Advanced Micro Devices, Inc. (NASDAQ: AMD) Is Growing At Its Peers’ Expense

According to the latest data released by Mercury Research, Advanced Micro Devices, Inc. (NASDAQ: AMD) has gained some market share from its competitors in the CPU and GPU segments. The report indicates that AMD gained significant market share in the CPU industry from its main rival Intel Corporation (NASDAQ: INTC) while at the same time taking market share in the GPU market from the dominant player NVIDIA Corporation (NASDAQ: NVDA).

The Mercury Research report further estimated that AMD gained about 6.3% in the GPU market against NVidia on a quarterly basis in the fourth quarter. The report further estimates that NVidia lost part of its GPU market due to the popularity of AMD Vega processors that were the preferred choice among cryptocurrency miners and gamers.

Review Our AMD Trading Plans Here.

AMD also gained significant ground in the CPU market where it increased its desktop CPU market by 2.1% on an annualized basis and its Server market by an annualized 0.5%. The popularity of its Ryzen processors, which were fairly priced and delivered excellent performance in comparison to the more expensive Intel chips, contributed significantly to AMD’s expansion in the CPU market.

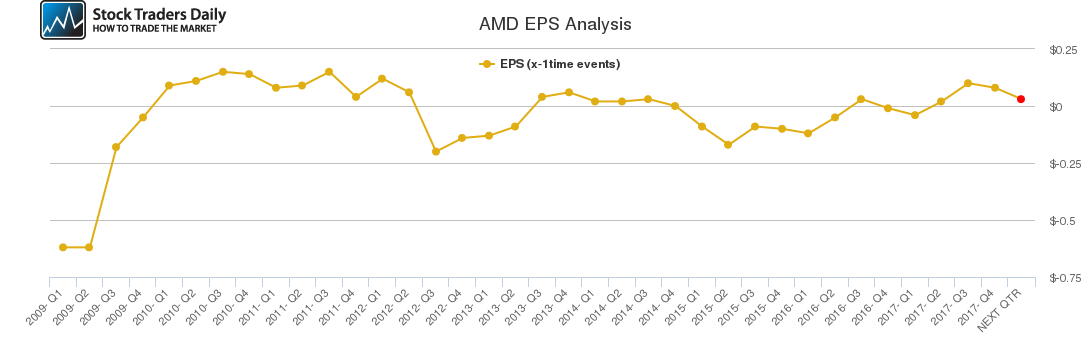

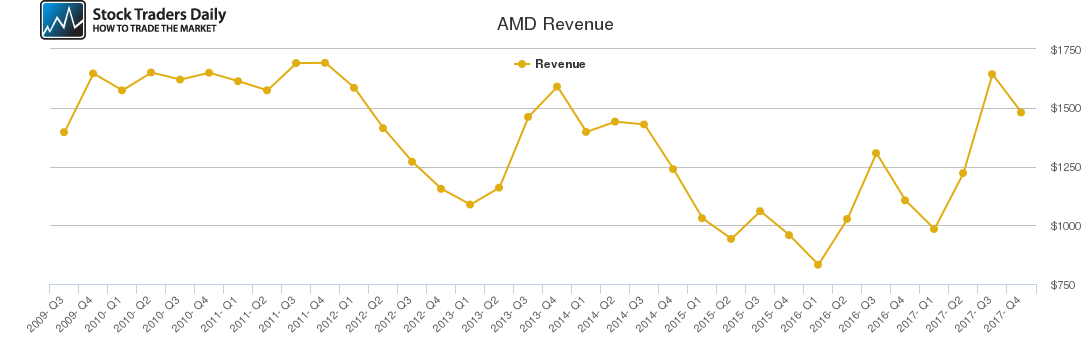

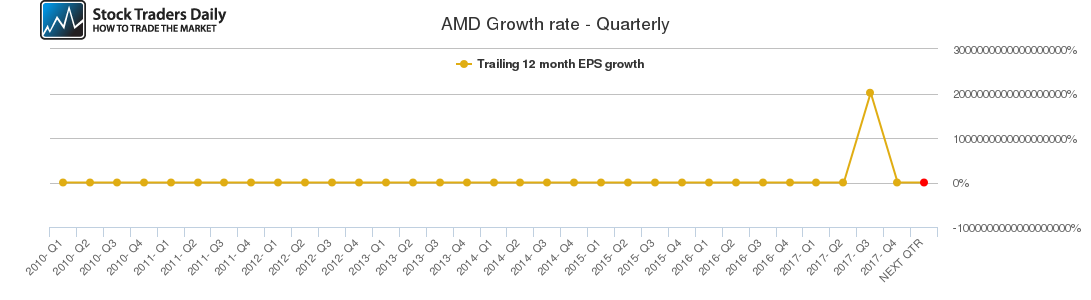

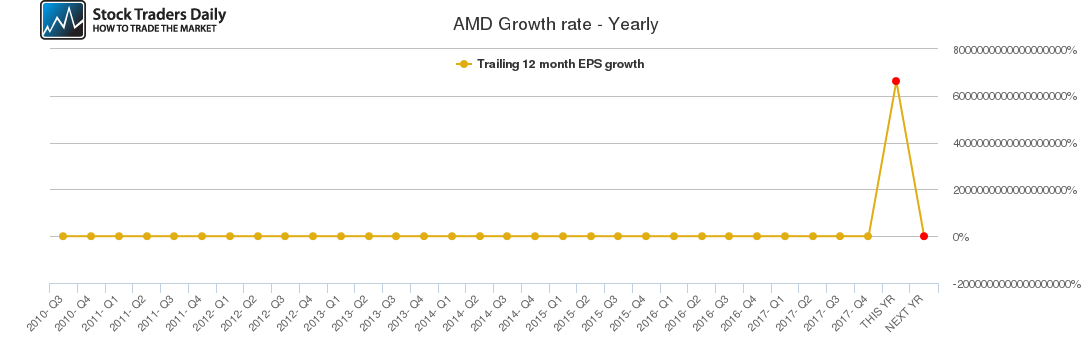

Our combined analysis of the chipmaker indicates that the company’s revenues are likely to dip in the next quarter as was the case in Q4 2017 given the cyclical nature of the semiconductor industry. The company is also expected to report much lower quarterly growth as compared to the previous quarter, but this might change driven by demand in the cryptocurrency mining and gaming markets as well as the demand for Ryzen laptop processors.

The company’s annual growth rate is expected to register a major spike driven by some of the factors mentioned above. The company is likely to continue taking market share from industry leaders NVidia and Intel if it continues to develop chips with excellent performance at lower prices. In the past, AMD was focused on selling its chips at lower prices to remain competitive, but its latest chips are competing based on performance.

Based on the technical data and associated charts at the time this article was written, Stock Traders Daily has provided detailed trading plans, with integrated risk controls, to its clients. These plans will change in real time as prices move. To receive an update or to review the detailed trading plans associated with this data please review our Real Time Trading Report for AMD.

Technical Summary

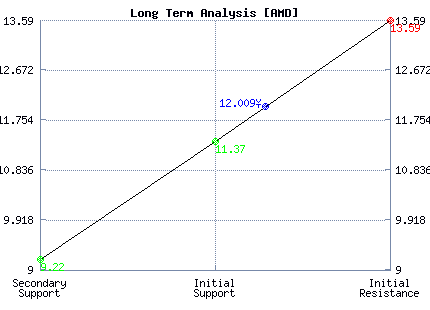

| Term → | Near | Mid | Long |

|---|---|---|---|

| Rating | Strong | Neutral | Neutral |

| P1 | 11.96 | 11.10 | 9.22 |

| P2 | 12.31 | 12.76 | 11.37 |

| P3 | 12.91 | 14.44 | 13.59 |

Support and Resistance Plot Chart for AMD

Long Term Trading Plans for AMD

March 1, 2018, 12:50 pm ET

The technical Summary and associated Trading Plans for AMD listed below will help you make important timing decisions for your trades. This data is based on our proprietary analysis for AMD. In addition we offer Market Timing Models and Stock Filters in the links above which may increase the proficiency of the decisions you make.

AMD - (Long) Support Plan

Buy over 11.37 target 13.59 stop loss @ 11.11.

The technical summary data tells us to buy AMD near 11.37 with an upside target of 13.59. This data also tells us to set a stop loss @ 11.11 to protect against excessive loss in case the stock begins to move against the trade. 11.37 is the first level of support below 12.009 , and by rule, any test of support is a buy signal. In this case, support 11.37 is being tested, a buy signal would exist.

AMD - (Short) Resistance Plan

Short under 13.59 target 11.37 stop loss @ 13.85

The technical summary data is suggesting a short of AMD as it gets near 13.59 with a downside target of 11.37. We should have a stop loss in place at 13.85 though. 13.59 is the first level of resistance above 12.009, and by rule, any test of resistance is a short signal. In this case, if resistance 13.59 is being tested, a short signal would exist.

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial