Valuation analysis for Wynn Resorts, Limited (NASDAQ:WYNN)

Valuation analysis for Wynn Resorts, Limited (NASDAQ:WYNN)

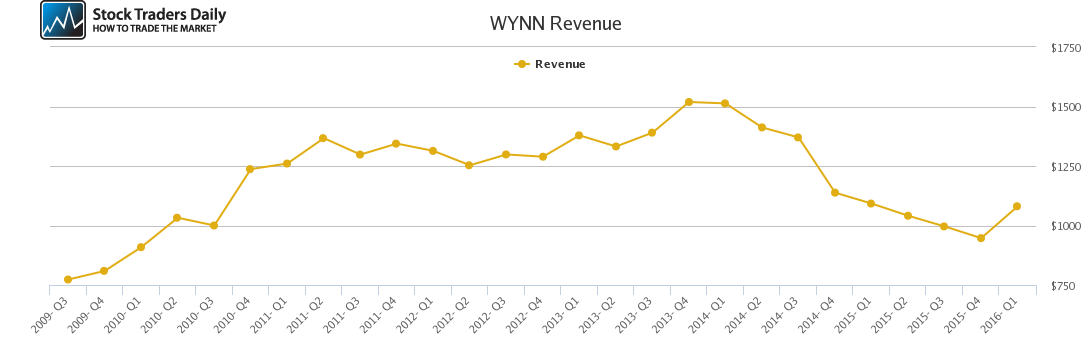

Income

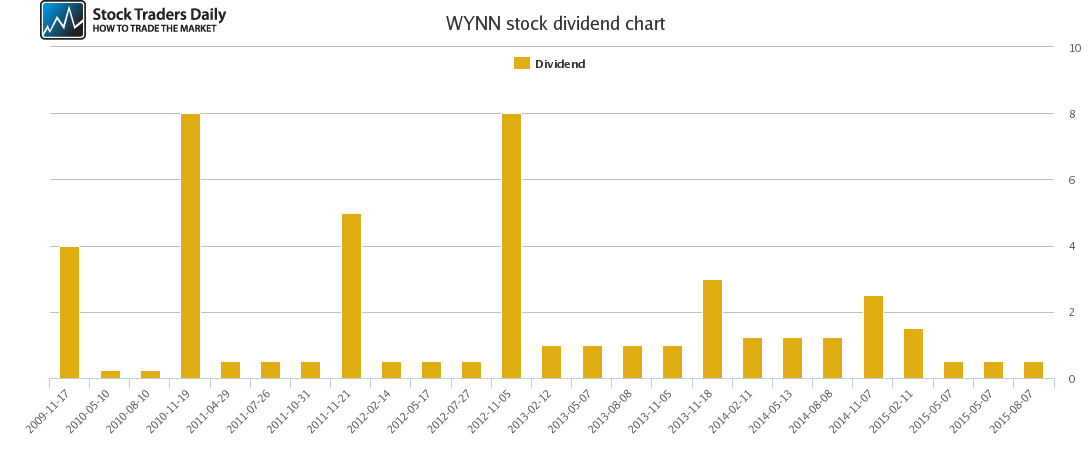

A decline in revenue and associated decline in profit margins have recently impacted WYNN and associated concerns pertaining specifically to net income deteriorations exist immediately.

Balance sheet

Debt levels have been increasing at a faster pace than assets on a percentage basis and the increase in the debt to assets ratio is a major concern. We do not believe the trajectory is sustainable but instead the assumption of debt must curtail in our opinion.

Cash flow

Recent trends in cash flow are relatively dysfunctional as declines in operating and investing cash flow data are offset by financing activities. This is not a sustainable relationship in our opinion.

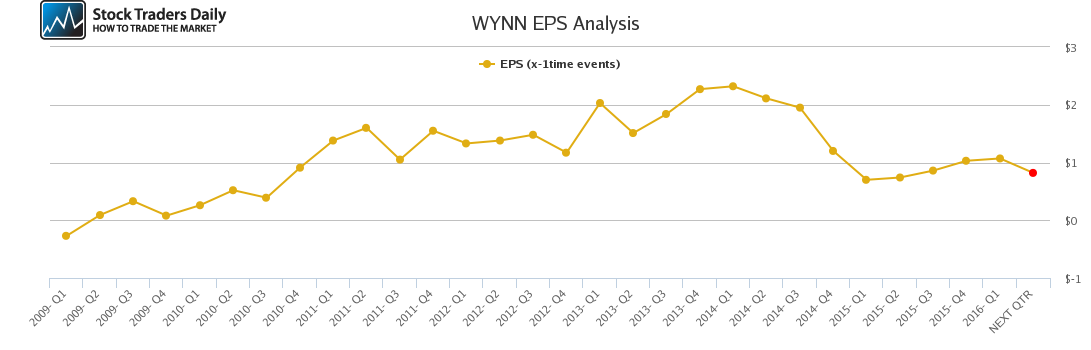

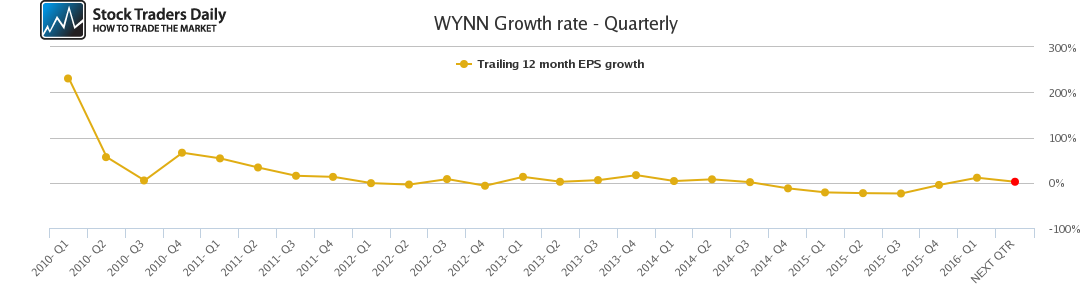

Growth rate

EPS trends have been in a negative trajectory for the past 2 years, EPS results are equivalent to 2011 levels, and negative TTM EPS growth rates have existed since Q4 2014. As of the last report growth was -19.39%, but this year the net result is expected to improve to appositive 4.57%. Analysts are currently expecting a material improvement in 2017, with projected EPS growth exceeding 34% according to analyst’s consensus.

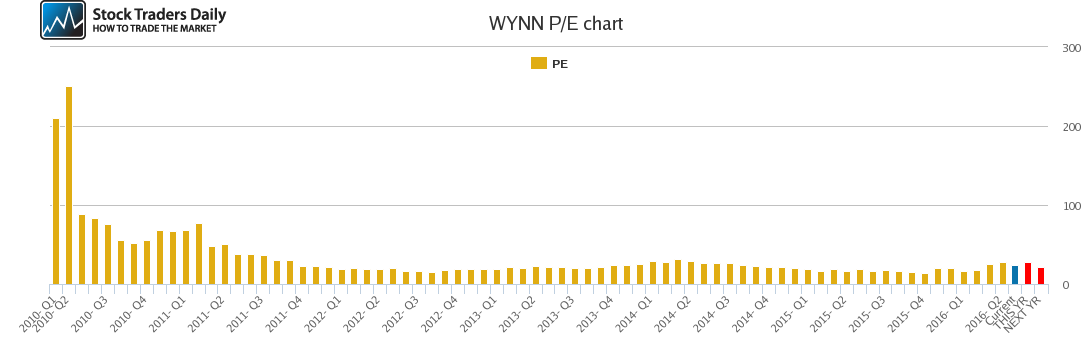

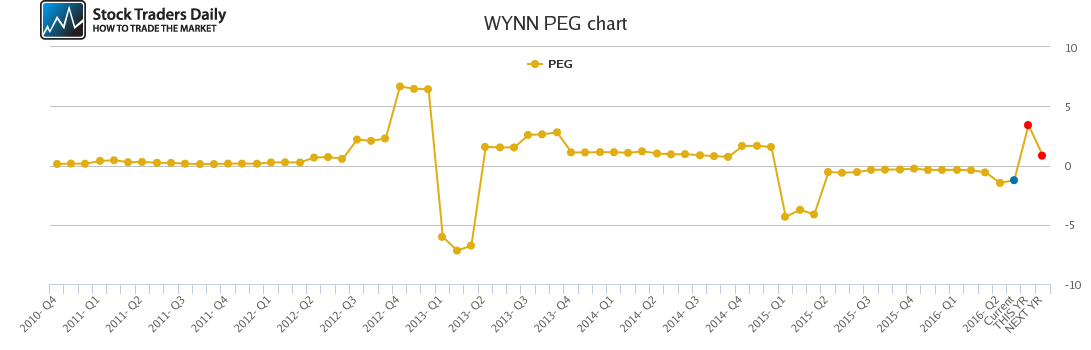

Valuation

After discounting 1-time events, the current PE on WYNN is about 27x, by the end of the year that is expected to increase to 28x, but this assumes that price remains the same and earnings come in as expected. The current multiple would adjust down to 21x by the end of 2017 if analysts are right about their projections and price remains the same. Immediately though, WYNN carries a negative PEG, -1.44, and if analysts are right this year’s PEG ratio will be 6.19. This does not represent a good value based on our definition. That will likely improve at the end of 2017 however if analysts are right and price remains the same.

Stock price

WYNN has fallen steadily and aggressively from the highs seen in early 2014, back to 2011 levels, which is on par with EPS levels. However, those former highs, although something still visible in the chart patterns, do not play an immediate role in our price-based observation. Resistance, in other words, exists much closer to $105, and our price-based observation suggests that material downside risk exists if resistance near $105 holds. A decline back towards $50 would be reasonable based on the charts.

Recent events

Leading up to the May Earnings release WYNN was downgraded by 2 firms, Credit Agricole and Deutsche Bank. On the heels of the release, although Revenue and EPS beats came, forward projections were tapered down by the firm.

Concerns

Financing activities are not the basis for sustained cash flow, and we would expect WYNN to curtail its dependence on financing activities to stabilize cash flow, but with that may come additional growth pressures. Growth levels have not been good, they are not good, but next year they are expected to have a sharp improvement, but we are not as confident as the analysts who are expecting this. We are concerned that the immediate and apparent continued pressure experienced by WYNN will itself continue to impact investor’s willingness to assume risk. The high multiple and recent negative growth rates are an immediate concern, and they are not expected to see a material change until next year, but that is a lifetime when it comes to valuation risk. We are concerned that investors will continue to consider WYNN a high valuation risk.

Opinions

Our Investment Opinion, including our price targets, are offered alongside our comprehensive report in our Institutional Research Section.

Support and Resistance Plot Chart for WYNN

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial