Valuation analysis for Acorda Therapeutics Inc (NASDAQ:ACOR)

What is more important, the technical observation of the fundamental observation? Clearly it depends on your timeframe, but when the technicals and fundamentals line up clear opportunities surface. Reasonably, they are not always int he direction that some would prefer.

Acorda Therapeutics Inc (NASDAQ:ACOR) has had excellent recent growth, but the stock price has been fluctuating rather wildly. Our observations suggest that if the company is capable of maintaining its current growth rate fair value will appear quite attractive at current levels, but the recent growth rate has been so strong that there are doubts as to whether or not the company can maintain this level of growth.

We begin with an evaluation of EPS growth and when we review earnings it is important to recognize that we exclude onetime events so as to focus on earnings from operations because that gives us a better picture of company based earnings. In addition, we use trailing 12 month data and compare that on a yearly basis to determine yearly growth rates. As of the last release, Acorda has been growing at 56.8%, which by any means is a solid growth rate.

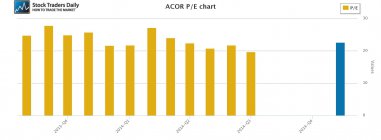

Interestingly, the PE multiple is slightly over 22 times earnings, suggesting that if the stock were to maintain its growth rate it would look significantly undervalued at current levels. Typically, when this happens, something is also going on behind the scenes, and with a more careful observation we can see that forward looking earnings estimates call for a reduction in EPS growth, in fact negative growth, in the coming year. This suggests that the growth rate we are observing is likely to change significantly.

Technical take:

According to our real time trading report for Acorda the stock is very close to longer term resistance and by rule when stocks are at longer term resistance levels sell signals surface. In fact, if longer term resistance levels remain intact we would expect the stock to fall back to longer term support, providing short Sellers with an opportunity to trade from resistance to support accordingly.

Summary:

Although Acorda has had excellent recent growth it is not expected to continue and as a result the relatively attractive valuation that appears at this immediate moment will likely change and if the growth rate becomes negative as analysts expect the stock will appear rich on a fundamental valuation basis in the near future. Given the fact that the stock is also near a level of longer-term resistance, we would sell this stock and expect declines back to longer term support accordingly.

Support and Resistance Plot Chart for

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial

Fundamental Charts for :