pool ads

pool adsMohawk Industries $MHK Technical Update

The Mohawk Industries (NYSE: MHK) update and the technical summary table below can help you manage risk and optimize returns. We have day, swing, and longer-term trading plans for MHK, and 1300 other stocks too, updated in real time for our trial subscribers. The data below is a snapshot, but updates are available now.

Technical Summary

| Term → | Near | Mid | Long |

|---|---|---|---|

| Rating | Strong | Strong | Neutral |

| P1 | 148.29 | 137.23 | 102.70 |

| P2 | 150.81 | 145.74 | 131.29 |

| P3 | 152.40 | 152.79 | 159.23 |

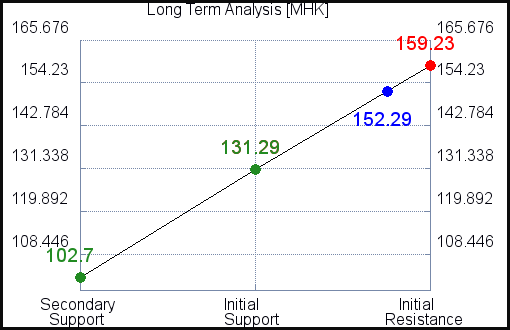

Support and Resistance Plot Chart for MHK

Long Term Trading Plans for MHK

June 16, 2019, 2:15 pm ET

The Technical Summary and Trading Plans for MHK help you determine where to buy, sell, and set risk controls. The data is best used in conjunction with our Market Analysis and Stock Correlation Filters too, because those help us go with the flow of the market as well. Going with the flow is extremely important, so review our Market Analysis with this MHK Report.

MHK - (Long) Support Plan

The technical summary data tells us to buy MHK near 131.29 with an upside target of 159.23. This data also tells us to set a stop loss @ 131.03 to protect against excessive loss in case the stock begins to move against the trade. 131.29 is the first level of support below 152.29 , and by rule, any test of support is a buy signal. In this case, support 131.29 is being tested, a buy signal would exist.

MHK - (Short) Resistance Plan

The technical summary data is suggesting a short of MHK as it gets near 159.23 with a downside target of 131.29. We should have a stop loss in place at 159.49 though. 159.23 is the first level of resistance above 152.29, and by rule, any test of resistance is a short signal. In this case, if resistance 159.23 is being tested, a short signal would exist.