pool ads

pool adsKilroy Realty $KRC Technical Update

The Kilroy Realty (NYSE: KRC) update and the technical summary table below can help you manage risk and optimize returns. We have day, swing, and longer-term trading plans for KRC, and 1300 other stocks too, updated in real time for our trial subscribers. The data below is a snapshot, but updates are available now.

Technical Summary

| Term → | Near | Mid | Long |

|---|---|---|---|

| Rating | Neutral | Neutral | Neutral |

| P1 | 68.03 | 66.27 | 65.35 |

| P2 | 69.73 | 68.81 | 70.62 |

| P3 | 71.40 | 71.45 | 75.59 |

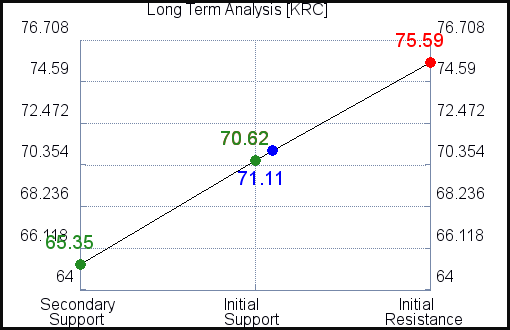

Support and Resistance Plot Chart for KRC

Long Term Trading Plans for KRC

December 7, 2018, 6:00 am ET

The Technical Summary and Trading Plans for KRC help you determine where to buy, sell, and set risk controls. The data is best used in conjunction with our Market Analysis and Stock Correlation Filters too, because those help us go with the flow of the market as well. Going with the flow is extremely important, so review our Market Analysis with this KRC Report.

KRC - (Long) Support Plan

The technical summary data tells us to buy KRC near 70.62 with an upside target of 75.59. This data also tells us to set a stop loss @ 70.36 to protect against excessive loss in case the stock begins to move against the trade. 70.62 is the first level of support below 71.11 , and by rule, any test of support is a buy signal. In this case, support 70.62 is being tested, a buy signal would exist.

KRC - (Short) Resistance Plan

The technical summary data is suggesting a short of KRC as it gets near 75.59 with a downside target of 70.62. We should have a stop loss in place at 75.85 though. 75.59 is the first level of resistance above 71.11, and by rule, any test of resistance is a short signal. In this case, if resistance 75.59 is being tested, a short signal would exist.