pool ads

pool adsTravelers Companies Inc (NYSE:TRV) Poised to Decline with The Market

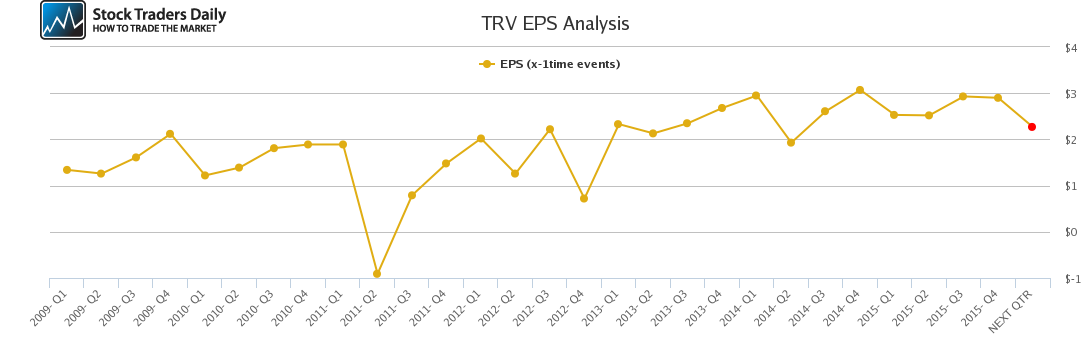

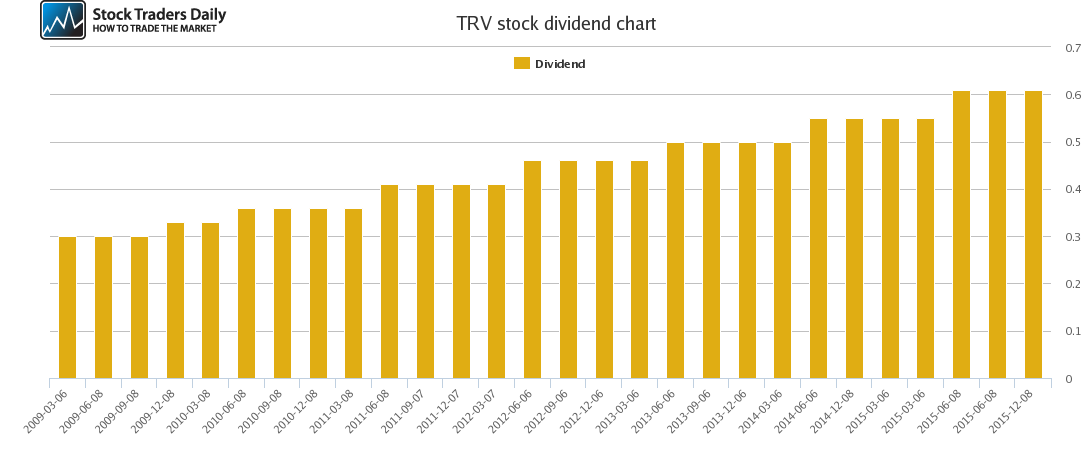

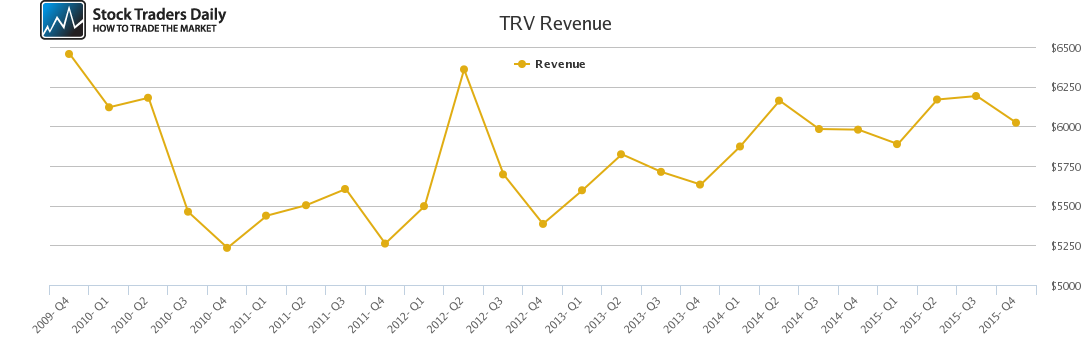

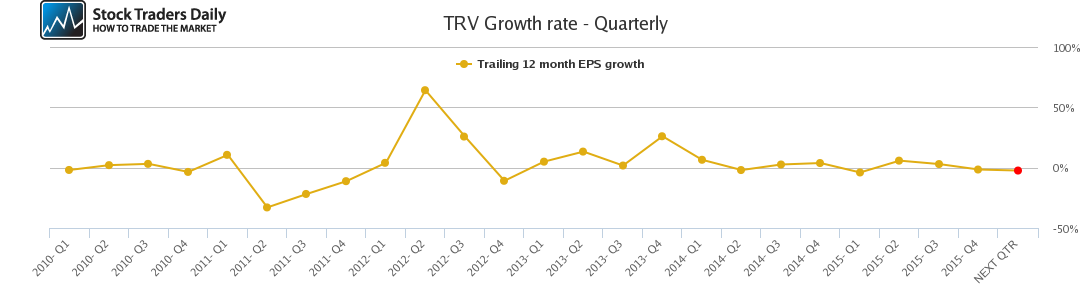

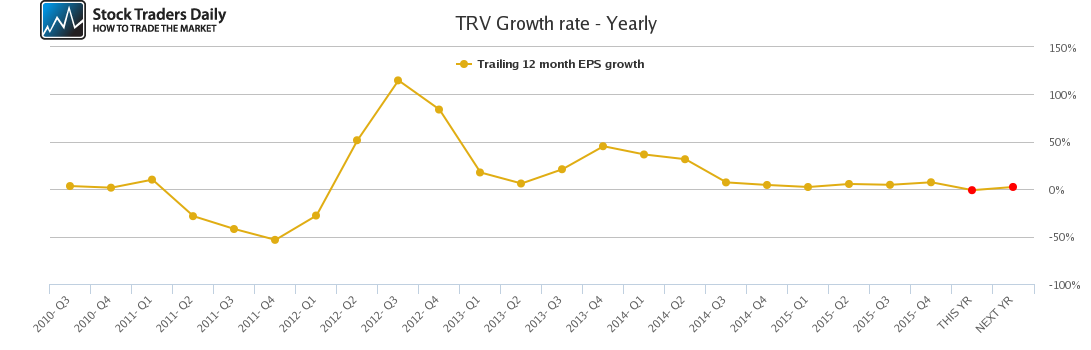

We recognize that Travelers Companies Inc (NYSE:TRV) is a bellwether stock that is widely held and considered top quality by veteran institutional investors, and for the most part we do not disagree, but when markets come under pressure good stocks fall too, especially ones that have meager growth rates.

