pool ads

pool adsValuation Analysis for Facebook Inc (NASDAQ:FB)

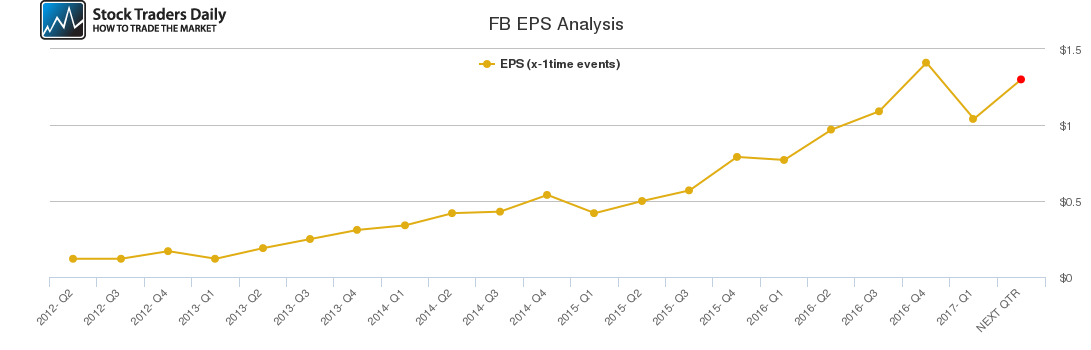

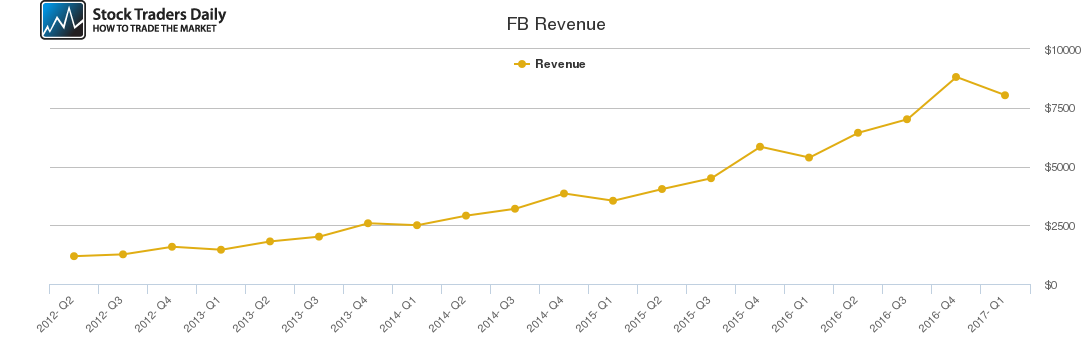

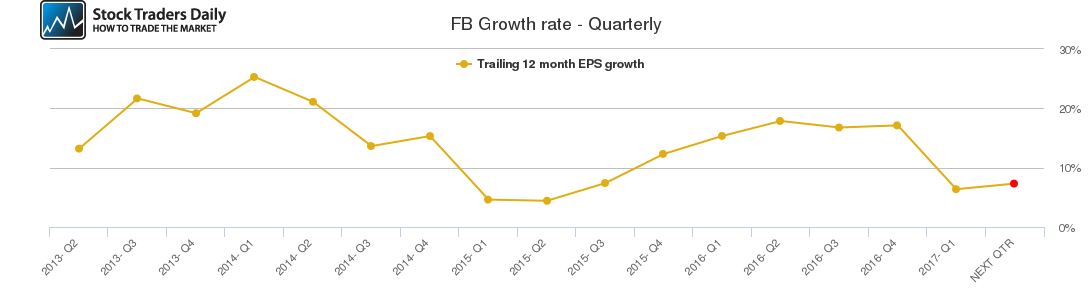

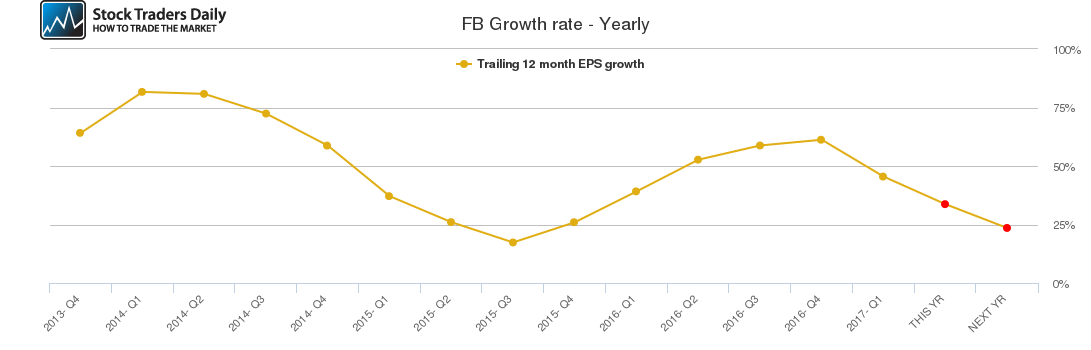

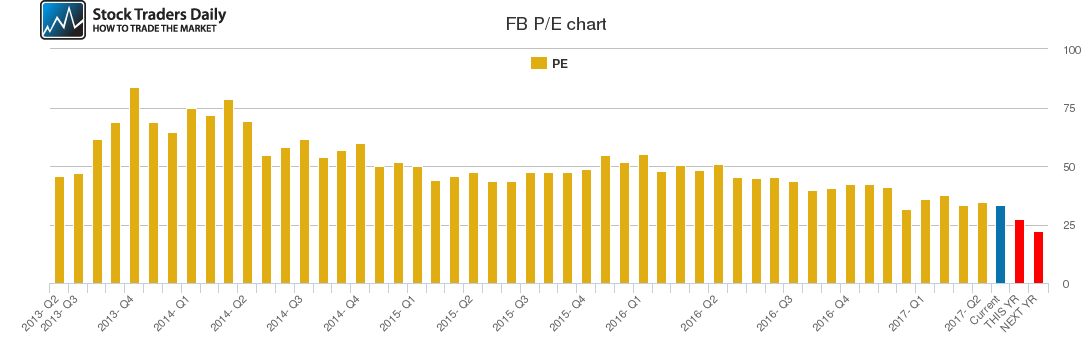

Earnings growth at Facebook Inc (NASDAQ:FB) has been declining, but recent earnings growth was 44% and overall earnings growth is expected to be over 33% in calendar 2017. The current PE multiple is 32.6 and that is expected to fall to 27.06 at the end of 2017 if analysts are right about their earnings expectations.

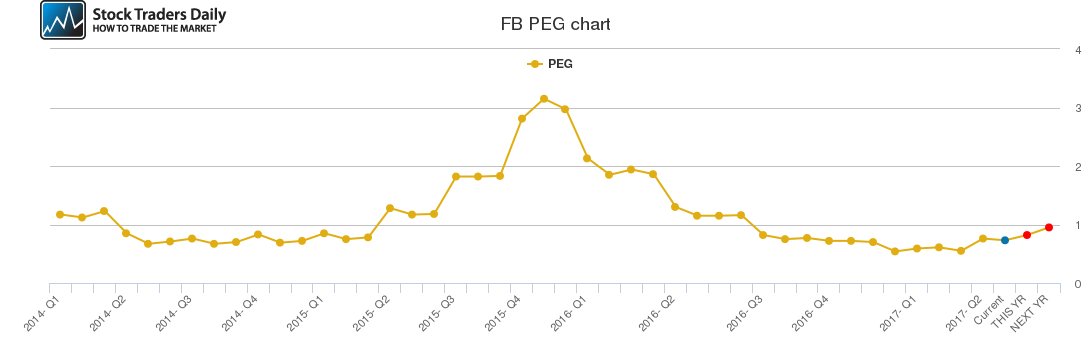

Accordingly, the peg ratio for Facebook represents a stock within our fair value range.

Specifically, the current peg ratio for Facebook is 0.72 and if analysts are right about calendar 2017 results the peg ratio will be 0.8. Our determination suggest that fair value exists somewhere between 0 and 1.5, and the peg ratio for Facebook falls right in the middle of this valuation range.

As a result, we believe that Facebook represents an attractive value so long as it can continue to meet analysts' expectations.

For Specific Trading Plans, including buy, sell, and stop loss recommendations, review our Real Time Report. It will update both the trading plans and valuation metrics as prices change.

Support and Resistance Plot Chart for FB

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial