pool ads

pool adsIs L Brands Inc (NYSE: LB) Currently Undervalued?

L Brands Inc (NYSE: LB) recently reported its January sales results where it recorded comparable sales growth of 7%. This figure is quite promising for the retailer given that many US retailers have been suffering from declining comp sales due to the growing popularity of e-commerce.

The retailer also reported that its flagship Victoria Secrets brand also generated 4% comp sales growth. This was despite the fact that the brand recently discontinued its Swim and Apparel segments. The only negative print reported by the retailer was declining margins, which is a trend that has affected most brick and mortar retailers due to increasing competition from online retailers.

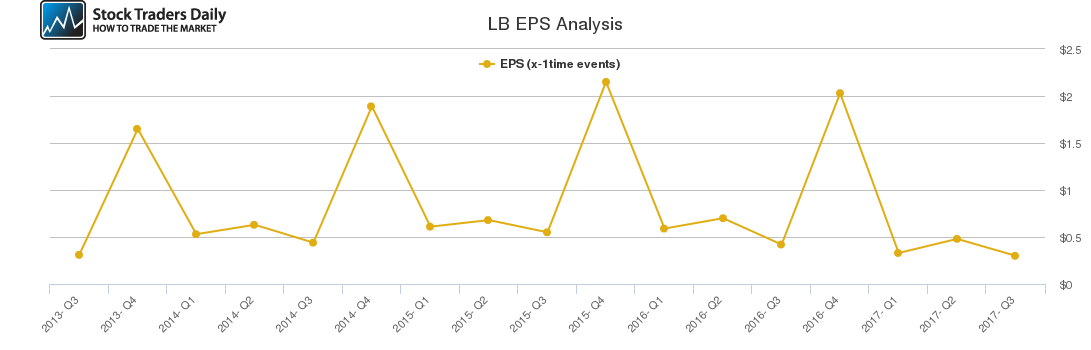

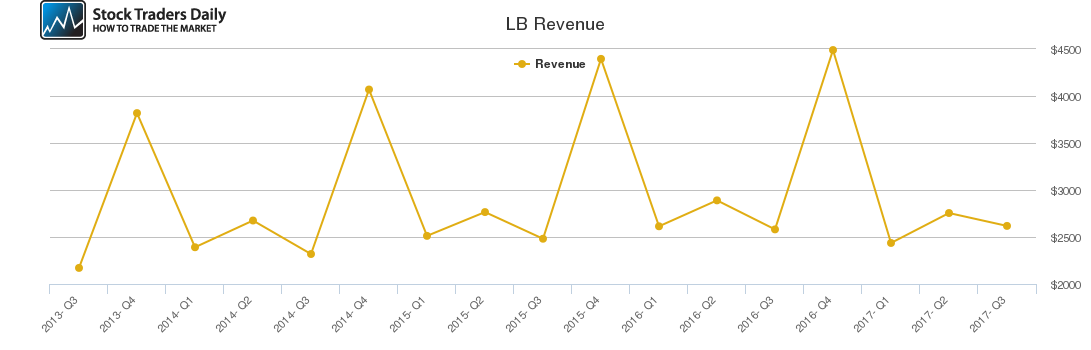

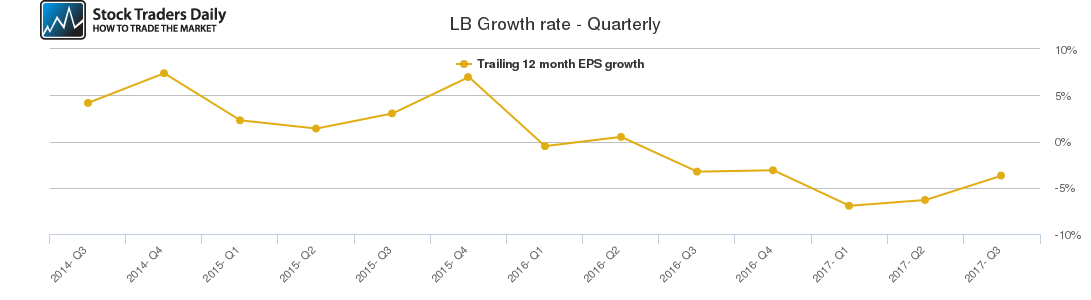

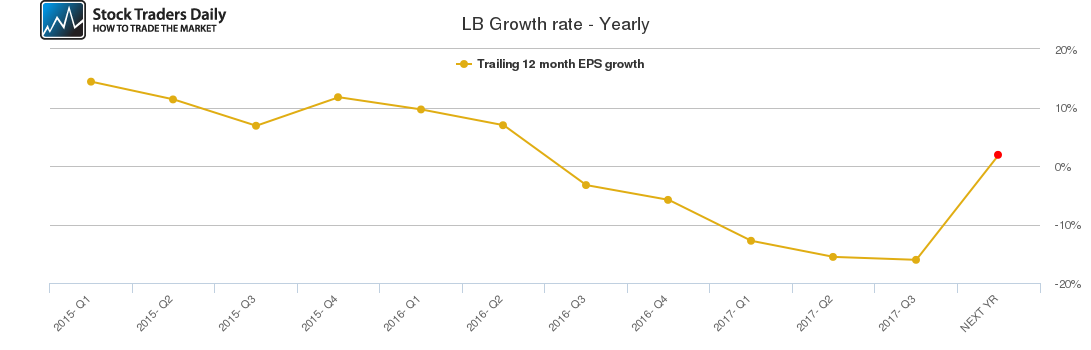

The charts below indicate that the retailer has witnessed declining quarterly growth since Q4 2015, which is likely to extend into the future. However, given that the retailer’s fourth quarter ends in January, it is highly likely that quarterly growth will improve significantly in the upcoming quarterly earnings report.

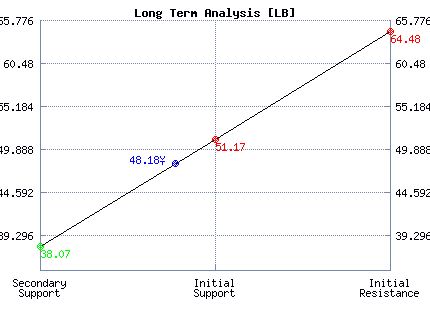

According to our long-term trading strategies, the stock is trading close to a crucial long-term resistance level, which could influence future performance. Our day trading strategies indicate that the company is trading slightly above a crucial short-term resistance level, which should influence short-term performance.

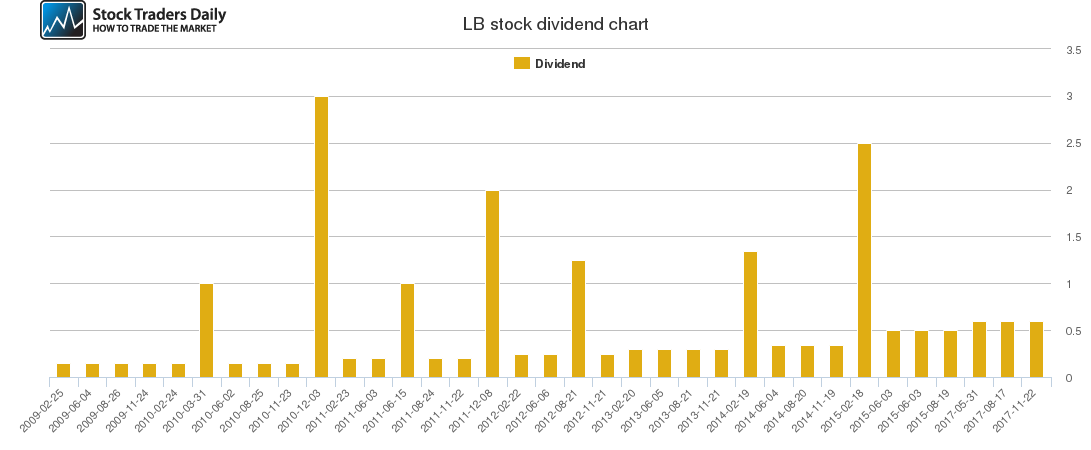

The company currently pays out a 4.87% dividend, which is quite high as compared to the retail industry’s average payout of 1.8% and the S&P 500’s average payout of 1.9%. The high dividend yield should make the stock quite attractive to dividend growth investors given the company’s solid performance in January.

L Brand’s annual growth metric has also witnessed a steady decline since 2015, but our proprietary analysis indicates that this trend is likely to reverse in the upcoming quarter. We expect the retailer’s annual growth metric to expand significantly this year, especially as weaker retailers exit the market, hence, reducing competition.

Based on the technical data and associated charts at the time this article was written, Stock Traders Daily has provided detailed trading plans, with integrated risk controls, to its clients. These plans will change in real time as prices move. To receive an update or to review the detailed trading plans associated with this data please review our Real Time Trading Report for L Brands.

Technical Summary

| Term → | Near | Mid | Long |

|---|---|---|---|

| Rating | Weak | Neutral | Neutral |

| P1 | 47.25 | 39.78 | 38.07 |

| P2 | 48.13 | 48.45 | 51.17 |

| P3 | 49.88 | 56.79 | 64.48 |

Support and Resistance Plot Chart for LB

Long Term Trading Plans for LB

February 22, 2018, 1:42 pm ET

The technical Summary and associated Trading Plans for LB listed below will help you make important timing decisions for your trades. This data is based on our proprietary analysis for LB. In addition we offer Market Timing Models and Stock Filters in the links above which may increase the proficiency of the decisions you make.

LB - (Long) Support Plan

Buy over 38.07 target 51.17 stop loss @ 37.81.

The technical summary data tells us to buy LB near 38.07 with an upside target of 51.17. This data also tells us to set a stop loss @ 37.81 to protect against excessive loss in case the stock begins to move against the trade. 38.07 is the first level of support below 48.18 , and by rule, any test of support is a buy signal. In this case, support 38.07 would be being tested, so a buy signal would exist.

LB - (Short) Resistance Plan

Short under 51.17 target 38.07 stop loss @ 51.43.

The technical summary data is suggesting a short of LB as it gets near 51.17 with a downside target of 38.07. We should have a stop loss in place at 51.43 though. 51.17 is the first level of resistance above 48.18, and by rule, any test of resistance is a short signal. In this case, if resistance 51.17 is being tested, so a short signal would exist.

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial