Valuation analysis for ABM Industries, Inc. (NYSE:ABM)

When companies have trouble bringing earnings to the bottom line it raises red flags. Sometimes companies act purposefully to reinvest, but others fail to bring revenues to the bottom line because their margins are collapsing. This reference is very important to the analysis below.

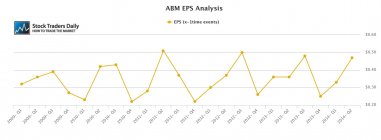

ABM Industries, Inc. (NYSE:ABM) clearly has seasonal earnings fluctuations, but the company has managed to successfully increase earnings modestly, after the haphazard nature of the seasonality is factored in of course. What does stand out, however, is that revenue growth has been consistent, much stronger than earnings growth, but this raises more concerns than it offers positive attributes.

Specifically, revenues increased by about 20% between 2012 and now, but earnings have barely increased during that same timeframe. This is a concern because it tells us that the ABM is not bringing revenues down to the bottom line, for whatever reason. Sometimes companies fail to do that by choice, other times it is simply because margins become tighter, but for whatever reason it is never OK to have this diverging relationship present itself consistently over time. Thus far, ABM has been doing this for a couple of years and that is concerning on a fundamental basis.

What's more concerning is that ABM trades at a relatively high PE multiple given its lackluster earnings growth rate. With a PE multiple of over 18 times earnings this stock looks rich given the earnings growth rate of 4.79% at this time. Of course, earnings growth has been sporadic, but it has also been negative, and overall relatively flat, but even with a reasonable consideration using the most recent growth rate a PE multiple of 18 times earnings still looks extremely rich.

Technical take:

According to our real time trading report for ABM the stock is testing longer term resistance and if longer term resistance remains intact we would expect the stock to fall back to test longer term support levels again. That means, if longer term resistance holds, we would recommend selling this stock.

Summary:

According to our observations ABM looks rich, the relationship between revenue growth and earnings is concerning, and the company has not demonstrated an ability to bring higher revenues to the bottom line. The stock has a very high PE multiple when compared to its lackluster earnings growth and the stock is testing longer term resistance. According to our observations valuations look rich and technical sell signals exist. We would not be buyers of this stock, but instead consider selling it.

Support and Resistance Plot Chart for

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial

Fundamental Charts for :