Should You Buy FedEx Corporation (NYSE:FDX)

What do you look for when you buy a stock in a company? Are you looking to jump on the bandwagon, or are you a prudent investor who is looking for value? If you are looking for value you might find it very hard to identify value stocks in this market, you might even be tempted to give in because of market action, and some of the most popular stocks on the Street are the most tempting, but if you are a value player you know that's the wrong thing to do.

In keeping with that, let's look at what not to do.

Are you looking for a stock that is trading at 5x its earnings growth rate, a stock that has been growing at a slower pace consistently for the past few quarters, a stock that is expected to continue to grow at a subdued pace, but one whose stock price has increased aggressively?

Of course, most people do not search for companies with these attributes. In fact, one might argue that when investors look for companies they look for companies with the exact opposite qualities. Investors prefer to find stocks that trade at relatively low valuations compared to earnings growth, stocks that have not already run aggressively, and stocks that actually have improving earnings growth. That is, if your definition of an investor is one that looks for long-term value.

There are other definitions of course, some people consider an investor someone who buys the market every month like clockwork, but the market is comprised of all stocks, some of which have good valuations, and some that don't.

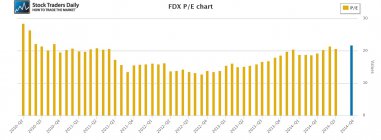

If you are looking for a company who has had deteriorating earnings growth, who is expected to continue to grow at a subdued pace, who is trading at five times its earnings growth rate, but a stock that has also increased aggressively, look no further than FedEx Corporation (NYSE:FDX)

Federal Express is a poster child for an overvalued company. A simple review of the valuation metrics shown in the graphs below demonstrate the points made above. Because Federal Express is a company that so many investors know of any use, they may be tempted to incorporate the Random Walk theory to influence their decision to invest. For example, if you use the service and like it, Random walk theory suggests that you might want to invest in it, but more work needs to be done before decisions are made.

Right now it seems that investors in FedEx are hoping that the company does better, but the projections from the company suggest that growth rates are not going to warrant PE multiples for years.

With those fundamental observations in Tow, what do the technicals say? According to our real time trading report for FDX the stock is at longer term resistance right now. That adds another element to that question above. If you are looking for a stock that is overvalued and a stock that is at long term resistance too, you have found it in FedEx.

FDX Valuations Graphs:

Support and Resistance Plot Chart for

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial

Fundamental Charts for :