pool ads

pool adsValuation analysis for Amazon.com, Inc. (NASDAQ:AMZN)

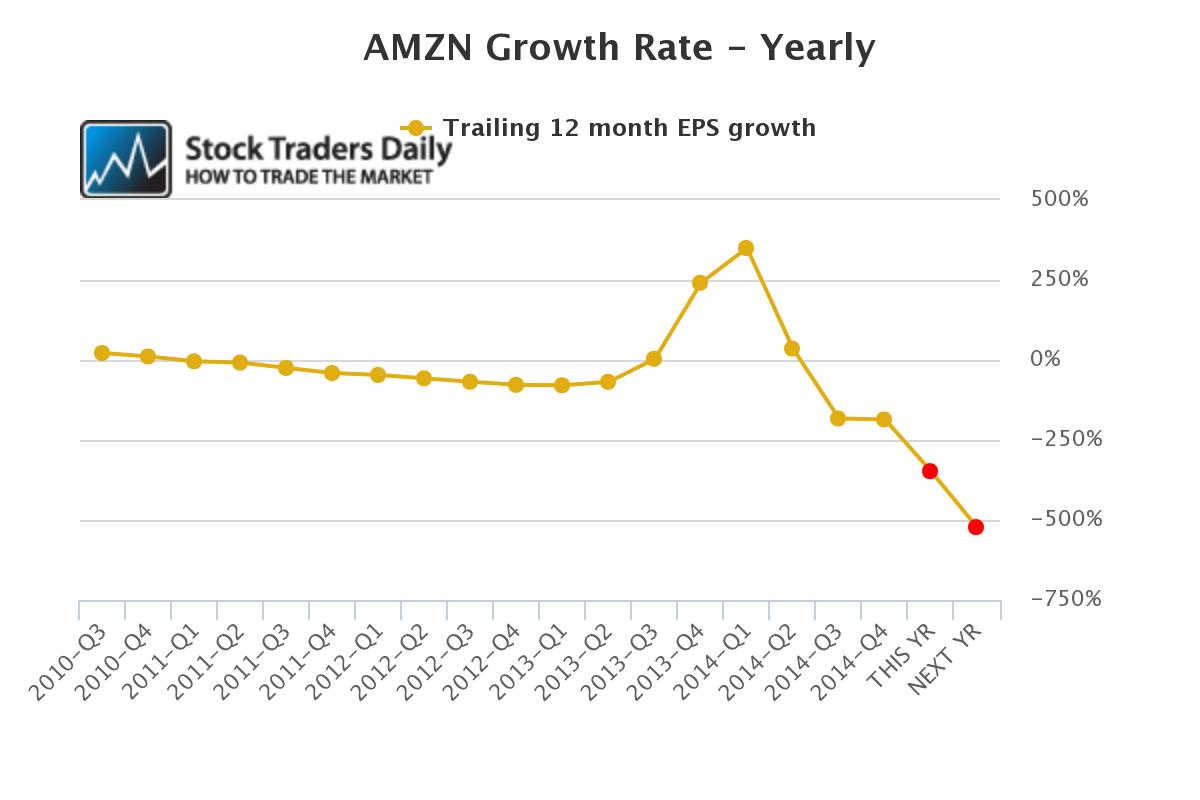

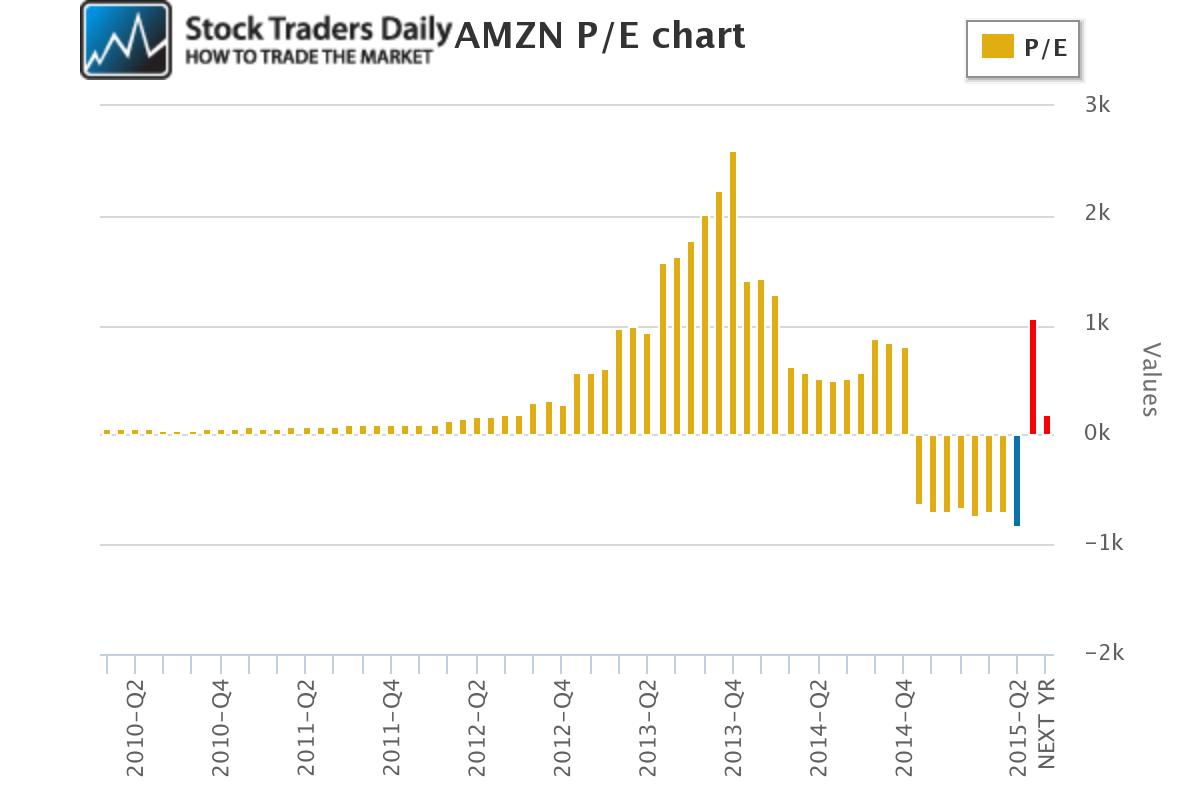

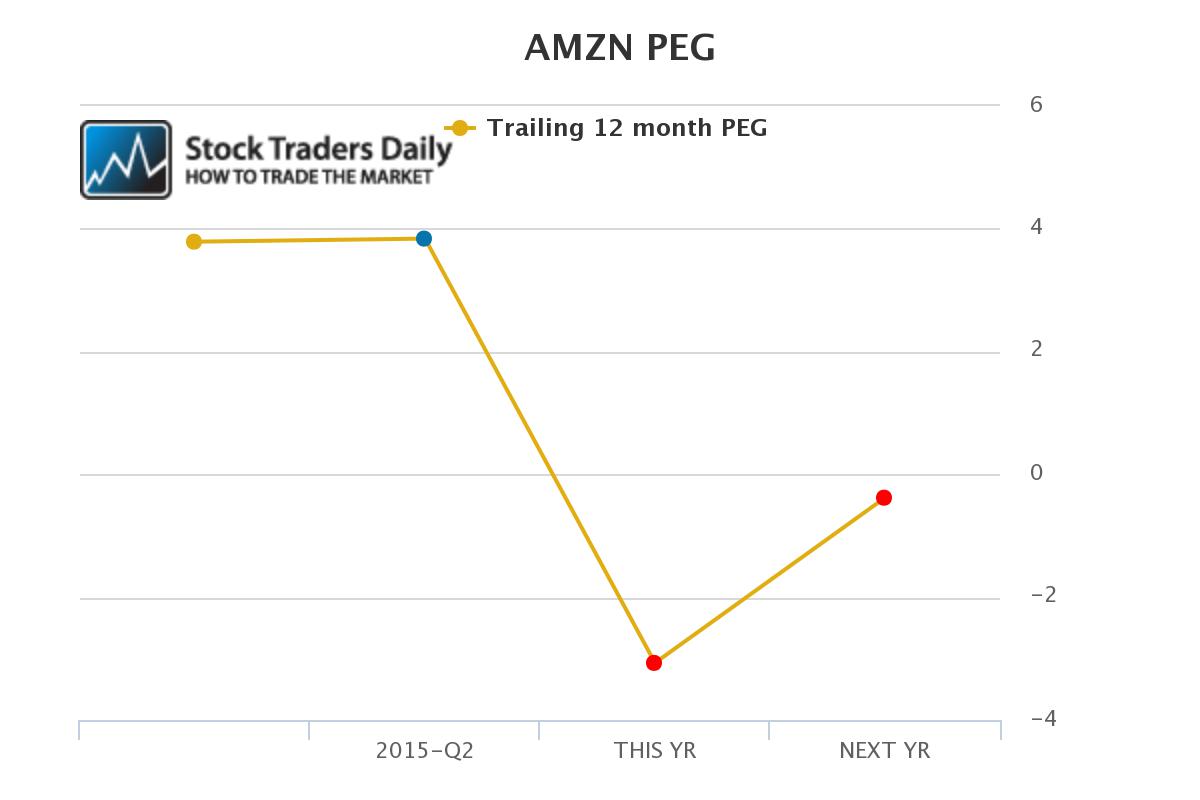

Stock Traders Daily has updated its valuation analysis for Amazon.com, Inc. (NASDAQ:AMZN) and the relevant data is offered below. In addition we have provided technical indicators that current suggest that AMZN is breaking out, but which will also be adjusted as the stock defines a new channel in the coming days.

Technical Summary

| Term → | Near | Mid | Long |

| Bias | Strong | Neutral | Neutral |

| P1 | 378.57 | 355.05 | 312.8 |

| P2 | 388.7 | 387.62 | 366.93 |

| P3 | 396.71 | 418.79 | 419.71 |

Support and Resistance Plot Chart for

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial

Fundamental Charts for :