pool ads

pool adsCBS Corporation (NYSE: CBS) Is Better Off Separate from Viacom

Recent news reports indicate that the Redstone family, which owns a controlling stake in both CBS Corporation (NYSE: CBS) and Viacom, Inc. (NASDAQ: VIAB) is in talks to combine the two companies. However, it is our opinion that merging the two companies is not likely to result in significant operational synergies, but is likely to destroy shareholder value in each of the companies.

The recent merger talks have been motivated by Walt Disney Co.’s (NYSE: DIS) pending acquisition of major assets belonging to Twenty-First Century Fox Inc (NASDAQ: FOXA) and AT&T Inc.’s (NYSE: T) pending acquisition of Time Warner Inc (NYSE: TWX). The above acquisitions are currently leading the way in the massive consolidation that is ongoing within the media and telecommunications industry.

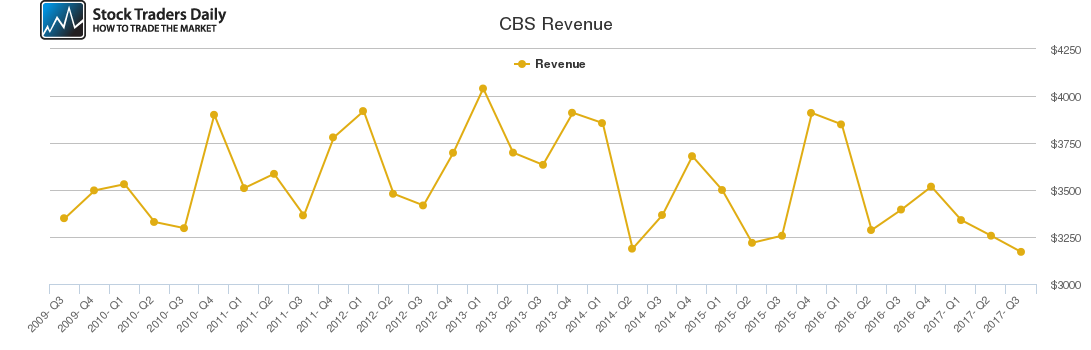

Our technical analysis of CBS stock indicates that the company has experienced declining revenues over the past three quarters, but this is expected to change in the latest quarter. CBS has historically performed better than Viacom and its executives have always been well paid. A merger of the two companies would lead to significant infighting as executives from the two companies jostle for powerful positions within the new entity.

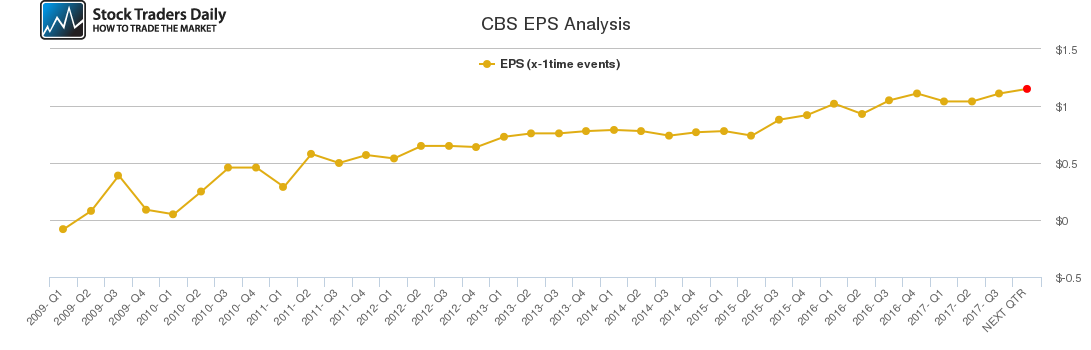

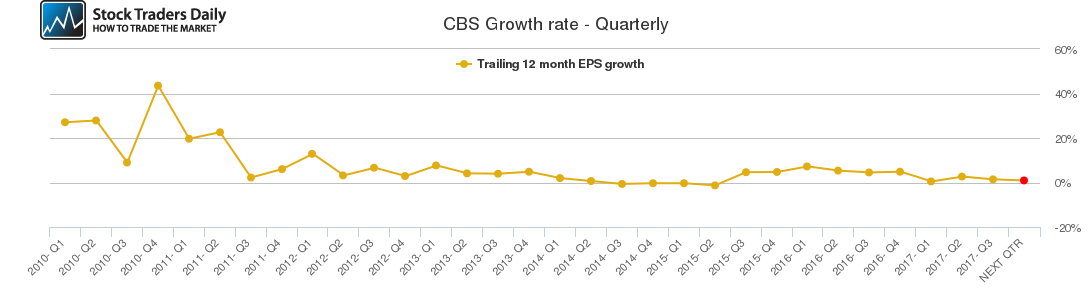

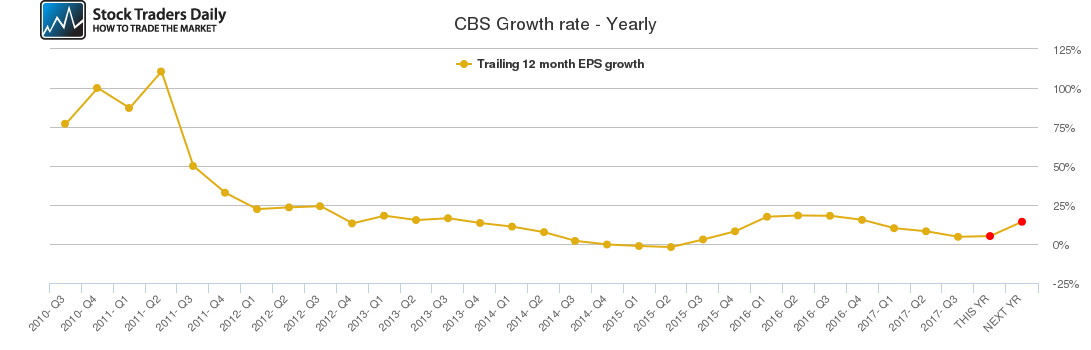

Although our analysis indicates that CBS’s quarterly growth is likely to decline in the latest quarter, this will have minimal impact on the company’s annual growth estimates. The broadcaster’s annual growth is expected to improve slightly this year, but will accelerate over the next year. Merging the two companies is likely to affect CBS’s future growth trajectory as it would be saddled with Viacom’s debts in addition to the latter’s poor performance.

A better alternative to the merger would be for CBS to acquire Paramount Studios from Viacom, while Viacom’s cable networks could be sold to cable companies such as Discovery Communications Inc. (NASDAQ: DISCA)

Based on the technical data and associated charts at the time this article was written, Stock Traders Daily has provided detailed trading plans, with integrated risk controls, to its clients. These plans will change in real time as prices move. To receive an update or to review the detailed trading plans associated with this data please review our Real Time Trading Report for CBS.

Technical Summary

| Term → | Near | Mid | Long |

|---|---|---|---|

| Rating | Strong | Weak | Neutral |

| P1 | 54.31 | 51.65 | 49.70 |

| P2 | 56.05 | 56.50 | 55.46 |

| P3 | 57.77 | 61.18 | 61.09 |

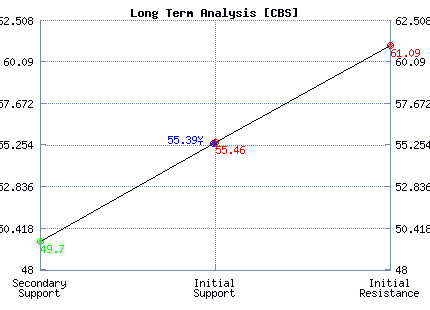

Support and Resistance Plot Chart for CBS

Long Term Trading Plans for CBS

February 21, 2018, 11:51 am ET

The technical Summary and associated Trading Plans for CBS listed below will help you make important timing decisions for your trades. This data is based on our proprietary analysis for CBS. In addition we offer Market Timing Models and Stock Filters in the links above which may increase the proficiency of the decisions you make.

CBS - (Long) Support Plan

Buy over 49.70 target 55.46 stop loss @ 49.44.

The technical summary data tells us to buy CBS near 49.70 with an upside target of 55.46. This data also tells us to set a stop loss @ 49.44 to protect against excessive loss in case the stock begins to move against the trade. 49.70 is the first level of support below 55.39 , and by rule, any test of support is a buy signal. In this case, support 49.70 would be being tested, so a buy signal would exist.

CBS - (Short) Resistance Plan

Short under 55.46 target 49.70 stop loss @ 55.72.

The technical summary data is suggesting a short of CBS as it gets near 55.46 with a downside target of 49.70. We should have a stop loss in place at 55.72 though. 55.46 is the first level of resistance above 55.39, and by rule, any test of resistance is a short signal. In this case, if resistance 55.46 is being tested, so a short signal would exist.

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial