Valuation analysis for Caterpillar Inc. (NYSE:CAT)

This is the third in a Series of 30 reports that are focused on identifying the valuation of the Dow Jones Industrial Average. We have already identified combined earnings growth in our Earnings Evaluation Module offered to Members of Stock Traders Daily, but this Series of reports will compliment that by evaluating each company on an individual basis. These report will be issued publicly at a rate of three per day over the next 10 days, however, the data is all already available to subscribers.

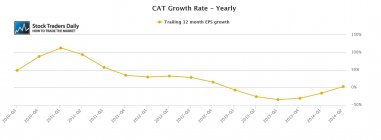

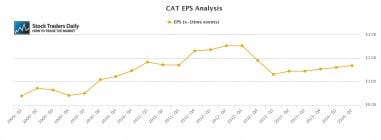

For Caterpillar Inc. (NYSE:CAT) the comps were so tough over the past few years that the Trailing 12 month EPS growth rate (excluding 1-time events to properly define growth from operations) was negative starting Q1 2013 and for the following 4 consecutive quarters. The good news is that the trailing 12 month growth rate was positive last time, but only by 2.78%. The question is, has the company made a turn?

Our review shows us that raw (Q/Q) EPS growth has been realized in recent quarters, but revenues have not increased proportionally. This suggests that Earnings growth is coming from sources not attributable to higher revenue, things like cost cutting, which can be a good thing once the company starts to realize revenue growth again, but is very concerning for anyone not expecting that in the near future.

Furthermore, although CAT looks like it has finally brought EPS growth back to shareholders on a trailing 12 month basis, it still has a multiple over 15, which suggests that analysts must be expecting good things going forward too.

Although the next few quarters do not support that, the comps between what analysts expect in 2014 and what they expect in 2015 is about 20%. That means, between now and the end of 2015 analysts are expecting CAT to grow significantly (they have been known to change their numbers in the past).

This tells us a few things. First, we can see that recent EPS has at least stabilized, even if it was due to something other than revenue growth, and although the current multiple is high relative to growth it will not appear high if the company grows by about 20% next year as analysts expect.

Technical Take:

The problem is that price is not supporting the numbers analysts are suggesting right now.

According to our real time trading report for CAT the stock has broken longer term support recently, and so long as that level remains broken (it is now converted resistance) we would expect the stock to decline. This is a red flag for anyone who believes that price matters.

Summary:

Although analysts seem to think that CAT will begin to grow nicely next year the price action recently does not support that, revenue growth does not support that, and we expect the stock to decline further. Using a PE analysis, a multiple of about 13 seems likely if the stock fails to reverse back above recently broken long term support.

Support and Resistance Plot Chart for

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial

Fundamental Charts for :