pool ads

pool adsIs Apple $AAPL still a Market Leader?

Is Apple still a Market Leader?

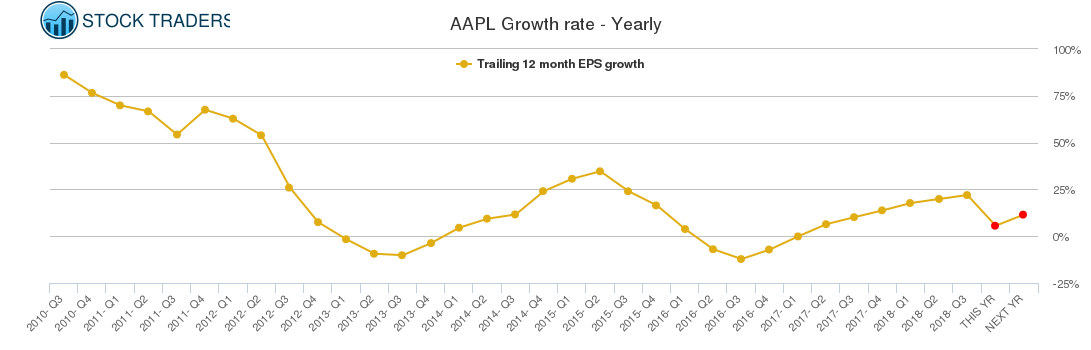

Leadership stocks in the Market are changing, and Investors should understand the implications these changes will have on their ability to identify upcoming market moves.

Apple Inc. (NASDAQ: AAPL) is a clear example. On Monday AAPL was down but the NASDAQ-100 (INDEXNASDAQ: NDX) was up solidly. This almost never happens. Because AAPL has been a leader for so long and it is dominant in terms of sheer size, investors expect it to lead the market, and investors have used it as a barometer for a long time.

After the declines in AAPL late last year, that direct correlation has faded, although the broad correlation is rather direct.

For example. on Tuesday, during volatile market conditions this lack of day-day correlation was clear. AAPL, a stock that investors have long relied upon, no longer seems to represent market conditions as well as it has, or does it?

Shares of AAPL have declined aggressively, they are choppy and they lack direction, and the chart patterns point to high degrees of risk. Does that sound familiar? This is exactly what the Market is like.

Although AAPL may have lost some day-day correlation, it may not actually have lost its leadership role. The leadership may not be what investors want, many want AAPL to lead on the way up, but they may be getting something else instead.

Instead of leading on the way up, AAPL may be warning us that more choppy and volatile conditions lay ahead. This may not be what investors want to hear, or the leadership they expected, but if AAPL is still a leader that’s the exact warning it is giving us.

To demonstrate the choppiness, we have produced a Trading Report for AAPL. Notice the longer term parameter chart and the proximity of AAPL to longer term support. This tells us that AAPL is choppy and volatile around longer term support levels.

Support and Resistance Plot Chart for AAPL

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial