pool ads

pool adsValuation analysis for Walt Disney Co (NYSE:DIS)

Our combined analysis for Walt Disney Co (NYSE:DIS) suggests that the stock is trading near the level of longer term support and the stocks ability or inability to hold support will be a major determining factor in direction and should be used by traders and investors in gauging their expectations respectively.

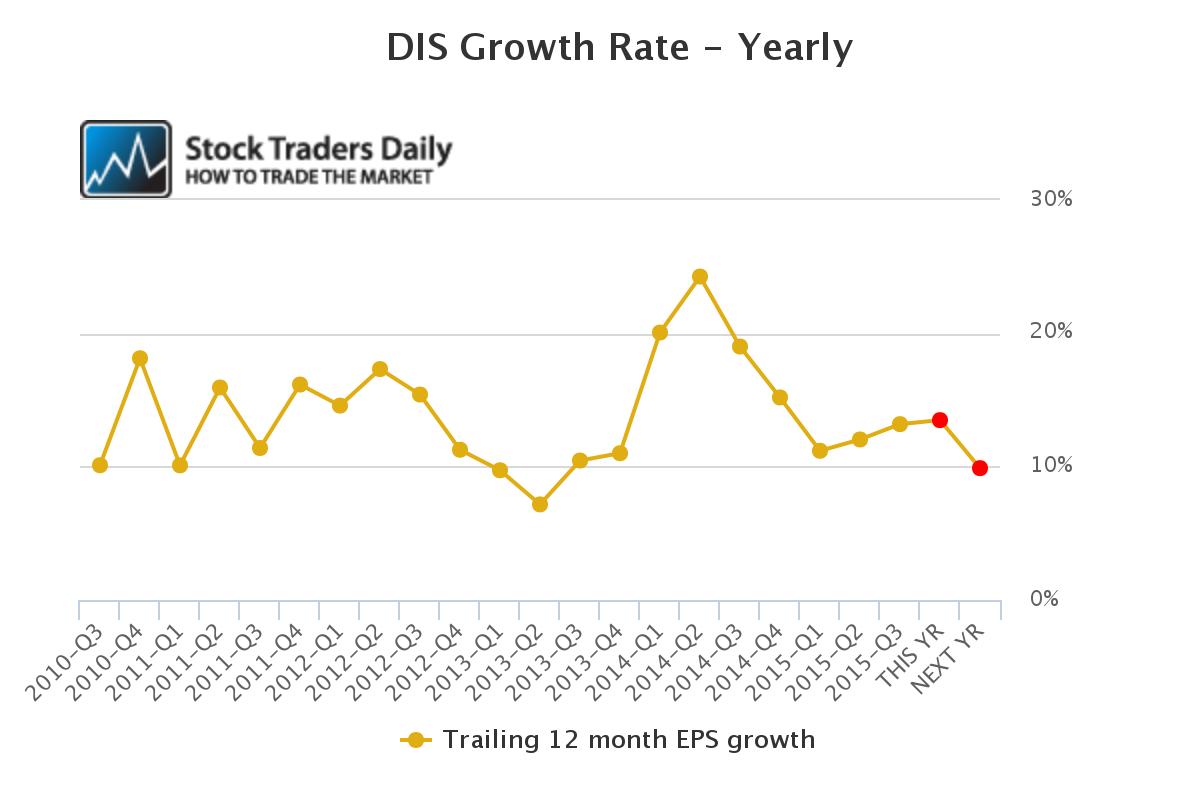

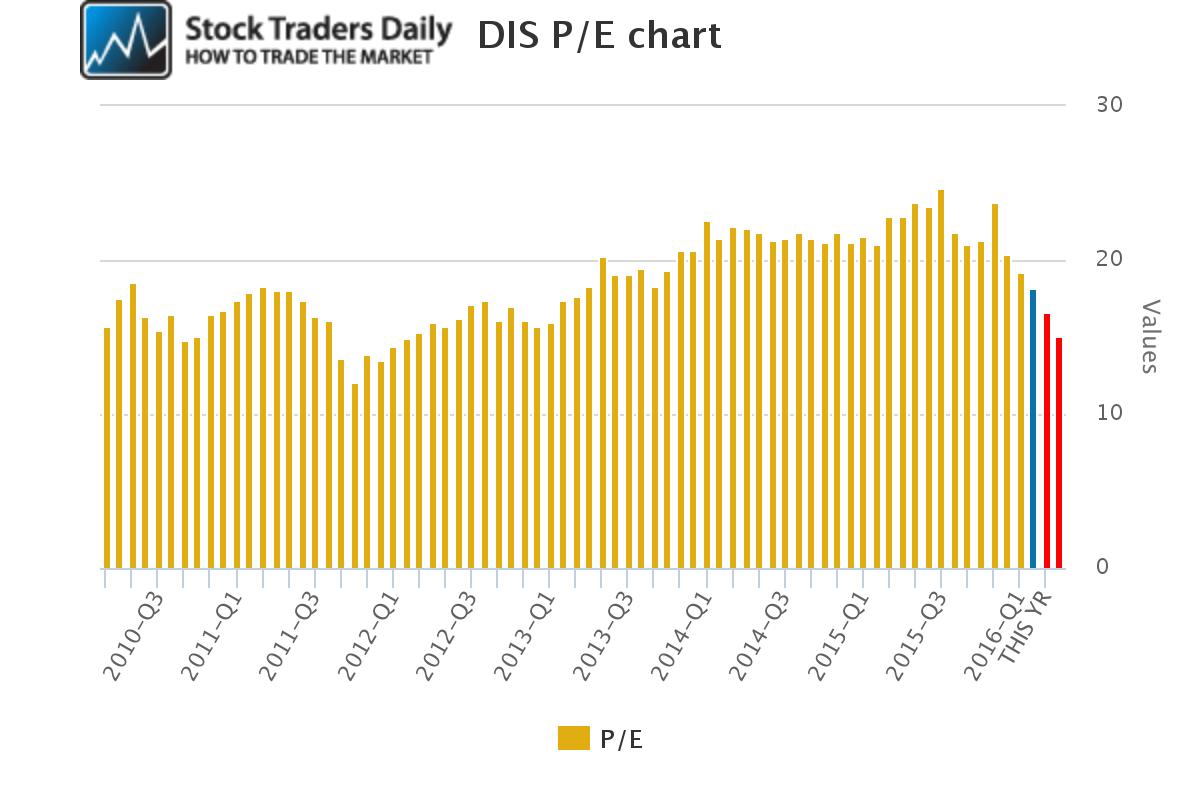

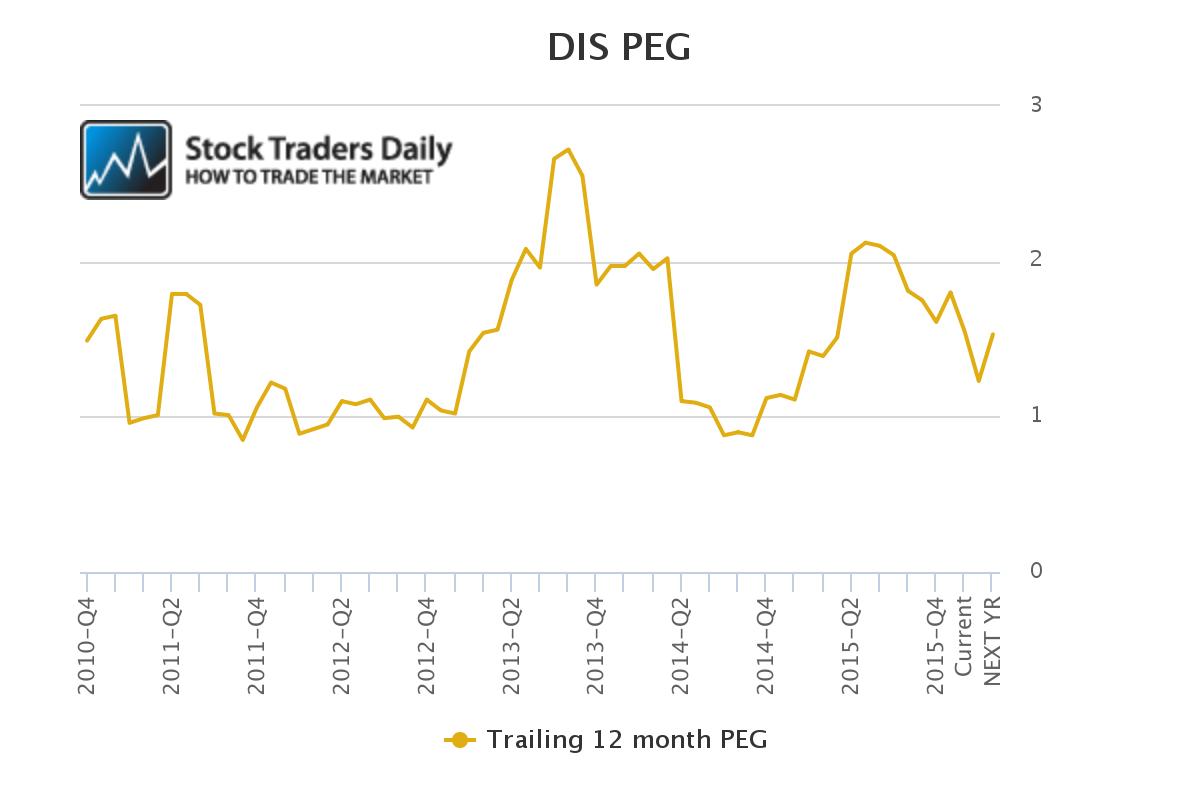

Furthermore, although valuation based on earnings growth it is not obtuse it certainly is expanding, which suggests that valuation levels look less attractive now than they did a year ago.

Fundamentally, at least from an earnings growth perspective, the company seems OK even though valuation looks less attractive going forward, so our attention turns two the longer term support level and the ability or the inability of the stock to hold support from here.

Technical Summary

|

Term → |

Near |

Mid |

Long |

|

Bias |

Weak |

Weak |

Neutral |

|

P1 |

94.35 |

94.23 |

93.98 |

|

P2 |

97.18 |

103.06 |

107.58 |

|

P3 |

