Apple Inc. (NASDAQ: AAPL) Shareholders Are Set To Benefit from the Recent Dip

During the latest earnings call, Apple Inc. (NASDAQ: AAPL) CFO Luca Maestri announced that the tech company wanted to neutralize its net cash position. He cited the recent tax reform laws as the main reason why the company was considering returning billions of dollars to its shareholders this year.

The announcement is a good move on Apple’s part given that it has a net cash position of $163 billion, which it could return to shareholders in the form of dividends or through share buybacks. Given the recent dip in Apple’s stock price following the massive sell-off that affected companies in the Dow Jones Industrial Average (INDEXDJX: DJI), Apple’s market cap fell to $812 billion.

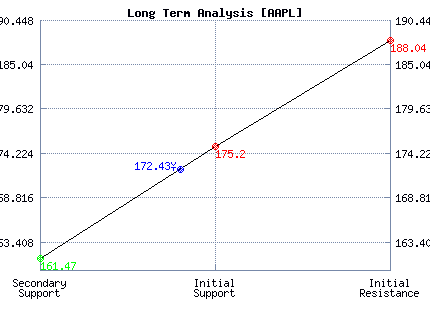

Our technical analysis of Apple indicates that the company is trading near a crucial support level, which could influence current and future trading plans.

The recent dip means that the company’s existing net cash can purchase almost 20% of existing shares, which translates into almost 1 billion shares.

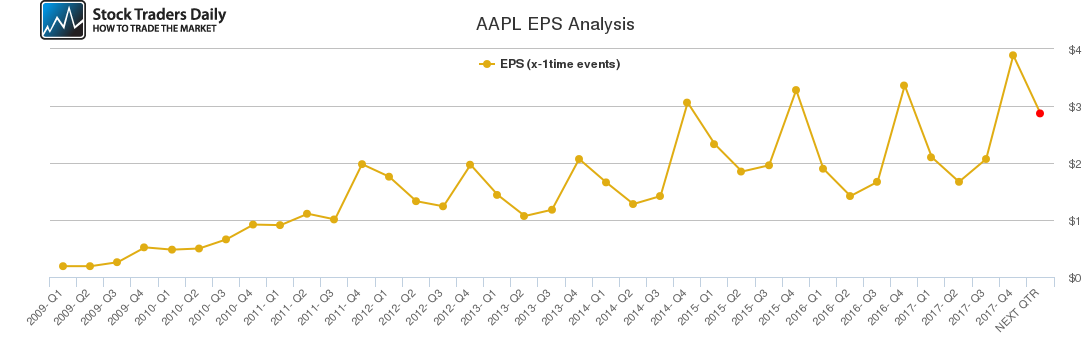

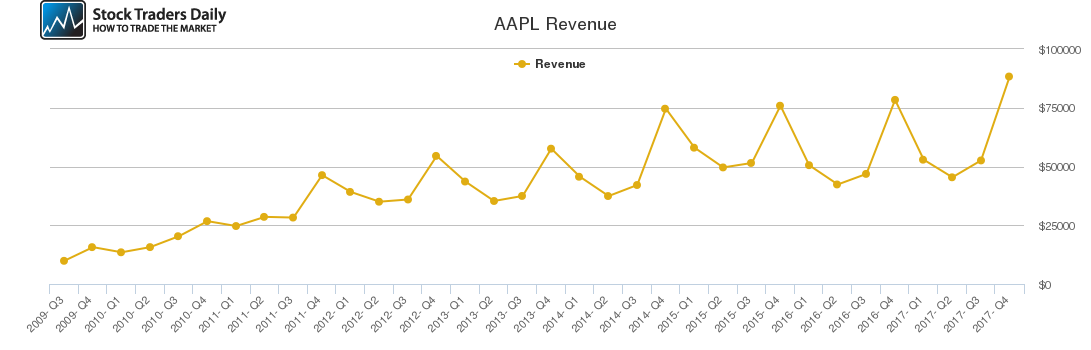

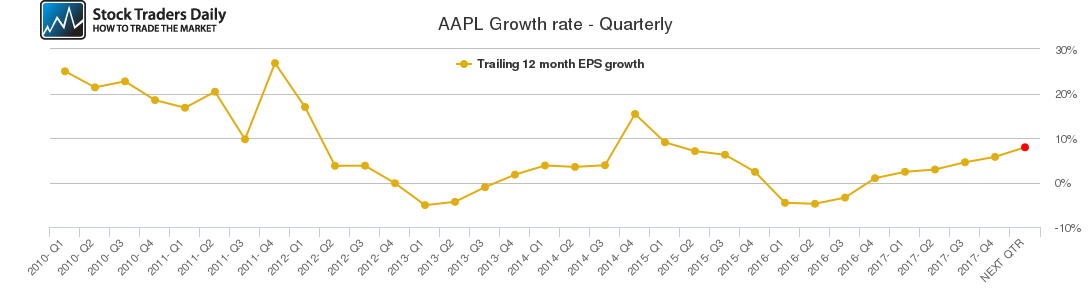

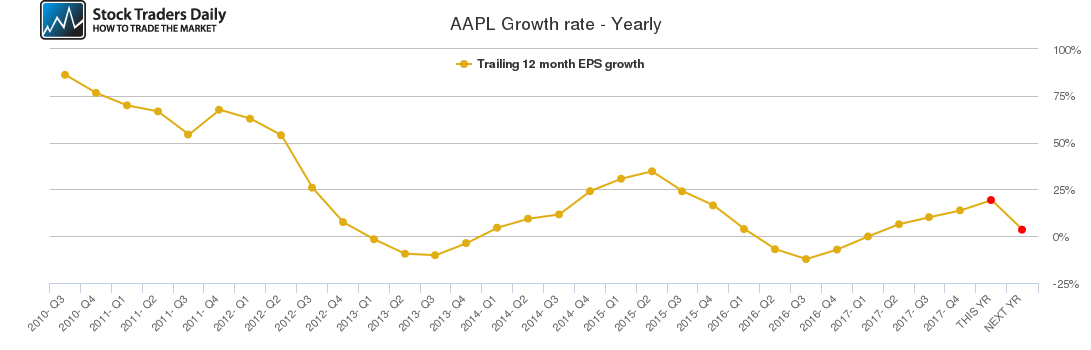

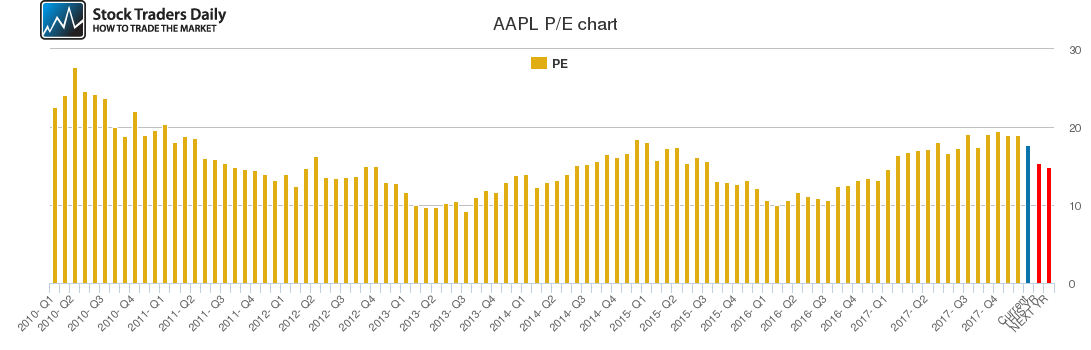

The company’s quarterly growth is expected to be much better in the current quarter, according to data provided in the charts below, but annual growth is expected to come in much lower next year. This data is factored into our technical analysis and is used together with numerous other data points to create our real-time trading plans based on the stock’s current price.

Based on the technical data and associated charts at the time this article was written, Stock Traders Daily has provided detailed trading plans, with integrated risk controls, to its clients. These plans will change in real time as prices move. To receive an update or to review the detailed trading plans associated with this data please review our Real Time Trading Report for AAPL.

Technical Summary

| Term → | Near | Mid | Long |

|---|---|---|---|

| Rating | Strong | Weak | Neutral |

| P1 | 164.45 | 154.29 | 161.47 |

| P2 | 170.80 | 167.28 | 175.20 |

| P3 | 175.04 | 178.07 | 188.04 |

Support and Resistance Plot Chart for AAPL

Long Term Trading Plans for AAPL

February 20, 2018, 3:02 pm ET

The technical Summary and associated Trading Plans for AAPL listed below will help you make important timing decisions for your trades. This data is based on our proprietary analysis for AAPL. In addition we offer Market Timing Models and Stock Filters in the links above which may increase the proficiency of the decisions you make.

AAPL - (Long) Support Plan

Buy over 161.47 target 175.20 stop loss @ 161.21.

The technical summary data tells us to buy AAPL near 161.47 with an upside target of 175.20. This data also tells us to set a stop loss @ 161.21 to protect against excessive loss in case the stock begins to move against the trade. 161.47 is the first level of support below 172.43 , and by rule, any test of support is a buy signal. In this case, support 161.47 would be being tested, so a buy signal would exist.

AAPL - (Short) Resistance Plan

Short under 175.20 target 161.47 stop loss @ 175.46.

The technical summary data is suggesting a short of AAPL as it gets near 175.20 with a downside target of 161.47. We should have a stop loss in place at 175.46 though. 175.20 is the first level of resistance above 172.43, and by rule, any test of resistance is a short signal. In this case, if resistance 175.20 is being tested, so a short signal would exist.

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial