NRS Explains Why Economy Is Not Stronger

I listened to Tim Geithner explain his rationale, and almost cringed. To paraphrase, he said that the reason the economy was not stronger today was that the Government took its foot off of the gas pedal soon after the 2008 meltdown, implying that economic recovery (growth) was reliant on the government.

Anyone in business today probably is quite happy right now after all that has happened, but those words must be listened to quite carefully, and then additional work must be done. The implications suggest that had it not been for the massive stimulus programs the economy would not be where it is, and that is exactly right. Geihtner's words also imply that those measures were required to stave off a Greater Depression and the collapse of the Financial System, something that I largely agree with, but the lingering question concerns the sustainability of economic growth without Government intervention.

Logically, given the tapering program initiated by Bernanke and thus far supported by Janet Yellen, a close look at the current Net Real Stimulus is warranted, and it helps us gauge the stock market. My definition of Net Real Stimulus (NRS) is as follows:

NRS = FOMC Stimulus - Domestic UST Operations.

The equation above implies an inverse foreign multiplier (excluding bills and notes) and recognizes that US Treasury operations remove liquidity from the financial system, offsetting the stimulus efforts of the FOMC. NRS is very important and it identifies the real flow of liquidity into the financial system.

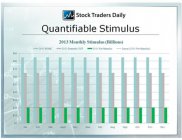

During Calendar 2013 that liquidity flowed like water, but the face value of the stimulus program was far different than NRS. During 2013, NRS was approximately $20B monthly, while the face value of the program was $85B, a substantial difference. The incorporated foreign multiplier was 0.85.

Fiscal 2014 is less demanding for the US Treasury due primarily to higher tax revenues, and the Government expects lower debt issuance as a result. This must be factored into the equation to extrapolate expected future NRS, as must the tapering schedule.

With those recognized in our 2014 evaluation, NRS effectively was flat beginning in April, 2014, and is now scheduled to become net-negative. The already approved next round of tapering will cause a net drain on liquidity in the financial system for the first time in recent memory, at a rate of about 1/2 the positive NRS during 2013.

The exodus of excess liquidity is already tangible in the financial system and the riskiest asset classes are feeling the first round of pain. The Russell 2000 (NYSE:IWM) and the high fliers in the NASDAQ (NASDAQ:QQQ), stocks that rely on excess liquidity levels to thrive, have recently been hit as institutional investors rotate to traditionally safer investments in stocks like those in the Dow Jones Industrial Average (NYSE:DIA).

Therefore, the liquidity changes are already being recognized in financial circles and in asset classes that were direct beneficiaries, but these are only the early innings. As Government intervention is removed, the implications of Tim Geightner recently should be heard loud and clear. Had it not been for the Government the recovery would not have happened. My thesis is, without the Government, the economy will not sustain recent growth rates either.

Support and Resistance Plot Chart for

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial

Fundamental Charts for :