pool ads

pool adsValuation Observations for Apple Inc. (NASDAQ:AAPL)

Using a combination of technical and fundamental analysis, Stock Traders Daily has issued Valuation Observations for Apple Inc. (NASDAQ:AAPL), including specific trading recommendations and price targets.

Here is an excerpt from our Valuation Observation:

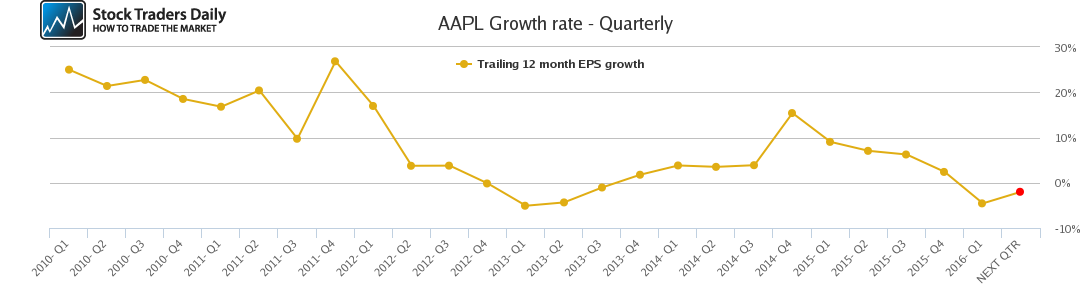

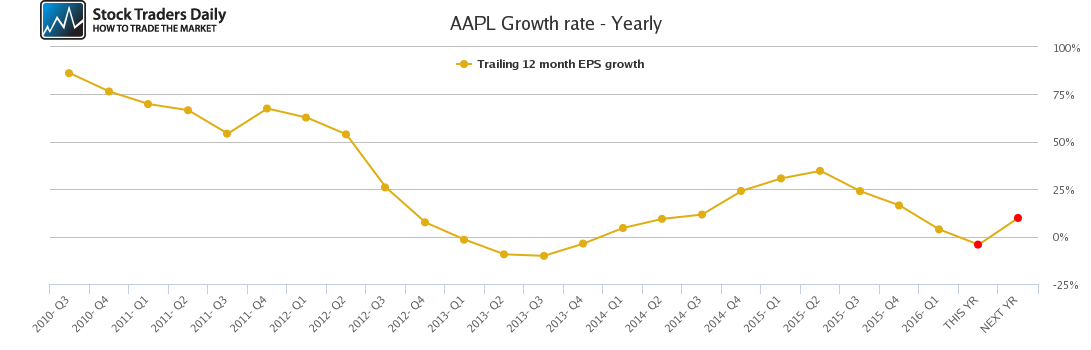

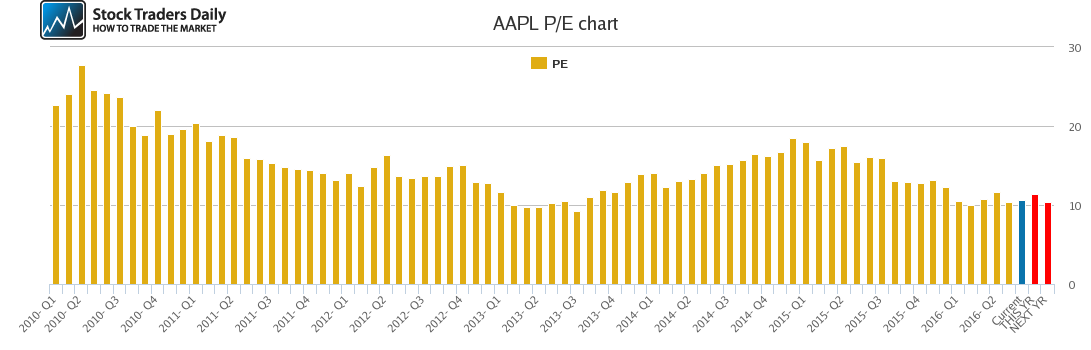

“The company is not growing. In fact, it is contracting, and at best trying its best to stabilize revenue contractions. The last time this happened China Mobile Ltd. (ADR) (NYSE:CHL) came to the rescue, but there is no China Mobile on the horizon this time. We do not believe the company can bounce back like it did last time. Cash flow is solid, and he company is not in a dire condition, but even at 11.57x the stock does not look cheap given the contractions it is experiencing.”

AAPL is not the only stock on the market that lacks value. The best approach, given the rich-looking market that exists today, is to be proactive, and consider our LETS Strategy.

Support and Resistance Plot Chart for AAPL

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial