitcoin is 1501. If Bitcoin remains below 16,500 we expect 15O1.

Review the chart associated with this analysis and expect continued communication related to Bitcoin to be promptly supplied to our clients going forward.

Support and Resistance Plot Chart for

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial

Fundamental Charts for :