Valuation analysis for McDonald's Corporation (NYSE:MCD)

The information contained in this article has already been disseminated to clients of Stock Traders Daily and the remaining 30 DJIA components and the raw data that provides fair valuation analysis for them as well has also already been provided to clients.

Our analysis of McDonald's Corporation (NYSE:MCD) suggests that the stock is in a no growth environment at this time. Specifically, our trailing 12 month yearly EPS growth chart for McDonald's shows us that as of the most recent quarterly report McDonald's was not growing at all. This is a major concern for investors looking for value, looking for growth, and looking for stock price appreciation.

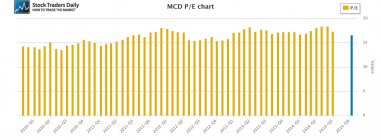

When a company is not growing earnings but its multiple remains at a level that suggests earnings growth it usually means that analysts are expecting much faster growth in the coming year, but that is not the case for McDonald's. The expectations are for very little growth if any at all in the coming year, and investors who are interested in stock price appreciation might take issue with that because the PE multiple is still over 16xearnings.

From the PE ratio analysis we offer it is also clear that shares of McDonald's tend to trough when the multiple is near 15 and peak when the multiple is near 18, so this is something that we should continue to observe, but it does nothing to satisfy the concerns of investors who are looking for growth.

Technical take:

According to our real time trading report for McDonald's the stock fell from longer-term resistance to test longer term support recently, but the stock now appears to be in the process of declining to test longer term support again. This makes longer term support important and it must hold for the stock to remain even remotely attractive on a technical basis. Treat longer term support as inflection; if it holds expect the stock to increase all the way back to longer-term resistance, but if longer term support breaks don't fight it. A break is a sell signal and the stock could fall aggressively if breaks occur.

Summary:

McDonald's has not been growing, it is not expected to grow, but it still trades at 16.4x earnings, making it rich on a valuation basis. The stock has held support recently, there are clear troughs in the PE multiple analysis as well, but if support breaks McDonald's can fall aggressively because the earnings growth necessary to attract investors who are interested in capital appreciation is not there at this time. If McDonald's falls back to test longer term support speculative investors could buy it for a trade, but treat support as risk control and stop the long position out if support breaks.

Yes, we consider MCD to be a speculative trade!

Support and Resistance Plot Chart for

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial

Fundamental Charts for :