pool ads

pool adsValuation analysis for Simon Property Group Inc (NYSE:SPG)

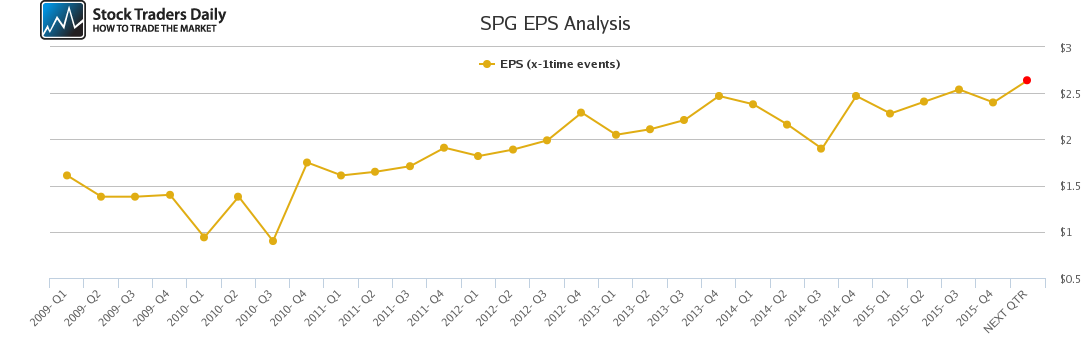

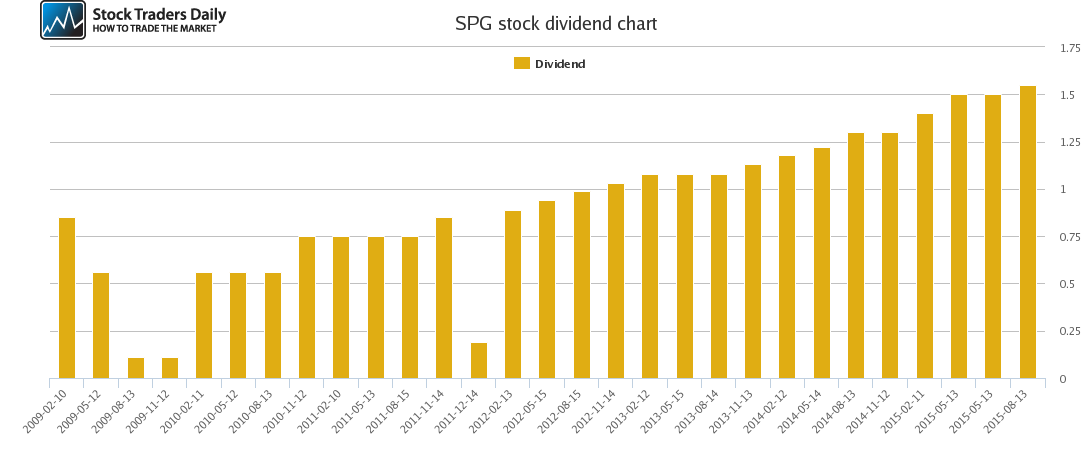

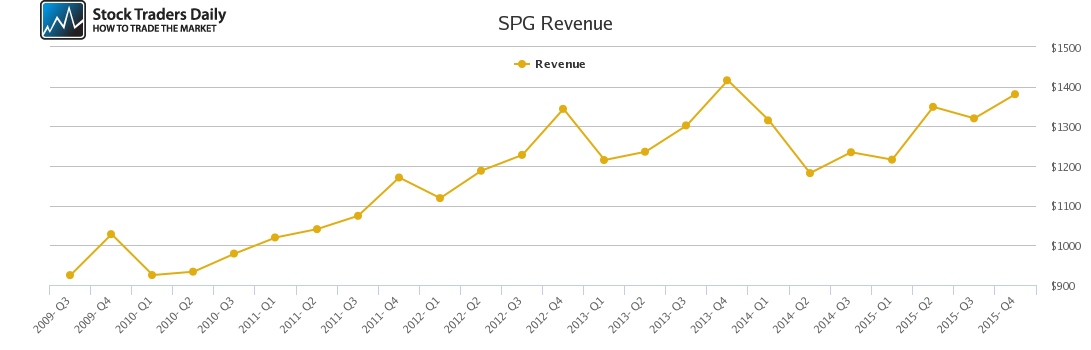

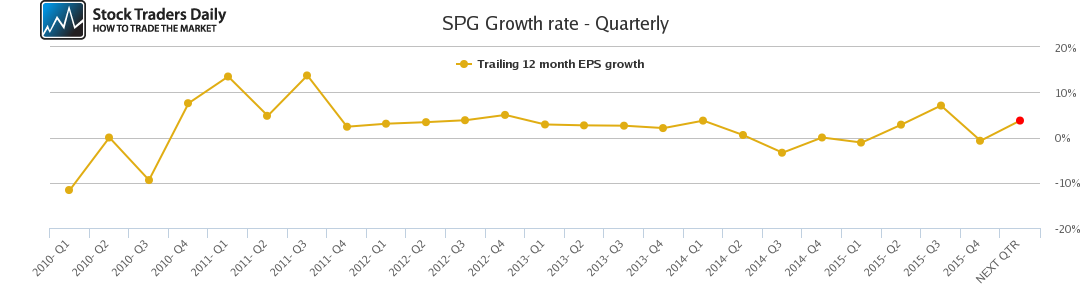

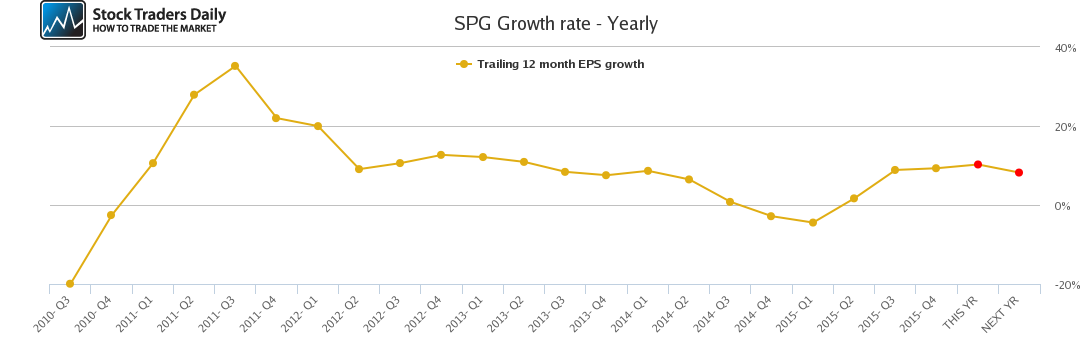

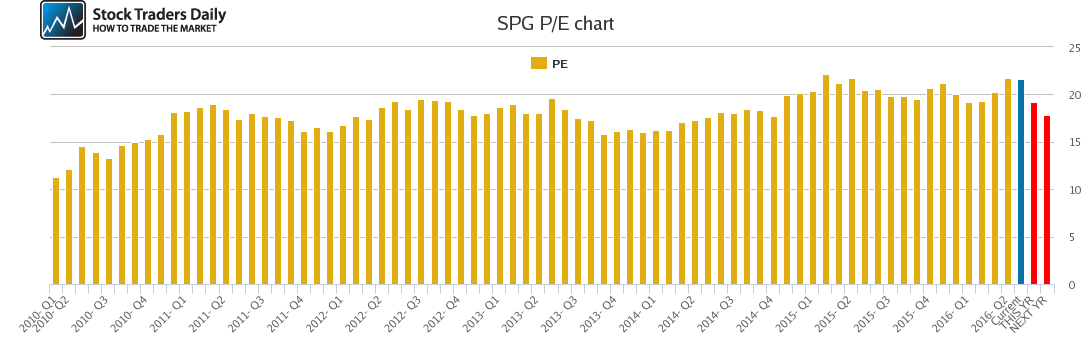

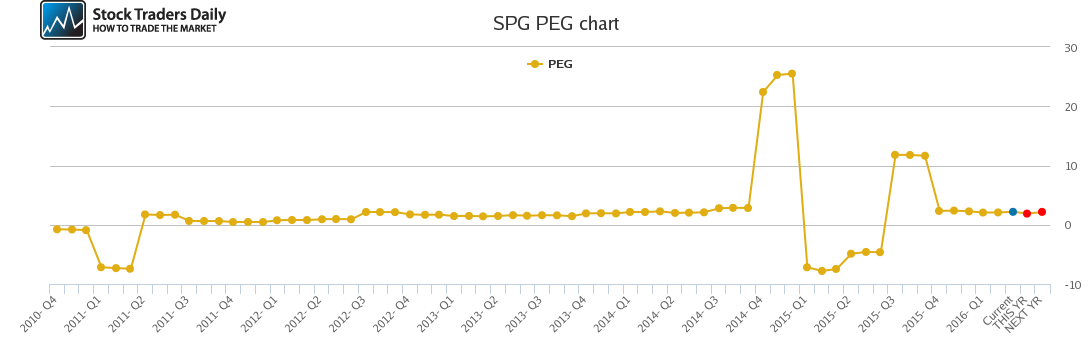

Using a valuation model that pins earnings growth to PE multiples to determine relative value as that relates directly to earnings growth rates, Stock Traders Daily has issued a sell rating for shares of Simon Property Group Inc (NYSE:SPG). The observations offered below help to summarize the findings.

Importantly, our macro economic analysis, which is called The Investment Rate, suggests that natural demand for equities will decline materially as this year continues, the Investment Rate measures the rate of change in the amount of new money available to be invested into the U.S. economy on an annualized basis dating back to 1900 and extending through 2040, and we are currently in a period of declining natural inflows.

Naturally, conditions like this suggest that there will be fewer buyers of stocks, and when that happens multiple contractions are a natural byproduct, and this can happen without economic deterioration and while economic conditions remain stable. The demand cycle identified by the Investment Rate is likely to influence weaker economic conditions, however.

In market environments like this those stocks that appear rich relative to their earnings growth rate are most vulnerable to decline, and Simon property group appears rich when compared to its price to earnings growth multiple. We believe that as this year continues and the macro economic landscape plays out shareholders in SPG will consider valuation to be expensive, that means they will consider the stock to be a higher risk, and net selling pressure will likely drive the stock down to fair values.

Technical Summary

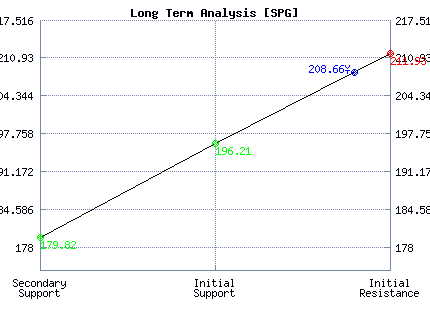

| Term → | Near | Mid | Long |

|---|---|---|---|

| Rating | Neutral | Strong | Neutral |

| P1 | 205.93 | 196.59 | 179.82 |

| P2 | 208.24 | 205.61 | 196.21 |

| P3 | 210.07 | 214.06 | 211.93 |

Support and Resistance Plot Chart for SPG

Long Term Trading Plans for SPG

April 7, 2016, 10:38 am ET

The technical Summary and associated Trading Plans for SPG listed below will help you make important timing decisions for your trades. This data is based on our proprietary analysis for SPG. In addition we offer Market Timing Models and Stock Filters in the links above which may increase the proficiency of the decisions you make.

SPG - (Long) Support Plan

Buy over 196.21 target 211.93 stop loss @ 195.95.

The technical summary data tells us to buy SPG near 196.21 with an upside target of 211.93. This data also tells us to set a stop loss @ 195.95 to protect against excessive loss in case the stock begins to move against the trade. 196.21 is the first level of support below 208.66 , and by rule, any test of support is a buy signal. In this case, support 196.21 is being tested, a buy signal would exist.

SPG - (Short) Resistance Plan

Short under 211.93 target 196.21 stop loss @ 212.19

The technical summary data is suggesting a short of SPG as it gets near 211.93 with a downside target of 196.21. We should have a stop loss in place at 212.19 though. 211.93 is the first level of resistance above 208.66, and by rule, any test of resistance is a short signal. In this case, if resistance 211.93 is being tested, a short signal would exist.

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial