pool ads

pool adsValuation Analysis for Netflix, Inc. (NASDAQ:NFLX)

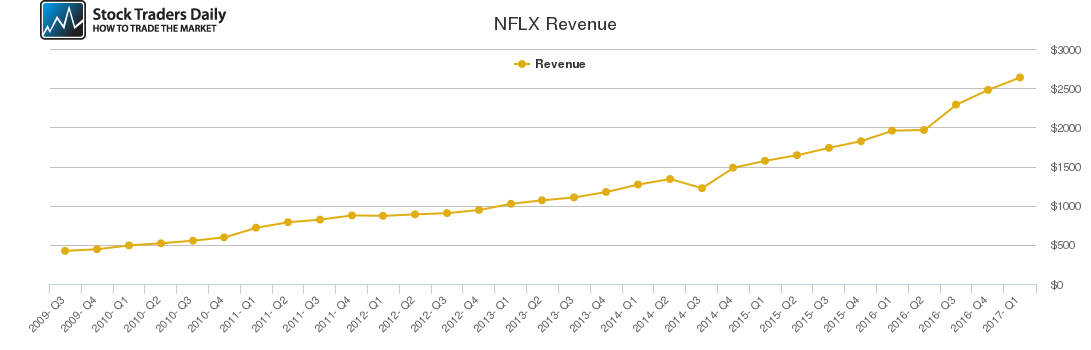

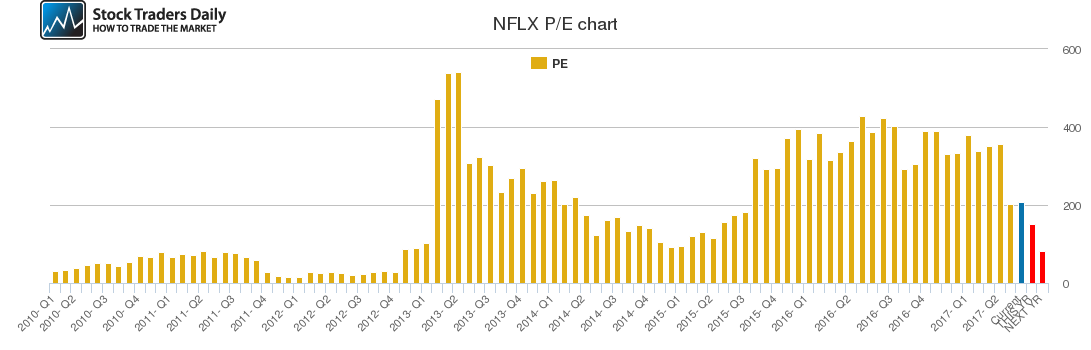

Valuing Netflix, Inc. (NASDAQ:NFLX) can be difficult because the stock has a PE multiple of 200 times earnings and that opens the door for significant volatility without much derivation to the valuation conclusions.

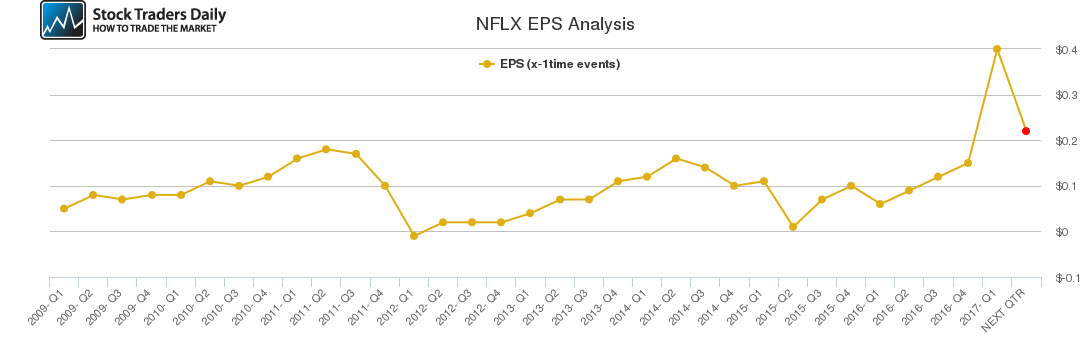

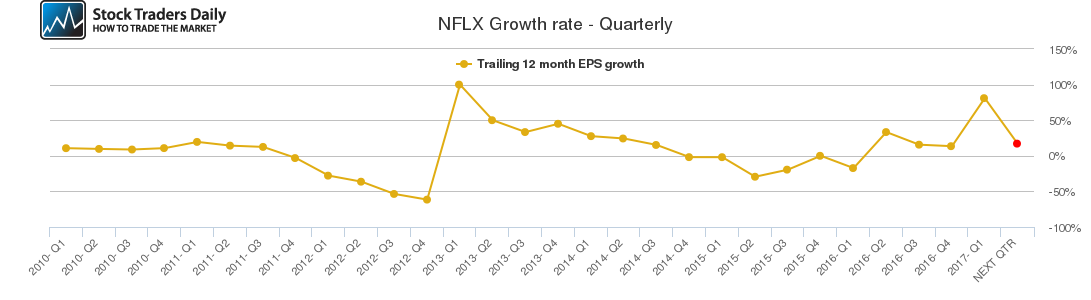

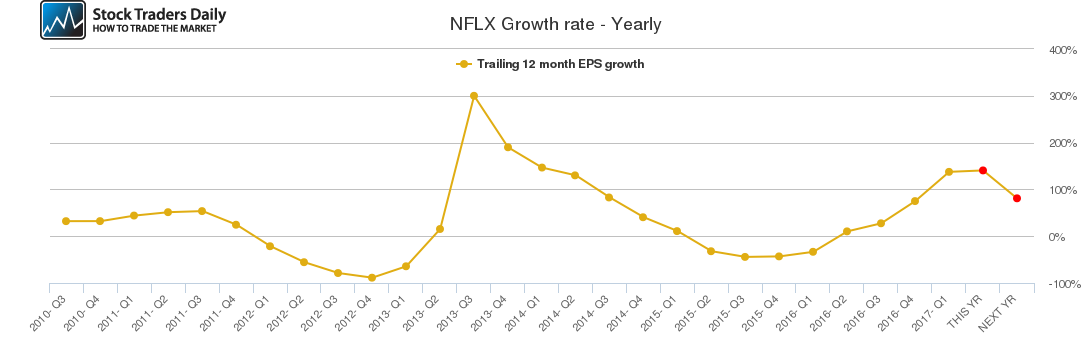

However, earnings growth has recently been solid; earnings growth was over 137% last time and for calendar 2017 it is expected to be over 140%. In 2018 the earnings growth is expected to decelerate but still be over 80%, so earnings are growing rapidly and expected to continue to grow rapidly.

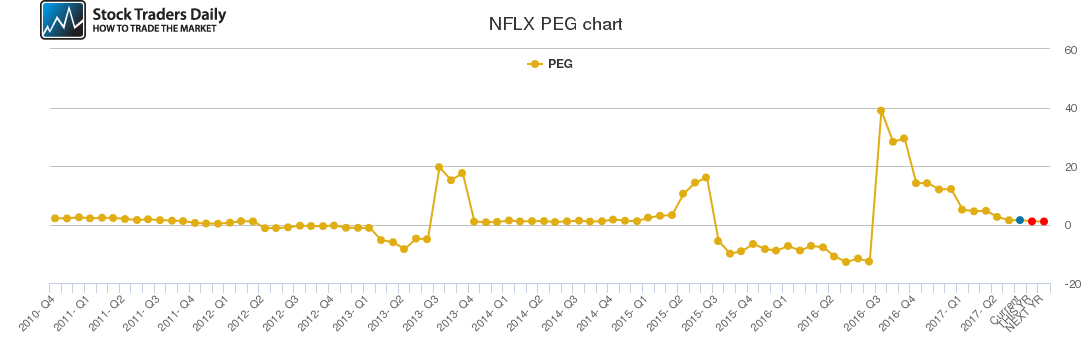

Given that growth rate the high PE multiples do not look out of line and our peg ratio analysis supports the same. Our evaluation is that fair value exists when a stock has a peg ratio somewhere between 0 and 1.5. Currently, shares of Netflix have a peg ratio of 1.46, just below the upper end of our fair value boundary.

In addition, if earnings growth comes in as expected for 2017 that peg ratio is going to decline to 1.03, making Netflix more attractive.

Immediately, our fair value observation suggest that shares of Netflix are currently fairly valued and will only become more attractive on in earnings growth valuation basis if the company continues to meet analysts' expectations.

For Specific Trading Plans, including buy, sell, and stop loss recommendations, review our Real Time Report. It will update both the trading plans and valuation metrics as prices change.

Support and Resistance Plot Chart for NFLX

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial