The Sentiment Table Strategy Secures 5.85% from ProShares UltraShort QQQ (ETF) (NYSEARCA:QID)

The Sentiment Table strategy offer by stock traders daily secured 5.85% in gains on the first day of 2016. This was achieved on the heels of an overbought indicator that was offered from the Sentiment Table last week, which in turn suggested that we engage ProShares UltraShort QQQ (ETF) (NYSEARCA:QID) for a short-term trade.

The Sentiment Table strategy was holding this position over the New Year holiday and on the heels of the market's collapse on Monday gains were secured and the position was closed.

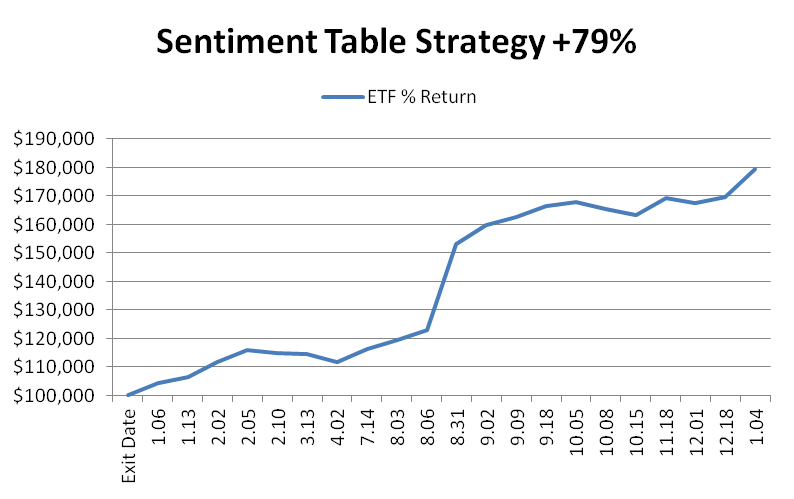

In calendar 2015 the Sentiment Table strategy returned approximately 70% on only 20 trades while spending about 2/3 time in cash. The Sentiment Table strategy was extremely efficient in calendar 2015 and it has gotten off to an exceptional start in 2016.

Details about the Sentiment Table strategy are available to our clients in our institutional research section and on the Sentiment Table page itself. These include the rules of the strategy, how to follow the strategy, and options to have the strategy managed professionally.

Support and Resistance Plot Chart for

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial

Fundamental Charts for :