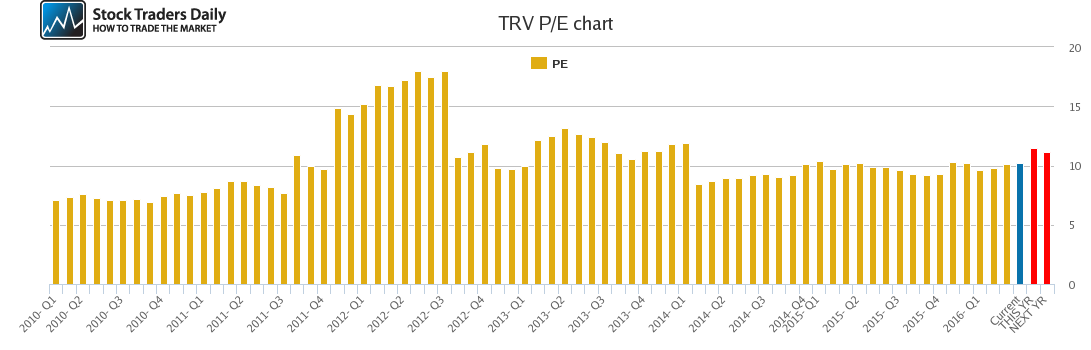

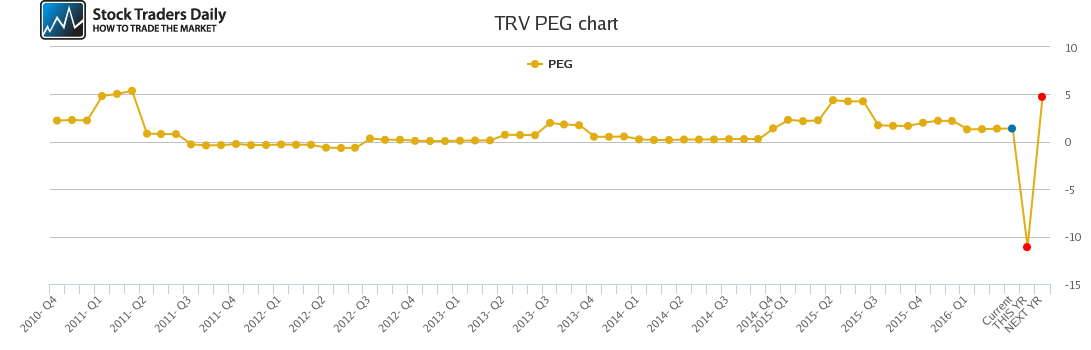

That is exactly what TRV investors are faced with. The Growth rates are expected to be dismal for the foreseeable future, and although the PE multiple does not look ridiculous when compared to other companies, it is very hard to justify a multiple like the current one given the negative current year and meager following growth rates.

In our opinion, given our longer term macroeconomic analysis called The Investment Rate, the Market is poised to come under severe pressure, and if it does shares of TRV are likely to get hit hard.

Technical Summary

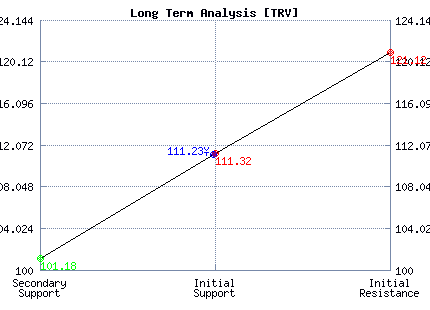

| Term → | Near | Mid | Long |

|---|---|---|---|

| Rating | Strong | Neutral | Neutral |

| P1 | 109.43 | 99.48 | 101.18 |

| P2 | 110.91 | 106.59 | 111.32 |

| P3 | 111.76 | 113.10 | 121.12 |

Support and Resistance Plot Chart for TRV

Long Term Trading Plans for TRV

March 10, 2016, 3:01 pm ET

The technical Summary and associated Trading Plans for TRV listed below will help you make important timing decisions for your trades. This data is based on our proprietary analysis for TRV. In addition we offer Market Timing Models and Stock Filters in the links above which may increase the proficiency of the decisions you make.

TRV - (Long) Support Plan

Buy over 101.18 target 111.32 stop loss @ 100.92.

The technical summary data tells us to buy TRV near 101.18 with an upside target of 111.32. This data also tells us to set a stop loss @ 100.92 to protect against excessive loss in case the stock begins to move against the trade. 101.18 is the first level of support below 111.23 , and by rule, any test of support is a buy signal. In this case, support 101.18 would be being tested, so a buy signal would exist.

TRV - (Short) Resistance Plan

Short under 111.32 target 101.18 stop loss @ 111.58.

The technical summary data is suggesting a short of TRV as it gets near 111.32 with a downside target of 101.18. We should have a stop loss in place at 111.58 though. 111.32 is the first level of resistance above 111.23, and by rule, any test of resistance is a short signal. In this case, if resistance 111.32 is being tested, so a short signal would exist.

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial