Valuation analysis for The Coca-Cola Co (NYSE:KO)

Is the DJIA overvalued, or is it likely to move up, or does valuation even matter anymore? Our opinion is that valuation absolutely matters, and this is the 30th in a series of 30 reports that identifies fair value for the DJIA one stock at a time. Using data already supplied to clients of Stock Traders Daily, this report and the 29 others serve to offer evidence of the fair valuation of the Dow as a whole.

Stable, consistent, reliable, a staple, these are all words that are often associated with investor's opinions about The Coca-Cola Co (NYSE:KO). The problem is, when we look at earnings growth and current valuation the conservative bias that might stem from that word association starts to look far less conservative.

First, when we evaluate earnings growth we do so on a trailing 12 month basis, removing onetime events to properly observed earnings from operations. We compare trailing 12 month earnings quarter by quarter and year by year to identify growth trends, and in the chart below our yearly EPS growth chart for KO is offered.

Back in 2011 Coke realized earnings growth of 8.99%, the most recent peak, but since then the EPS growth rate has been declining and as of the last report it was -0.48%. To put that another way, Coca-Cola is not growing at this time. In fact, if the trend continues it will likely begin to fall more deeply into negative territory. This should absolutely be concerning to investors when they consider the corresponding PE multiple.

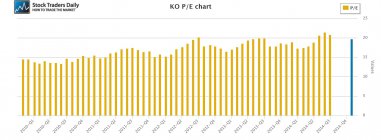

When earnings growth deteriorates we would expect investors to speak with their pocketbooks, and specifically we would expect PE multiples to contract, but that is not the case with Coca-Cola. Instead, the PE multiple remains at about 20 times earnings, a level that appears quite rich compared to the growth trend we have been witness to lately.

Technical take:

According to our real time trading report for KO the stock is testing longer term support at this time and if the stock remains at or above longer term support we would be a buyer on a technical basis with a target of longer-term resistance as that is defined in our report. Support would act as our downside risk control, however, and if support breaks we would not hold the stock, but instead sell it.

Summary:

Our observations suggest that Coca-Cola is overvalued given its current growth rate. In addition, our observations suggest that investors are rather hopeful and determined to continue to believe that Coca-Cola is as stable as ever, but the EPS growth rate that we are observing does not suggest the same. In fact, when comparing the EPS growth rate to the PE multiple Coca-Cola looks extremely rich and that makes it much more risky than the conservative investors who are typically touting the stock would believe. The stock is, however, testing a longer term support level, and that makes it a buy on a technical basis, but if Coca-Cola breaks below longer term support we would not only sell it, but the stock could fall aggressively because it is at longer term support, an important inflection point, and no additional support levels exist under that level in our longer-term analysis for the stock at this time.

Support and Resistance Plot Chart for

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial

Fundamental Charts for :