pool ads

pool adsIs American Eagle Outfitters (NYSE: AEO) A Good Value Stock Despite The Recent Dip?

American Eagle Outfitters (NYSE: AEO) recently experienced a slight dip that might have scared investors despite its positive Q4 and full year 2017 results. The retailer posted excellent results in the latest quarter as comp sales grew by 34%, which is quite rare in the physical retail industry despite the industry’s recovery in the last few months.

Despite its recent dip, the company has a bright future as its Aerie brand is extremely popular among millennials, a demographic that is predicted to be the growth engine for the American economy. The company’s iconic American Eagle brand is not doing badly either and recorded comp sales growth of about 2%. The company is well positioned to benefit from future trends among millennials, which bodes well for its shareholders.

Review Our American Eagle Trading Plans Here.

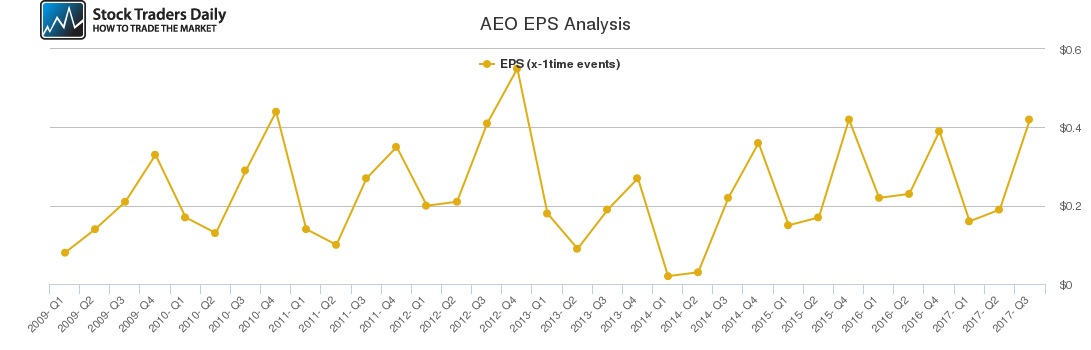

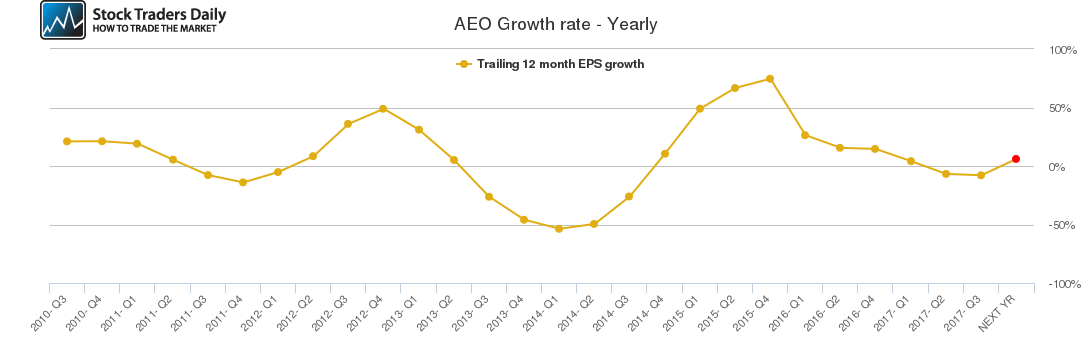

Our combined analysis of the company indicates that the first quarter is usually its weakest quarter, but despite this, the retailer is still expected to continue posting excellent results this year. However, the 34% comp sales growth is not likely to be repeated, but the company has a history of posting market beating results given that it reported comp sales growth of 17% in Q4 2016, which is still quite high.

Our analysis also reveals that Q1 and Q2 are typically weak quarters for the company given that in the past two years, the company has posted negative quarterly growth in Q1 and once in Q2, but this is expected. Therefore, we expect this trend to continue in the upcoming quarters given the seasonal fluctuations in the retail industry, but it is still highly likely that the retailer will continue to outperform its peers.

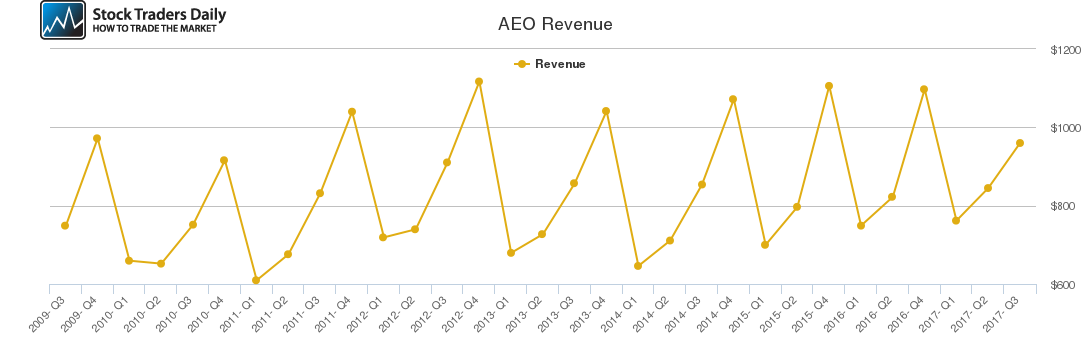

The company’s management has a target of hitting $1 billion in sales from its Aerie brand in the next two years, while projecting that the brand will reach $2-$3 billion dollars in revenue over the next few years. This ties in with our assessment that the Aerie brand is extremely valuable to the retailer and that this trend is likely to contribute to positive annual growth figures in the coming years as depicted in the charts below.

Based on the technical data and associated charts at the time this article was written, Stock Traders Daily has provided detailed trading plans, with integrated risk controls, to its clients. These plans will change in real time as prices move. To receive an update or to review the detailed trading plans associated with this data please review our Real Time Trading Report for AEO.

Technical Summary

| Term → | Near | Mid | Long |

|---|---|---|---|

| Rating | Neutral | Strong | Strong |

| P1 | 19.35 | 17.31 | 17.45 |

| P2 | 19.57 | 19.25 | 19.75 |

| P3 | 19.85 | 21.05 | 22.04 |

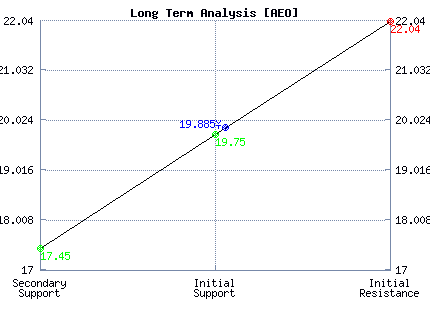

Support and Resistance Plot Chart for AEO

Long Term Trading Plans for AEO

March 20, 2018, 12:55 pm ET

The technical Summary and associated Trading Plans for AEO listed below will help you make important timing decisions for your trades. This data is based on our proprietary analysis for AEO. In addition we offer Market Timing Models and Stock Filters in the links above which may increase the proficiency of the decisions you make.

AEO - (Long) Support Plan

Buy over 19.75 target 22.04 stop loss @ 19.49.

The technical summary data tells us to buy AEO near 19.75 with an upside target of 22.04. This data also tells us to set a stop loss @ 19.49 to protect against excessive loss in case the stock begins to move against the trade. 19.75 is the first level of support below 19.885 , and by rule, any test of support is a buy signal. In this case, support 19.75 is being tested, a buy signal would exist.

AEO - (Short) Resistance Plan

Short under 22.04 target 19.75 stop loss @ 22.3

The technical summary data is suggesting a short of AEO as it gets near 22.04 with a downside target of 19.75. We should have a stop loss in place at 22.3 though. 22.04 is the first level of resistance above 19.885, and by rule, any test of resistance is a short signal. In this case, if resistance 22.04 is being tested, a short signal would exist.

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial