pool ads

pool adsUnion Pacific Corporation (NYSE:UNP) is the Stock of the Week

The Stock of the Week Strategy is a strategy designed with specific risk controls in mind. Last Week's selection, Amgen, Inc. (NASDAQ:AMGN), resulted in a gain of about 1.6 percent.

Every Week Stock Traders Daily singles out one stock as its "Stock of the Week" and this week the selection was Union Pacific Corporation (NYSE:UNP). The criteria in selection this stock are many, but some fundamental valuation observations are provided below which play a role in the process.

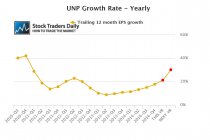

Our identification of fundamental value begins with an understanding of the EPS growth rates that are expected in the future. In our EPS Graph below, which excludes onetime events and includes complete earnings cycles to avoid seasonal anomalies and to identify truer growth rates, we can see that analysts are expecting EPS Growth of 21.32% this year, and next year that jumps to 30.21%. These are identified by the first and second red dots in our chart.

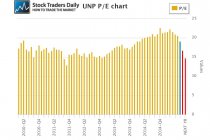

Next, our attention turns to the PE multiple, and based on analysts estimates as noted in the EPS Growth chart above, we can see that the PE is currently 19.11 (blue bar) but expected to fall to 16.66 at the end of this year if UNP matches estimates and price remains the same. That is shown in the first red bar, but the second red bar shows 2016 PE data if the same is true, and that's 14.68.

This combination of EPS Growth and PE evaluation allows us to reach a fundamental earnings based conclusion using a PEG Ratio approach. Our identification is that fair value based on this PEG approach is when a PEG is between 0 and 1.5, and in this case the current PEG on UNP is 1.07 (blue dot). This is in the ballpark, and that's great, but looking ahead to 2015 and 2016, the first and second red dots, that gets even better. PEG drops to 0.78 at the end of this year if analysts are right and price remains the same, and PEG falls even further to 0.49 at the end of 2016 if analysts are right and price remains the same. That begs the question, should price remain the same?

Our fundamental analysis certainly suggests that it should not, but the stock has been breaking down recently (not today) and that is a price based concern.

Still, UNP and the characteristics we have defined for the stock have prompted us to select UNP as the Stock of the Week this Week.

Support and Resistance Plot Chart for

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial

Fundamental Charts for :