Baidu Inc (NASDAQ: BIDU) Is Well-Positioned To Profit from Future Trends

Baidu Inc (NASDAQ: BIDU) recently reported its fourth quarter results, which came in quite strong given that the Chinese internet giant reported growing margins along with other solid financial metrics. Last year was a good year for the company as it divested noncore businesses key among them being Waimai, which was sucking a lot of cash from the company, causing it to underperform in 2015 and 2016.

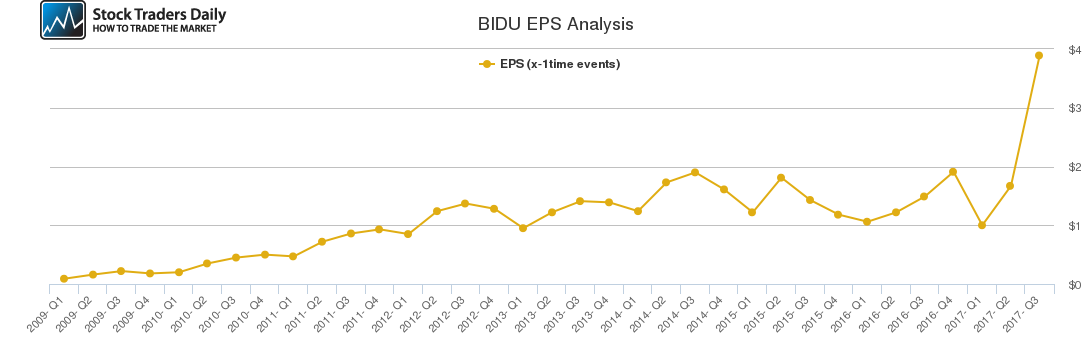

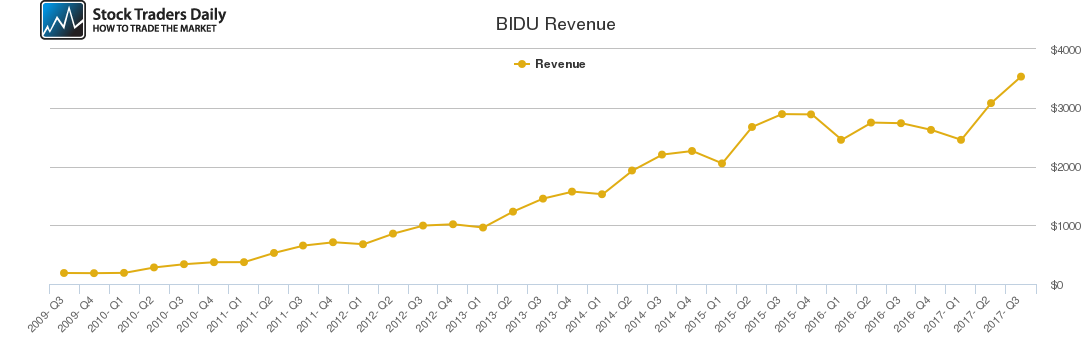

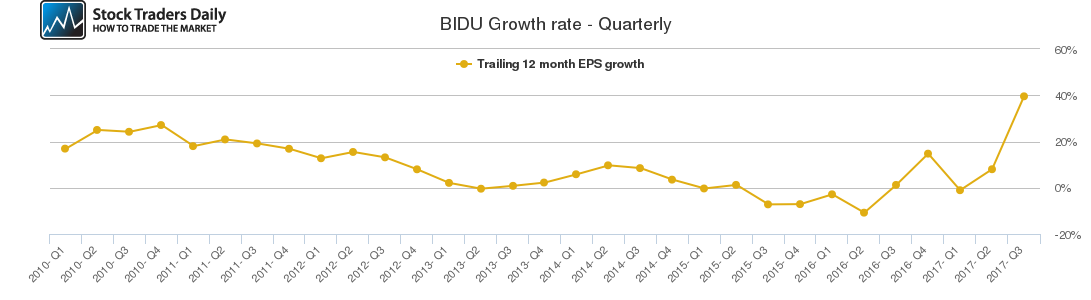

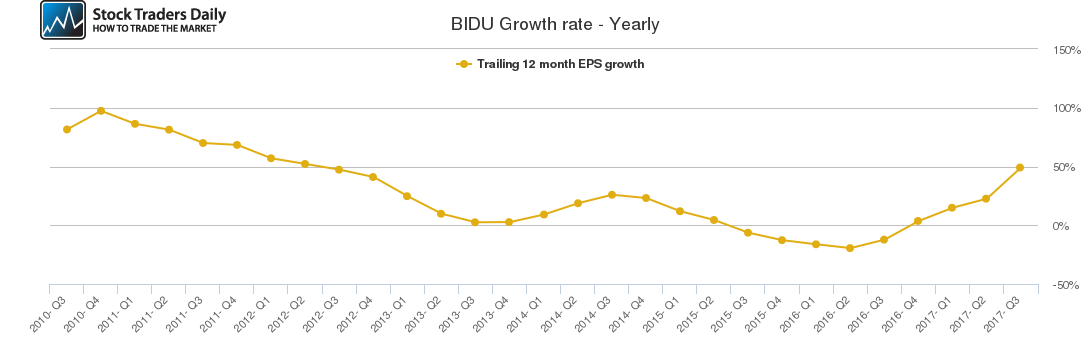

Despite the sluggish growth recorded by the company in previous years, our proprietary analysis as depicted in the charts below indicates that Baidu’s annual growth figures started improving in Q2 2016. However, the company’s recovery to positive growth begun in Q4 2016 and gained traction in 2017.

The company’s revenues have been growing since Q1 2017 and are not showing any signs of slowing down. The company’s CFO Herman Yu stated that the company was divesting all its non-core businesses to focus on its core businesses, which give it an edge in the highly competitive Chinese tech industry.

Baidu reported an increase in its quarterly growth to extend a growth curve that has been in place for the past three quarters. The internet company is currently focused on its core business, which is its mobile search platform, and has recently upgraded the platform to offer better services to its clients.

The company has improved the quality and quantity of content on its search platform, while at the same time increasing the video content on its newsfeed. The improvements to its search platform have led to the company reporting increased customer engagement on its platform as the time spent on the platform grew by an annualized 30% in the latest quarter.

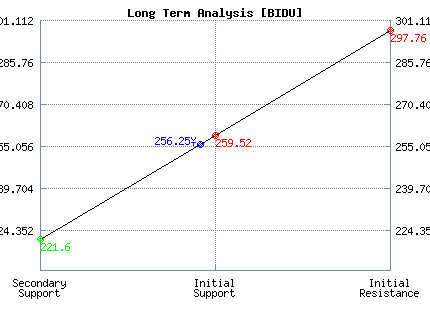

Our technical analysis indicates that the company is currently trading above a crucial long-term support level, which could influence its future performance. The company is also investing heavily in key growth sectors including AI and autonomous car technologies, which means it is well-positioned to profit from the projected future growth in these technologies.