100.87 |

111.58 |

120.46 |

|

The data above has been derived in real time using our proprietary algorithms. These have been in use since 2002, and they help us to determine actionable trading plans for more than 1300 stocks, ETFs, markets, and more. This is a stock-specific report, but complete market analysis is also available. Please note: The Trading Plans associated with this report were generated at the time of the report. This is therefore a Real Time Trading report, and the trading plans herein will change as prices change. To obtain an updated report at any time, please click here: UPDATE THIS REPORT |

Long Term Trading Plans for DIS

January 19, 2016, 2:36 am ET

The technical Summary and associated Trading Plans for DIS listed below will help you make important timing decisions for your trades. This data is based on our proprietary analysis for DIS. In addition we offer Market Timing Models and Stock Filters in the links above which may increase the proficiency of the decisions you make.

DIS - (Long) Resistance Plan

Buy over 93.98, target 107.58, stop loss @ 93.72

Buy over 93.98, target 107.58, stop loss @ 93.72

Buy over 93.98, target 107.58, stop loss @ 93.72.

If 93.98 begins to break higher, the technical summary data will suggest a buy of DIS over 93.98, with an upside target of 107.58. The data also tells us to set a stop loss @ 93.72 in case the stock turns against us. 93.98 is the first level of resistance above 93.90, and by rule, any break above resistance is a buy signal. In this case, resistance 93.98 would be breaking higher, so a buy signal would exist.

DIS - (Short) Resistance Plan

Short under 93.98, target N/A, stop loss @ 94.24

Short under 93.98, target N/A, stop loss @ 94.24

There is no current Support Plan to trigger a short at this time. Shorts should be based n tests of resistance levels. In this case, the door is wide open for additional declines unless resistance breaks higher...

Please use the resistance plan as a short-indicator until new support levels have been added to the database. Usually revised trading indicators will update at the beginning of the next trading session.

Support and Resistance Plot Chart for

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial

Fundamental Charts for :