pool ads

pool adsValuation Analysis for Amazon.com, Inc. (NASDAQ:AMZN)

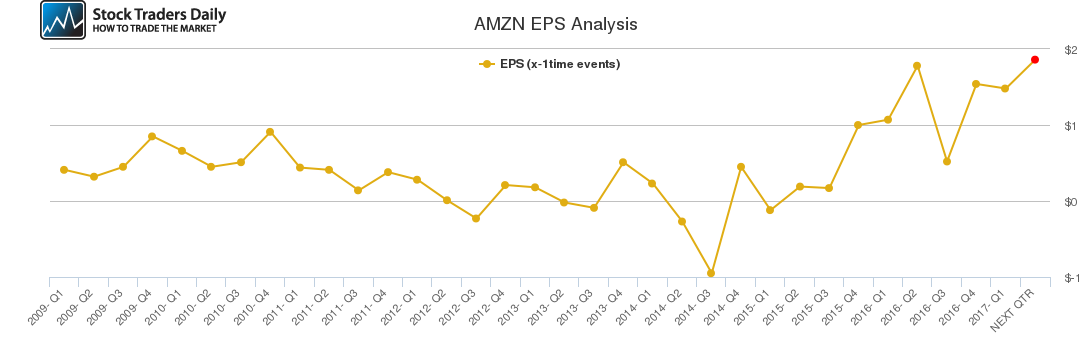

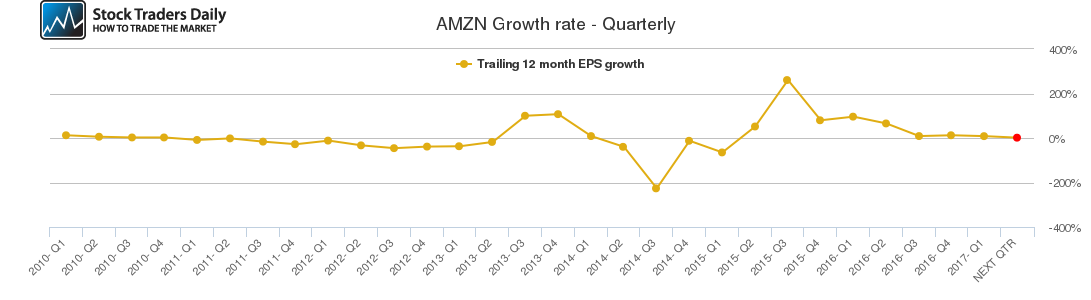

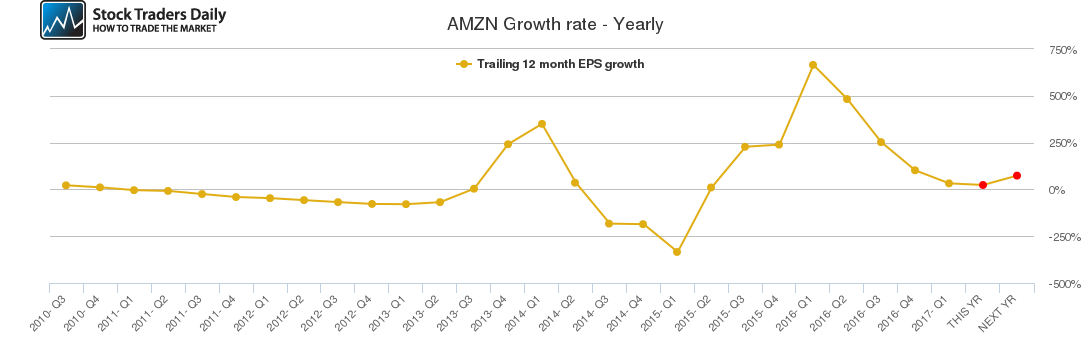

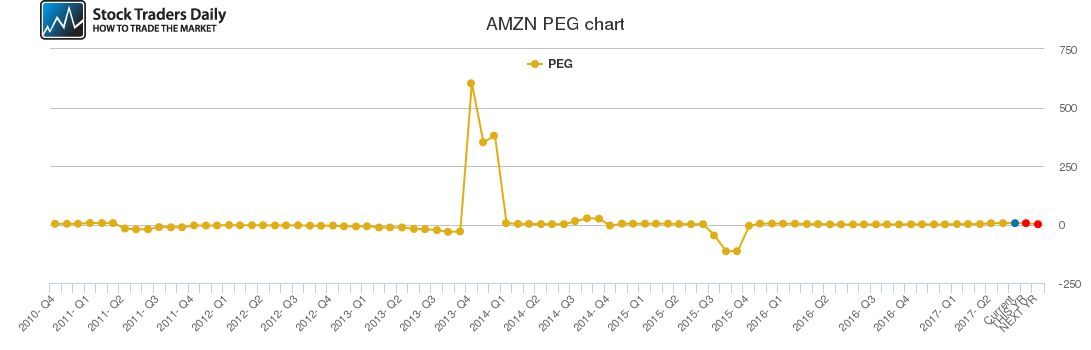

Although our preference is to use earnings growth in evaluating fair value, that is very difficult to do with Amazon.com, Inc. (NASDAQ:AMZN). Because Amazon does not have much earnings small fluctuations can change earnings growth tremendously and distort fair value conclusions based on earnings growth alone.

As a result, we will take a different approach, not a peg ratio approach, in evaluating Amazon.

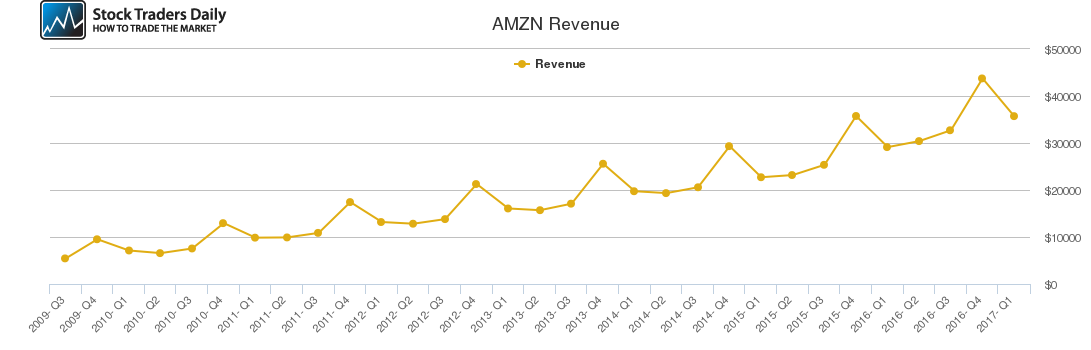

The problem with Amazon is that the company cannot bring earnings to the bottom line. They have grown revenues arguably better than anyone else, eyeballs they attract are willing buyers and active, and the properties they own create exceptional conversions, but not earnings.

In fact, the revenue generated from the retail division, which amounts to most of the revenue reported by Amazon, actually results in negative earnings. The company loses money from their retail division, and as a result, if this retail division was separated out it would not have any immediate value.

That's a huge problem because it represents such a large amount of the company's revenue, and analysts have recently been using revenue growth as a metric for valuing Amazon.

However, if the revenue is not translating into earnings the valuation placed on that revenue needs to be adjusted, and we do not think analysts are currently doing that.

There are a few good earnings segments within the company, cloud and prime, and those arguably feed off of the retail eyeballs, so there is intrinsic value with in the retail segment that must also be recognized, but even the earnings from those divisions don't amount to much in relation to revenue.

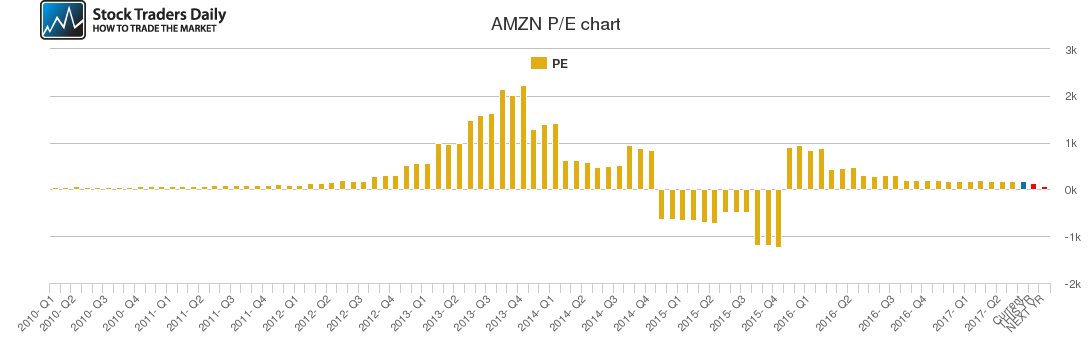

In addition, the stock is near $1000, making the PE multiple as high as Internet stocks in the.com era.

Analysts are incorrectly valuing Amazon because they are doing it based on revenue growth that does not amount to much earnings growth. It is almost as if they are saying that earnings don't matter for Amazon, but ultimately it does. We think Amazon will crash the moment investors want to see earnings that validate the multiple. Avoid this stock at all costs.

For Specific Trading Plans, including buy, sell, and stop loss recommendations, review our Real Time Report. It will update both the trading plans and valuation metrics as prices change.

Support and Resistance Plot Chart for AMZN

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial