pool ads

pool adsCan Walt Disney Co (NYSE: DIS) Achieve Success in the Video Game Market?

The Walt Disney Co (NYSE: DIS) is set to acquire significant video game assets once it completes the acquisition of Twenty-First Century Fox Inc (NASDAQ: FOXA) later this year. FoxNext, a subsidiary of Twenty-First Century Fox, just released a new game based on Disney’s Marvel superhero franchise titled Marvel Strike Force, which was created by the same team that developed the hit Marvel video game Contest of Champions.

The popularity of Contest of Champions has grown significantly after the release of the billion-dollar grossing Black Panther movie, which Disney could capitalize on to market its games. The Contest of Champions is currently the 6th highest grossing game in America based on its daily net revenues, which is a feat that could be replicated by the new game Marvel Strike Force.

Review Our Disney Trading Plans Here.

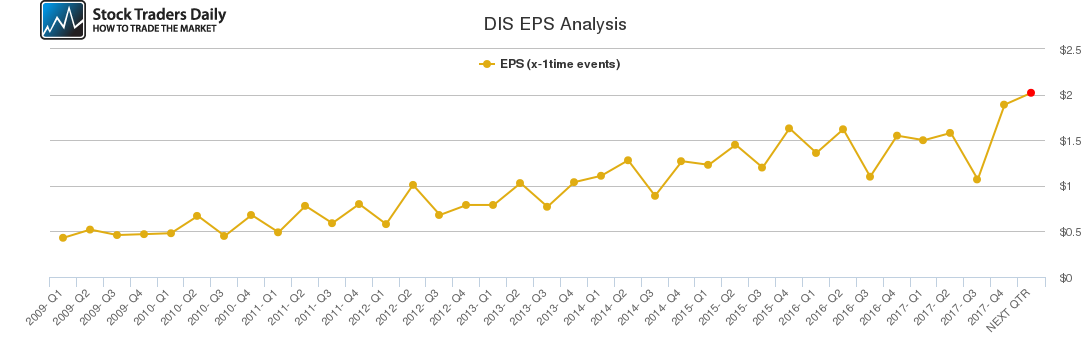

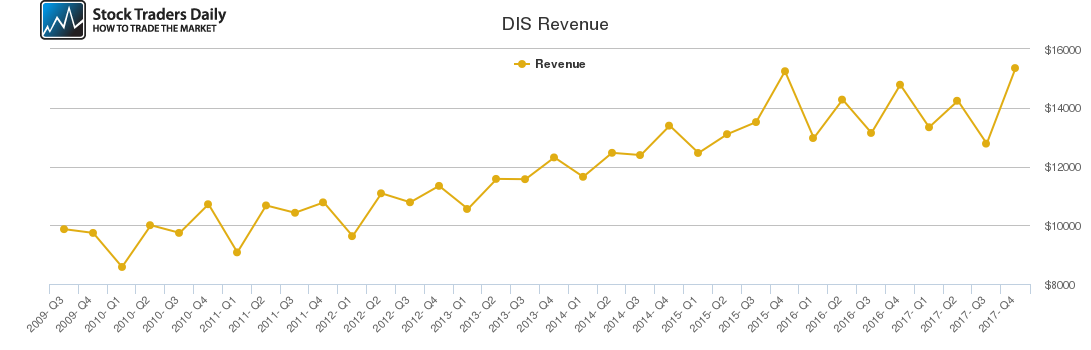

Our combined analysis of Disney reveals that its revenues and earnings spiked higher in the seasonally strong fourth quarter and we expect this feat to be repeated in Q1 2018. The company is likely to surpass analysts’ estimates for Q1 2018 revenues and earnings based on the massive success of its Black Panther movie.

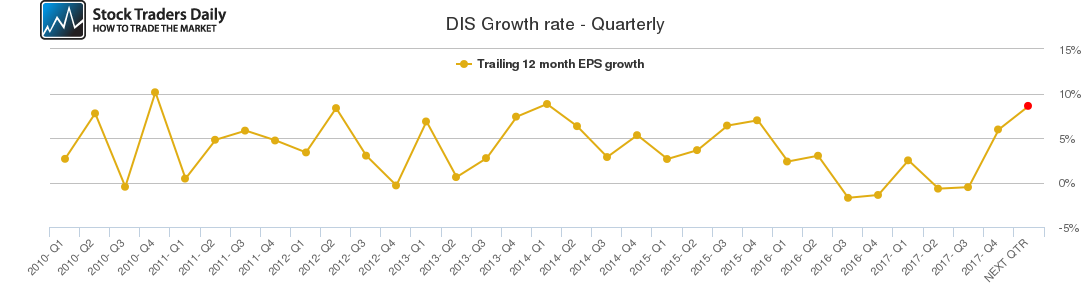

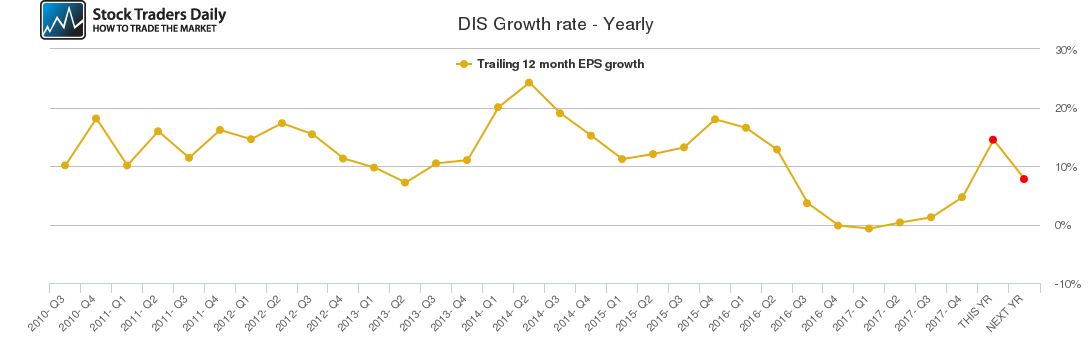

The company’s quarterly and annual growth rates also increased in the fourth quarter with the annual growth rate recording positive growth as from Q2 2017. Disney’s growth this year largely hinges on the successful acquisition of Twenty-First Century Fox and the monetization of its gaming assets.

We believe that the global video gaming industry has greater potential that the movie industry given that North American box office revenues have largely stagnated over the past few years. On the other hand, video game revenues have been growing steadily with some games such as Activision Blizzard, Inc. (NASDAQ: ATVI) Overwatch, which has crossed the billion dollar mark.

There is significant potential in the global video game industry as adult players spend hundreds of dollars making in-app purchases while playing video games. The Battle Royale genre is currently the most popular and Disney could capitalize on this by developing its own video games instead of selling licensing rights to other developers.

Based on the technical data and associated charts at the time this article was written, Stock Traders Daily has provided detailed trading plans, with integrated risk controls, to its clients. These plans will change in real time as prices move. To receive an update or to review the detailed trading plans associated with this data please review our Real Time Trading Report for DIS.

Technical Summary

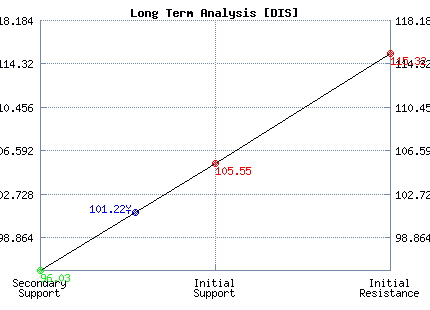

| Term → | Near | Mid | Long |

|---|---|---|---|

| Rating | Neutral | Neutral | Neutral |

| P1 | 99.64 | 94.07 | 96.03 |

| P2 | 100.64 | 99.12 | 105.55 |

| P3 | 101.79 | 103.31 | 115.32 |

Support and Resistance Plot Chart for DIS

Long Term Trading Plans for DIS

April 13, 2018, 10:43 am ET

The technical Summary and associated Trading Plans for DIS listed below will help you make important timing decisions for your trades. This data is based on our proprietary analysis for DIS. In addition we offer Market Timing Models and Stock Filters in the links above which may increase the proficiency of the decisions you make.

DIS - (Long) Support Plan

Buy over 96.03 target 105.55 stop loss @ 95.77.

The technical summary data tells us to buy DIS near 96.03 with an upside target of 105.55. This data also tells us to set a stop loss @ 95.77 to protect against excessive loss in case the stock begins to move against the trade. 96.03 is the first level of support below 101.22 , and by rule, any test of support is a buy signal. In this case, support 96.03 would be being tested, so a buy signal would exist.

DIS - (Short) Resistance Plan

Short under 105.55 target 96.03 stop loss @ 105.81.

The technical summary data is suggesting a short of DIS as it gets near 105.55 with a downside target of 96.03. We should have a stop loss in place at 105.81 though. 105.55 is the first level of resistance above 101.22, and by rule, any test of resistance is a short signal. In this case, if resistance 105.55 is being tested, so a short signal would exist.

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial