pool ads

pool adsUpdate: Apple Inc. (NASDAQ:AAPL) Short

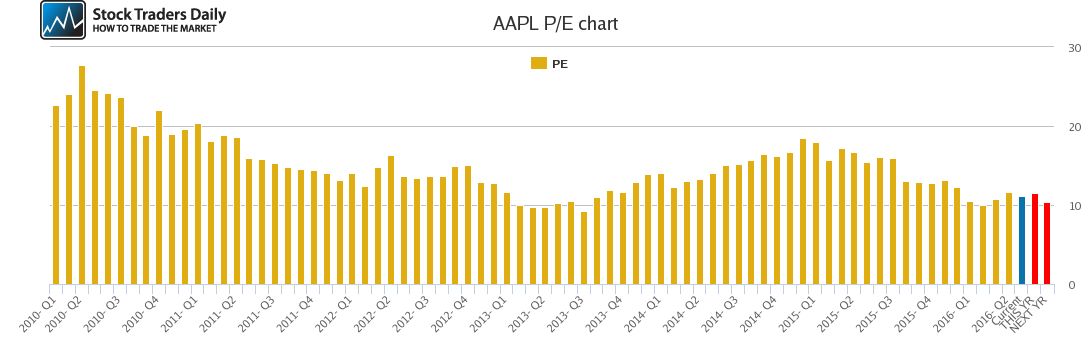

Our short recommendation on Apple Inc. (NASDAQ:AAPL) is working nicely and we suggest that traders maintain their short positions. Reuters also has confirmed to us that we were the only analyst on the street with a short recommendation, only a few had sell or hold recommendations, and almost everyone had buy recommendation on the stock, which goes to show just how surprised almost everyone was at this horrible earnings miss, but we were not bearish on AAPL when t was much lower earlier this year.

For trading purposes, early in the year when Apple fell with the market there absolutely look to be an opportunity to buy the stock, which we suggested to clients, but our intention was to initiate short positions in Apple on the heels of the increase that we expected. In many ways, the buy signal that we issued when Apple was near $90.00 and the associated sell signal that we issued when Apple pressed above $100 was much more of a trading call than our current short signal.

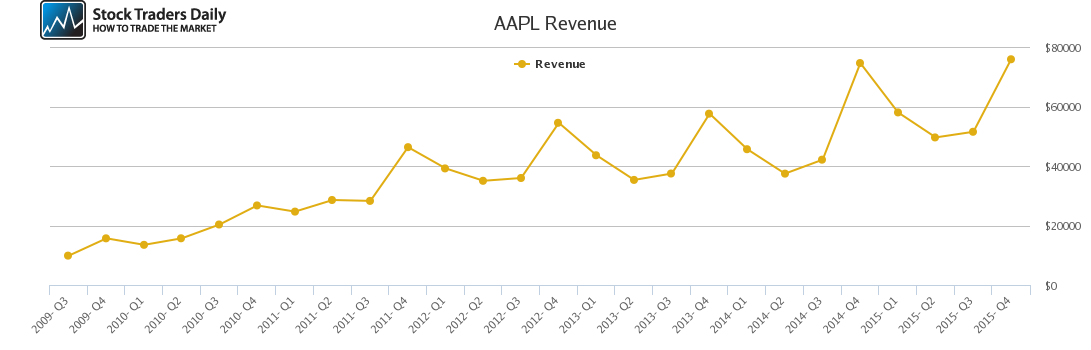

According to our observations fickle consumers are considering iPhones commodities, they are no longer exceptionally better than the competition, and they are not nearly as innovative in many ways. The company could invest money in all different types of businesses, but it is the handset business that makes the most difference and handset sales are dwindling.

This is no surprise. In fact, it happened before. Before China Mobile came online sales of iPhones were flat lining, and declining, and the stock was too. In fact, had it not been for China Mobile it is likely that Apple would still be significantly lower, but China Mobile helped to ramp up demand for a iPhones all over again.

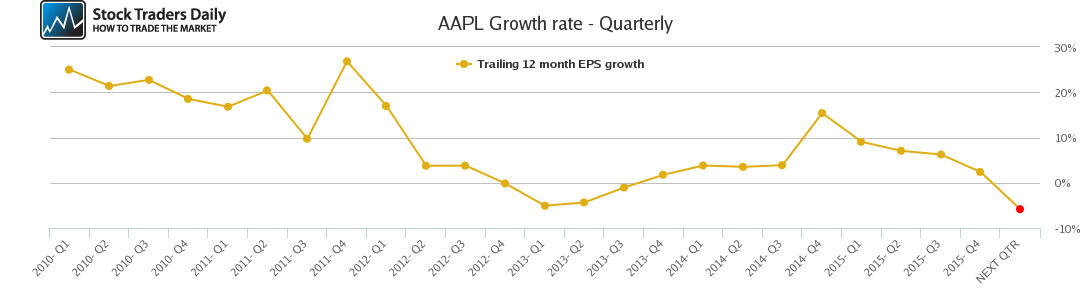

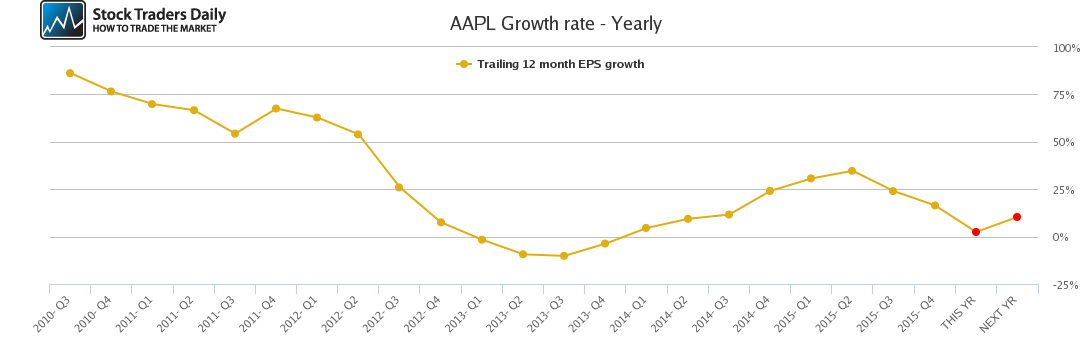

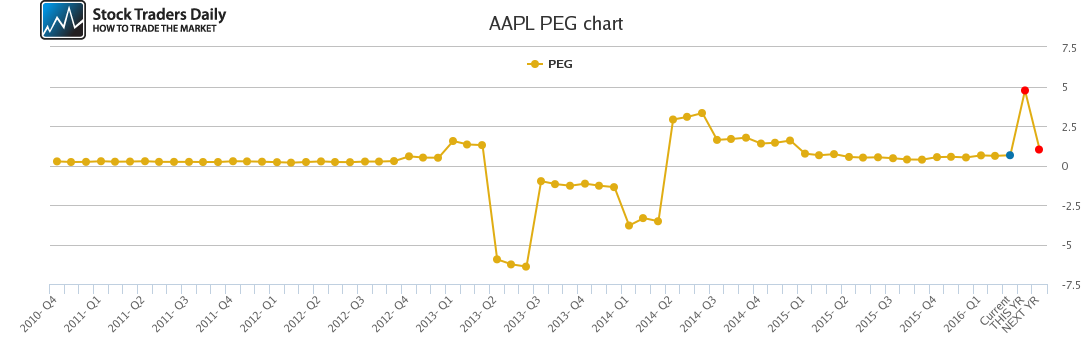

Interestingly, we're also seeing a repeat of what happened prior to China Mobile coming online, and that is a lack of growth. In fact, it's negative growth.

Unfortunately, this time, we do not see a China Mobile there to save the day. That means that the decline we expect from Apple will likely be much longer lived than the one that happened prior to China Mobile.

We maintain our bearish posture and suggest that investors who engaged short positions on the heels of our recommendations maintain those positions as well.

Click here to review the short recommendation offered by Stock Traders Daily: AAPL Short Recommendation

Technical Summary

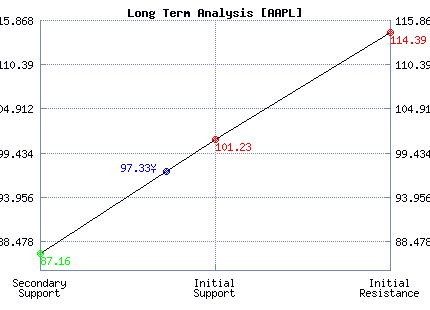

| Term → | Near | Mid | Long |

|---|---|---|---|

| Rating | Weak | Neutral | Neutral |

| P1 | 104.38 | 105.80 | 87.16 |

| P2 | 105.67 | 111.22 | 101.23 |

| P3 | 107.08 | 116.65 | 114.39 |

Support and Resistance Plot Chart for AAPL

Long Term Trading Plans for AAPL

April 27, 2016, 10:38 am ET

The technical Summary and associated Trading Plans for AAPL listed below will help you make important timing decisions for your trades. This data is based on our proprietary analysis for AAPL. In addition we offer Market Timing Models and Stock Filters in the links above which may increase the proficiency of the decisions you make.

AAPL - (Long) Support Plan

Buy over 87.16 target 101.23 stop loss @ 86.9.

The technical summary data tells us to buy AAPL near 87.16 with an upside target of 101.23. This data also tells us to set a stop loss @ 86.9 to protect against excessive loss in case the stock begins to move against the trade. 87.16 is the first level of support below 97.33 , and by rule, any test of support is a buy signal. In this case, support 87.16 would be being tested, so a buy signal would exist.

AAPL - (Short) Resistance Plan

Short under 101.23 target 87.16 stop loss @ 101.49.

The technical summary data is suggesting a short of AAPL as it gets near 101.23 with a downside target of 87.16. We should have a stop loss in place at 101.49 though. 101.23 is the first level of resistance above 97.33, and by rule, any test of resistance is a short signal. In this case, if resistance 101.23 is being tested, so a short signal would exist.

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial