pool ads

pool adsValuation Analysis for Apple Inc. (NASDAQ:AAPL)

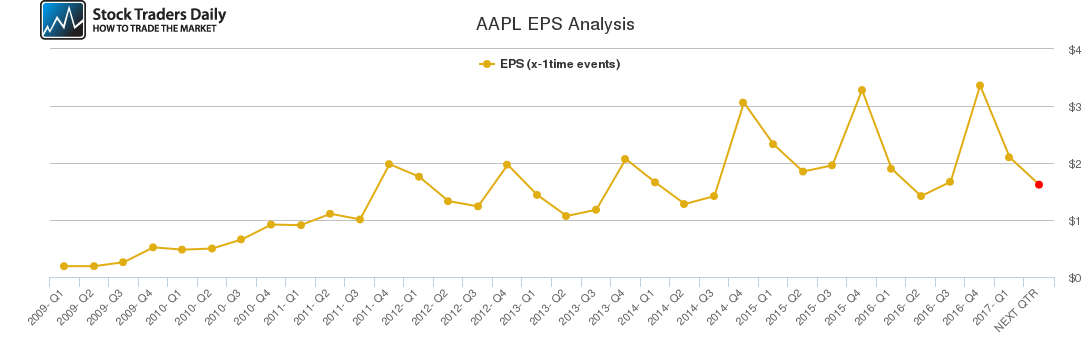

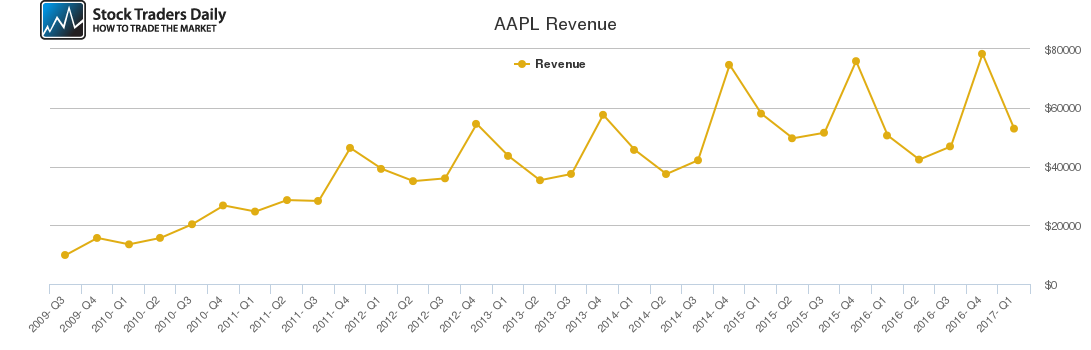

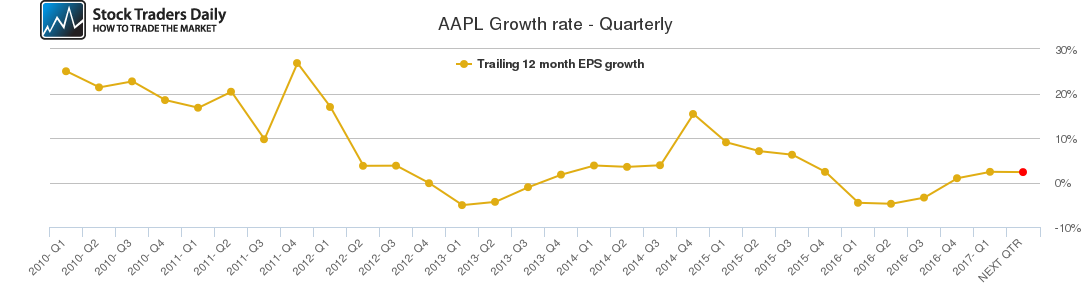

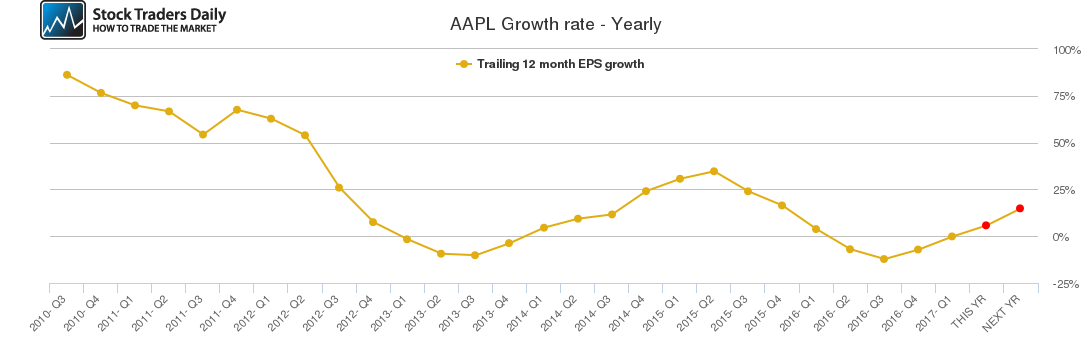

Earnings growth at Apple Inc. (NASDAQ:AAPL) began to decline in the early part of 2015 only to turn negative in the early part of 2016. However, if analysts are right about their expectations for the next coming quarter apple will have the first positive earnings growth quarter after moving into negative territory. The direction in earnings growth has improved, and that is healthy.

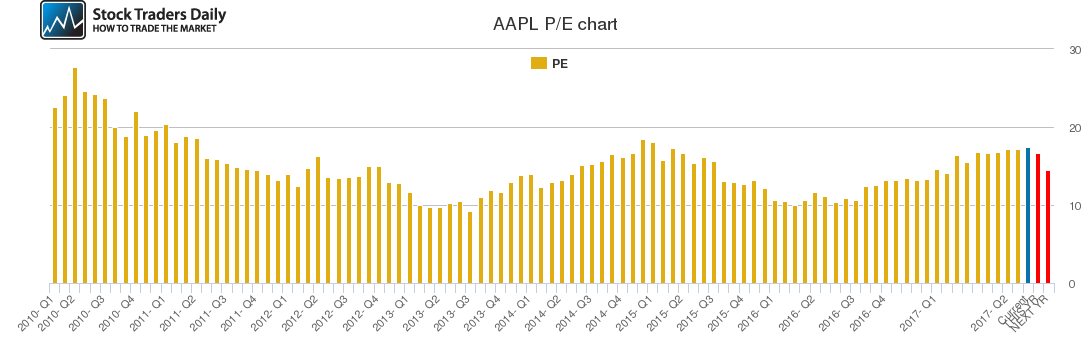

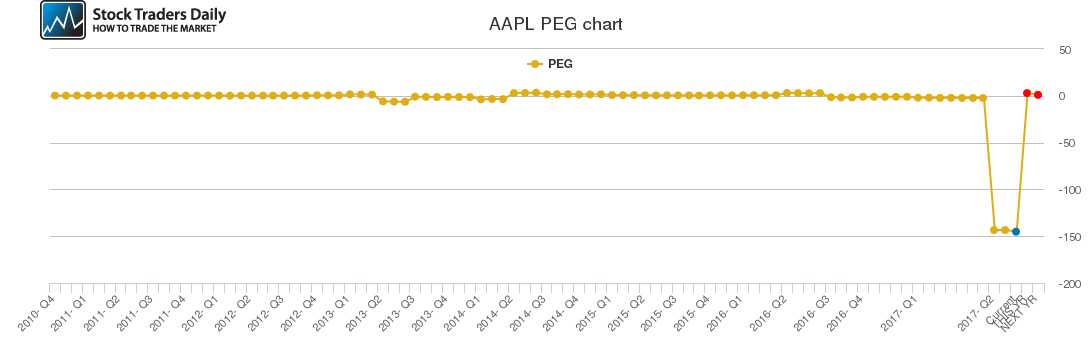

At the same time, the PE ratio is 17.42, almost as high as it was in the early part of 2015 when the earnings demise began. That brings valuation into question, but because Apple does not have positive trailing 12 month earnings growth right now its peg ratio is negative.

That will change next quarter if analysts are right about their expectations, but even if they are right the peg ratio will still show excessive valuation. For example, if analysts are right about their full year 2017 earnings growth expectations for Apple the peg ratio for Apple will be 2.87.

Our estimate of fair value is one a peg ratio exists between 0 and 1.5, with 1.5 being the upper end of that boundary. Anything above that level represents excessive valuation, and at the end of 2017, according to current analyst estimates and current valuation metrics, Apple's peg will be significantly higher than 1.5.

Therefore, even with improvement in the trajectory of earnings growth shares of Apple lack immediate value.

For Specific Trading Plans, including buy, sell, and stop loss recommendations, review our Real Time Report. It will update both the trading plans and valuation metrics as prices change.

Support and Resistance Plot Chart for AAPL

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial