pool ads

pool adsIs IBM (NYSE: IBM) Ready For A Turnaround?

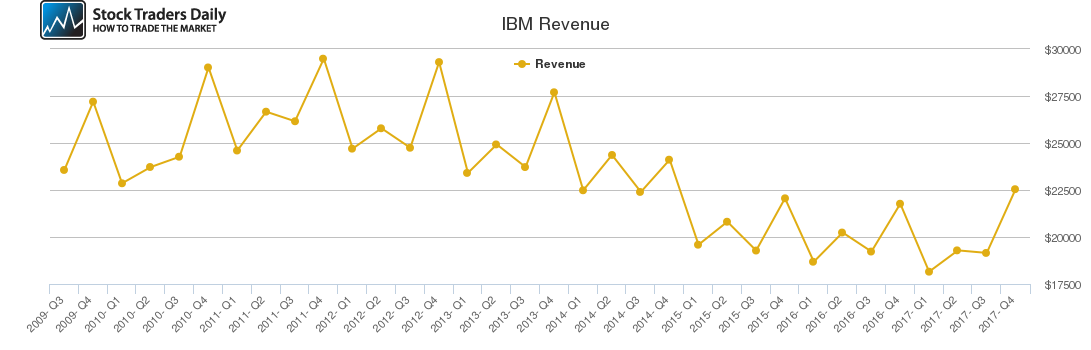

IBM (NYSE: IBM) recently reported its fourth quarter results, which for the first time posted growth of almost 4%, as compared to a similar period in 2016. The company has been on a losing streak for over 5 years as it has consistently reported declining revenues in the past; however, it seems like the losing streak might have come to an end.

The company reported steady revenues in the third quarter as compared to the previous year and the revenue growth recorded in the fourth quarter could be an indicator that the company might have put an end to its revenue losses. However, the company’s stock price did not reflect the better revenue performance as markets focused on the declining margins reported by the company, which caused its stock price to falter.

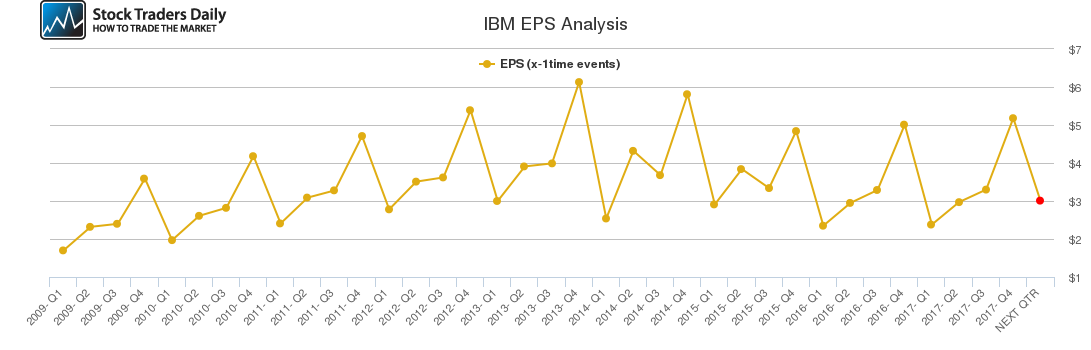

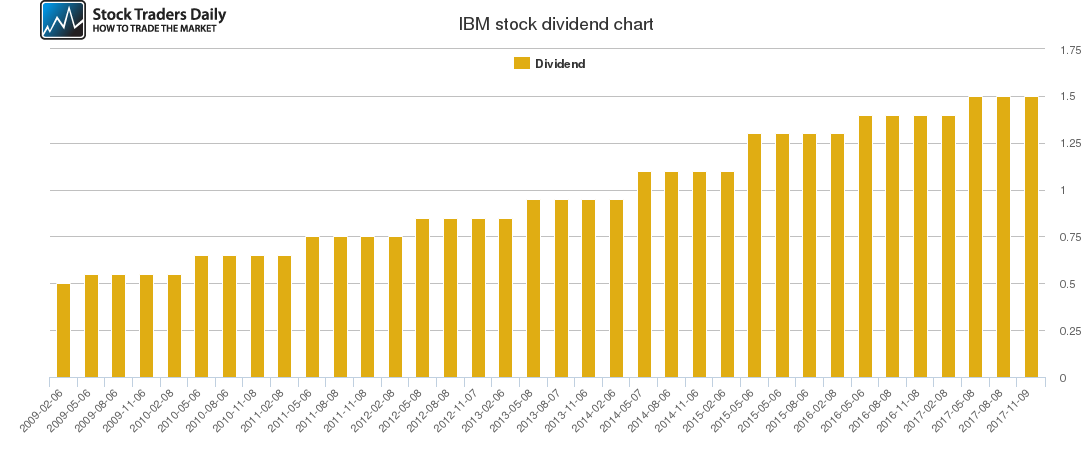

Our technical analysis of the company as outlined in the charts below revealed that the company’s revenues are likely to decline in the first quarter as it is typically a weak quarter. This would have a negative impact on the earnings per share in the current quarter, but investors could be well compensated by the company’s high dividend yield, which is currently pegged at 3.88%.

This could be the year that IBM turns around its fortunes as its efforts to transform from an old technology company to a modern tech company over the past few years start to bear fruit. The company recorded significant growth in its cloud services segment, which is part of its strategic imperatives division, and is projected to grow significantly in future.

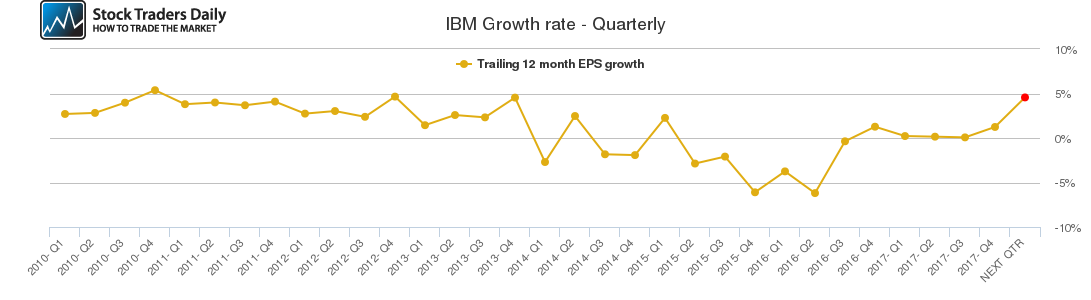

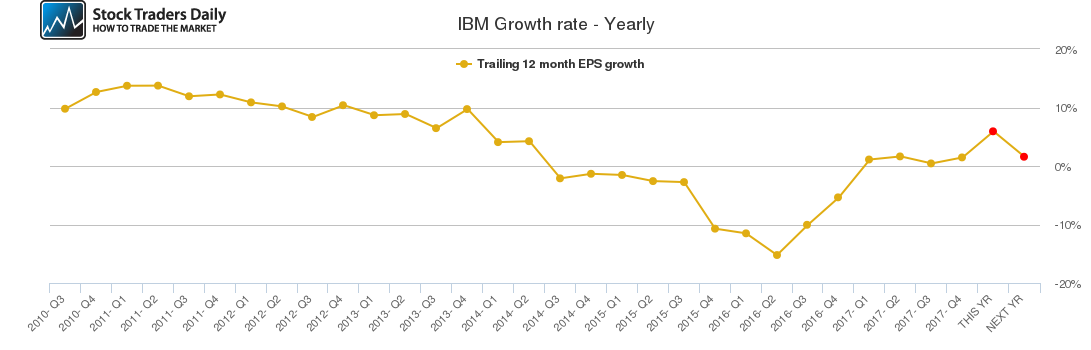

According to our analysis, the company’s quarterly growth rate is expected to expand significantly in the current quarter, while overall growth is also expected to increase throughout the year. However, the outlook for next year is not as rosy given that annual growth is expected to decline. The company is currently trading at a moderate valuation given that its P/E ratio is currently pegged at 25.31, which is slightly lower than the tech sector average of 29.17.

Based on the technical data and associated charts at the time this article was written, Stock Traders Daily has provided detailed trading plans, with integrated risk controls, to its clients. These plans will change in real time as prices move. To receive an update or to review the detailed trading plans associated with this data please review our Real Time Trading Report for IBM.

Technical Summary

| Term → | Near | Mid | Long |

|---|---|---|---|

| Rating | Strong | Weak | Neutral |

| P1 | 147.43 | 148.32 | 144.17 |

| P2 | 152.46 | 161.00 | 156.86 |

| P3 | 154.39 | 173.05 | 169.94 |

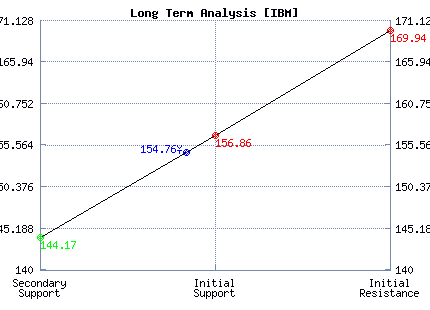

Support and Resistance Plot Chart for IBM

Long Term Trading Plans for IBM

February 15, 2018, 8:04 am ET

The technical Summary and associated Trading Plans for IBM listed below will help you make important timing decisions for your trades. This data is based on our proprietary analysis for IBM. In addition we offer Market Timing Models and Stock Filters in the links above which may increase the proficiency of the decisions you make.

IBM - (Long) Support Plan

Buy over 144.17 target 156.86 stop loss @ 143.91.

The technical summary data tells us to buy IBM near 144.17 with an upside target of 156.86. This data also tells us to set a stop loss @ 143.91 to protect against excessive loss in case the stock begins to move against the trade. 144.17 is the first level of support below 154.76 , and by rule, any test of support is a buy signal. In this case, support 144.17 would be being tested, so a buy signal would exist.

IBM - (Short) Resistance Plan

Short under 156.86 target 144.17 stop loss @ 157.12.

The technical summary data is suggesting a short of IBM as it gets near 156.86 with a downside target of 144.17. We should have a stop loss in place at 157.12 though. 156.86 is the first level of resistance above 154.76, and by rule, any test of resistance is a short signal. In this case, if resistance 156.86 is being tested, so a short signal would exist.

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial