pool ads

pool adsRising Health Care Costs and UnitedHealth Group Inc (NYSE: UNH)

If you were ever wondering why medical costs in the United States are so expensive, you need look no further than the revenues of the big companies in the health industry.

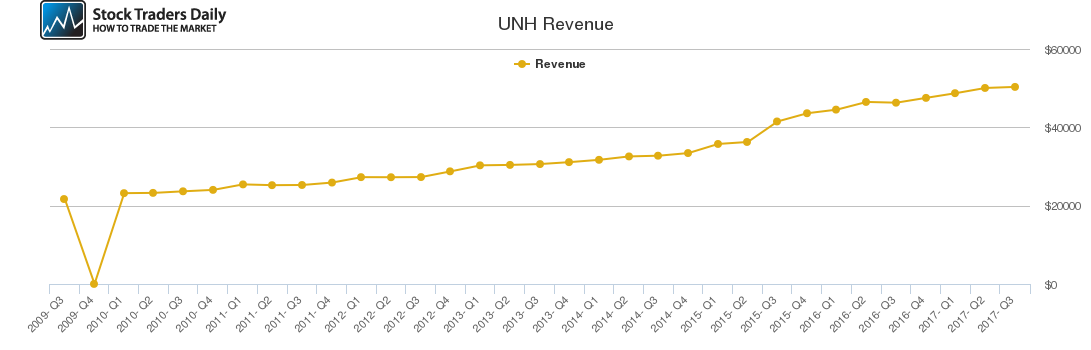

UnitedHealth Group Inc (NYSE: UNH) is a great example. Since Obamacare officially began in January 2014 revenues at UNH have increased by 61%. The chart below depicts that revenue growth.

The PE multiple for UNH is also very high, but with corresponding growth the actual valuation metrics do not look expensive even with a high PE multiple. Review the PEG ratio in our complete UNH Report.

Support and Resistance Plot Chart for UNH

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial