The Coca-Cola Co (NYSE:KO) Initiated with a Sell Rating

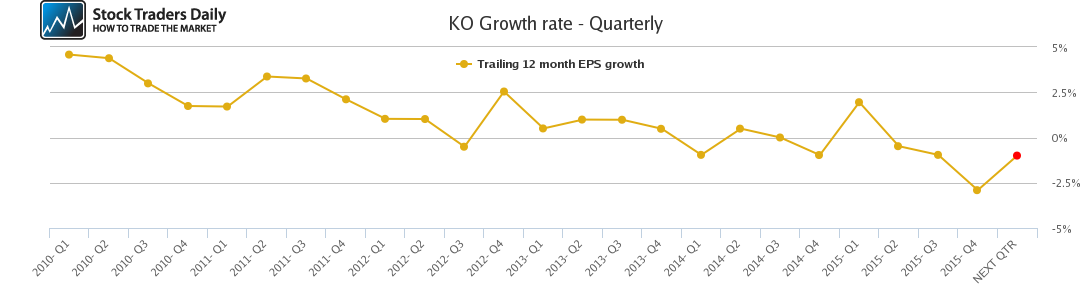

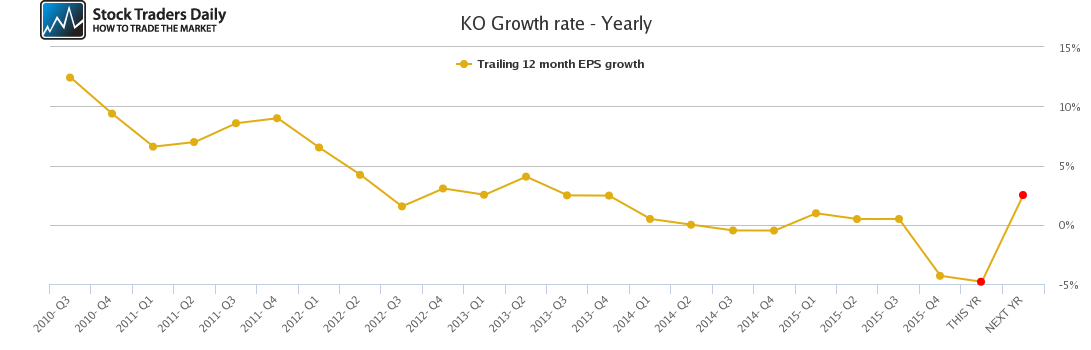

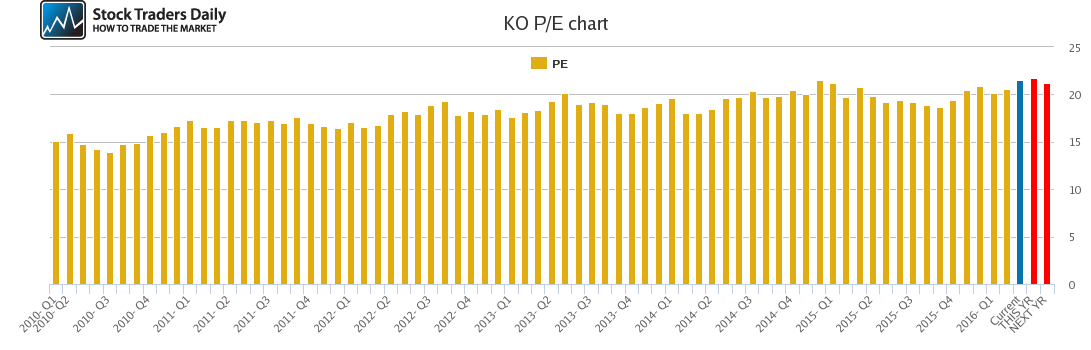

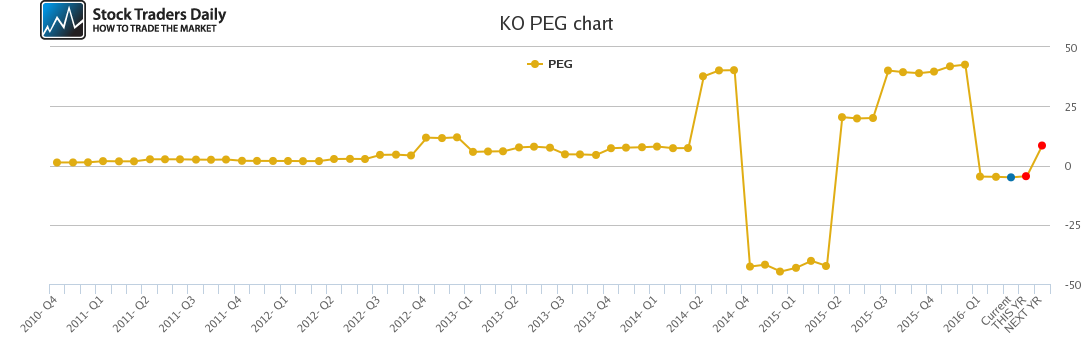

As far as The Coca-Cola Co (NYSE:KO) is concerned, valuation looks stretched. This is directly related to the high PE multiple and low relative growth rates. In fact, growth is expected to be dismal. The only positive takeaway is that KO products are often considered staples, even though they are in many cases discretionary, but that connotation often draws in safe-haven investors.

The problem here is that hose safe-haven investors, which are largely a conservative demographic, can easily miss the stretched valuation characteristics of a company like KO, while relying solely on the name, brand, or connotation. That lasts until it doesn't, and eventually investor willingness to ignore valuation in favor of connotation dissolves, and when it does those stocks fall.

We expect exactly this to happen to shares of KO.

Support and Resistance Plot Chart for KO

Blue = Current Price

Red = Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial

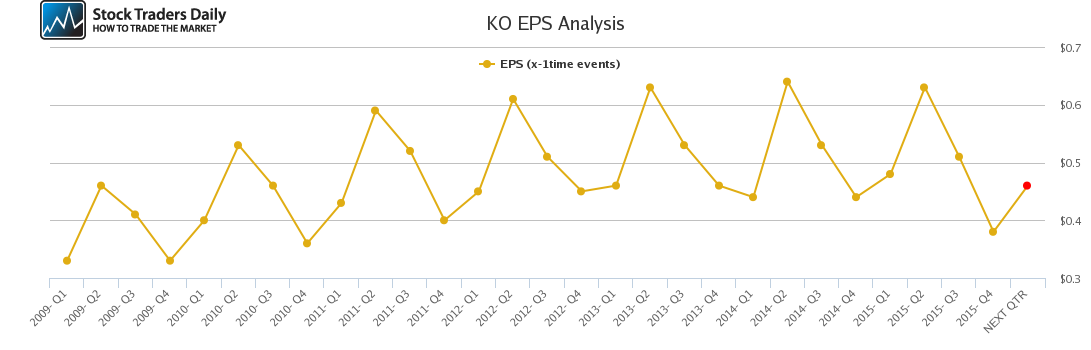

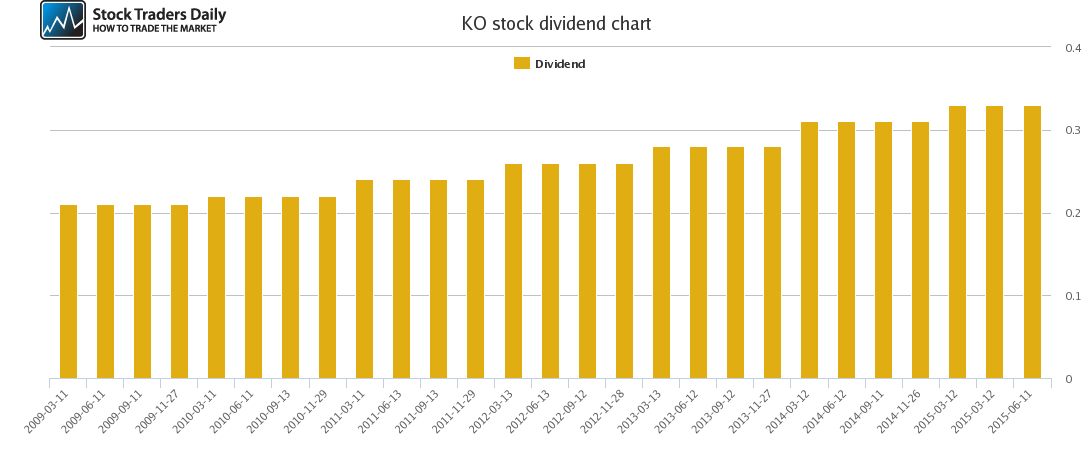

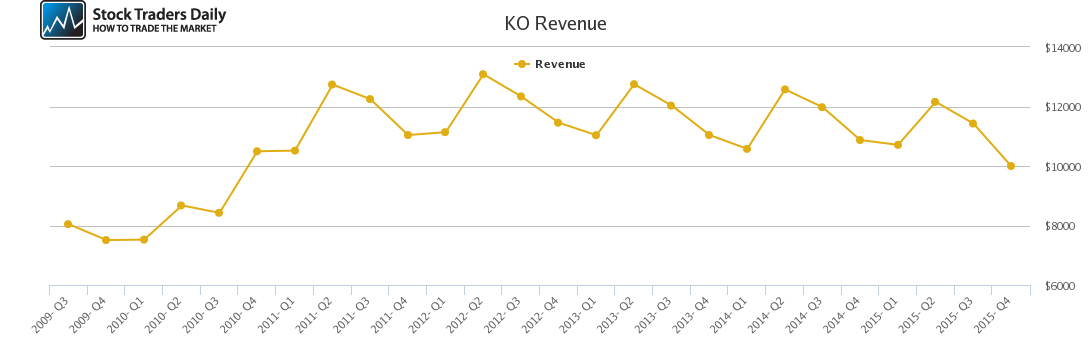

Fundamental Charts for KO: