Valuation analysis for Target Corporation (NYSE:TGT)

When companies experience earnings contractions and then management successfully rights the ship and earnings growth is realized again stocks usually recover nicely initially, but after the party has ended rational minds prevail. That could mean different things depending on the outlook that exists for the stock in the years ahead.

This article identifies the fair value for Target Corporation (NYSE:TGT) using a forward looking earnings driven approach. Our observations entail complete earnings cycles to avoid seasonal anomalies, we exclude onetime events to identify truer growth rates, and we look ahead two years, not longer than two years, because we also discount analysts ability to predict earnings that far in advance.

To begin, our earnings analysis shows us that earnings growth was recently negative, but as of the last report the yearly earnings growth for Target is back in the black. Currently, earnings are growing at a rate of 17.33%, but if analysts are right about their estimates for 2015 the growth rate will increase to 36.4%, represented by the first red dot in our earnings graph. The second red dot represents expectations for calendar 2016, and if analysts are right the growth rate will be 28.98%. Not only is Target recovering from negative earnings growth, but according to analysts earnings are expected to accelerate.

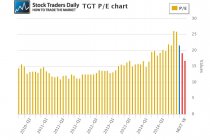

Turning our attention to the PE multiple, the first blue bar in our PE multiple chart represents the current PE, which is 21.63. The first red bar represents what the PE would be if analysts are correct about their estimates for 2015 and price remains the same, which is 19.23, and the second red bar represents the same for calendar 2016 and that is 16.77. According to our PE multiple chart the price earnings multiple is expected to decline over the next couple of years because earnings are expected to grow, and that's usually a good sign.

This allows us to look at fair value using a peg ratio approach much more closely. We're comparing the yearly growth rate for Target to its PE multiple to better define valuation, and our definition of fair value using a peg ratio approach suggests that peg ratio is between zero and 1.5 typically represent fair value. The current peg ratio for Target is 1.25, represented by the blue dot in our chart, so it is currently showing a relatively fair value. The first red dot represents what the peg ratio would be if analysts are correct about 2015 and price remains the same, and that would be 0.53. The second red dot represents 2016 and that is 0.58. Everything considered, the peg ratio is not only currently representing fair value, but future peg ratios make valuation look better. That's good news too.

Should price remain the same?

Typically, when valuation improves prices increase over time, and that would be what we would expect from Target if analysts are right about their earnings expectations.

For value oriented investors Target actually is interesting, and unless analysts change their estimates for calendar 2015 and 2016 respectively our observations suggest that Target represents an attractive value for value oriented investors. We caution investors to evaluate price closely as well before making an investment, but fundamentally the stock does offer value given its recent earnings recovery and the expectations that currently exist.

Support and Resistance Plot Chart for

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial

Fundamental Charts for :