Based on the technical data and associated charts at the time this article was written, Stock Traders Daily has provided detailed trading plans, with integrated risk controls, to its clients. These plans will change in real time as prices move. To receive an update or to review the detailed trading plans associated with this data please review our Real Time Trading Report for BIDU.

Technical Summary

| Term → | Near | Mid | Long |

|---|---|---|---|

| Rating | Strong | Weak | Neutral |

| P1 | 243.97 | 217.84 | 221.60 |

| P2 | 249.03 | 243.57 | 259.52 |

| P3 | 252.76 | 268.16 | 297.76 |

Support and Resistance Plot Chart for BIDU

Long Term Trading Plans for BIDU

February 27, 2018, 10:22 am ET

The technical Summary and associated Trading Plans for BIDU listed below will help you make important timing decisions for your trades. This data is based on our proprietary analysis for BIDU. In addition we offer Market Timing Models and Stock Filters in the links above which may increase the proficiency of the decisions you make.

BIDU - (Long) Support Plan

Buy over 221.60 target 259.52 stop loss @ 221.34.

The technical summary data tells us to buy BIDU near 221.60 with an upside target of 259.52. This data also tells us to set a stop loss @ 221.34 to protect against excessive loss in case the stock begins to move against the trade. 221.60 is the first level of support below 256.25 , and by rule, any test of support is a buy signal. In this case, support 221.60 would be being tested, so a buy signal would exist.

BIDU - (Short) Resistance Plan

Short under 259.52 target 221.60 stop loss @ 259.78.

The technical summary data is suggesting a short of BIDU as it gets near 259.52 with a downside target of 221.60. We should have a stop loss in place at 259.78 though. 259.52 is the first level of resistance above 256.25, and by rule, any test of resistance is a short signal. In this case, if resistance 259.52 is being tested, so a short signal would exist.

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial