Valuation analysis for Agilent Technologies Inc (NYSE:A)

Some companies have been direct beneficiaries of FOMC stimulus, and the question is which ones were they and what should we do about it? This article helps shed some light on that.

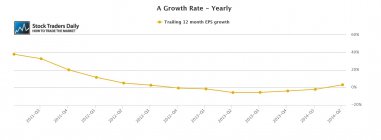

Two years ago Agilent Technologies Inc (NYSE:A) reported revenues that were in line with the recent revenue release, in between there has not been any material internal growth, and as we would expect during that same time EPS growth has been dismal. In most cases revenues and EPS are directly correlated, and that seems to the case for Agilent. In one respect that is a concern because some investors like it when companies are able to grow earnings without growing revenues, but we consider that type of growth to be unsustainable.

In fact, our EPS growth observations exclude onetime events so as to define growth from operations exclusively, and when we observe the growth from Agilent in recent years all we can possibly conclude is that growth has been virtually nonexistent.

However, at almost the same time EPS growth stalled, which was the third quarter of 2012, the stock began to press higher. This clearly was not due to either revenue or EPS growth, but instead it was due to something else. It was due to multiple expansion. The PE multiple went from near 12 to near 20 during a time when EPS and Revenue hit a wall.

The above observation is very important, and it tells us that the stock may have been a direct beneficiary of stimulus. That means, the excess liquidity that was chasing stocks since the FOMC began its monthly bond buying program at the beginning of 2013 seems to have brought buyers to Agilent that were not so concerned with EPS or revenue growth. A clear rationale for this could be the money flow into S&P 500 index ETFs because that brings buyers for ALL stocks in the S&P 500 regardless of their growth rates.

Summary:

Our observations suggest that the no-growth environment that Agilent has experienced in recent years did not warrant the increase in stock price. The stock price was a direct beneficiary of excess liquidity in the financial system, and the multiple expansion that took place was not supported by anything other than more money chasing S&P 500 stocks. That poses serious risks for investors and we would absolutely avoid Agilent as a result.

Support and Resistance Plot Chart for

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial

Fundamental Charts for :