pool ads

pool adsValuation analysis for United Technologies Corporation (NYSE:UTX)

Stock Traders Daily is in the process of conducting an extensive valuation analysis for the Dow Jones Industrial Average and although the raw data has already been supplied to clients of Stock Traders Daily the public disclosure here is the 23rd of the 30 DJIA components.

The relationship between EPS growth and revenue growth at United Technologies Corporation (NYSE:UTX) is exactly the relationship that we look for when trying to identify companies who are on the right track. Our analysis shows us that the relatively parallel relationship is a healthy one.

However, a parallel relationship does not always mean that improvements or material growth are being realized, and as we can see by looking at our yearly trailing 12 month EPS growth chart for United Technologies the company absolutely experienced earnings growth contractions in the past. In addition, we can see that the company has regained its footing in terms of earnings growth and it is currently growing at 14.67% on a yearly trailing 12 month basis, and analysts are expecting solid growth going forward, so those are good things.

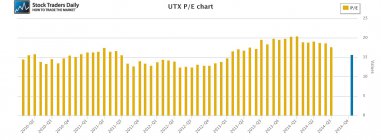

This brings our attention to the PE multiple. Recently, shares of United Technologies were trading with a PE multiple close to 20 times earnings. That was a very rich multiple for this company, but since then the stock has fallen and with it the multiple has also come down. Historically, the best time to buy United Technologies has been when the PE multiple dips below 15 times earnings. Last week, when the Dow Jones industrial average suffered a severe decline, United Technologies quite probably dipped below 15 times earnings and the stock currently trades at 15.67 times earnings.

Technical take:

According to our real time trading report for United Technologies the stock has recently tested longer term support after declining from longer-term resistance and if longer term support remains intact we should expect the stock to increase back towards longer term resistance by rule.

Summary:

United Technologies is growing nicely, it is expected to continue to grow nicely, its PE multiple dipped to a reasonable level, and the stock has recently tested longer term support levels. If longer term support levels remain intact we would expect the stock to increase back towards longer term resistance. Longer term support is our inflection level, however, and the stock must remain above longer term support as we have identified that in our real time trading report for us to remain positive on United Technologies. That is our risk control and if the stock breaks support we would not be positive on a technical basis, but because the stock has tested support and support is holding, given the relatively positive fundamental attributes, we would be buyers of United Technologies near longer term support levels.

Support and Resistance Plot Chart for

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial

Fundamental Charts for :