pool ads

pool adsIs Ross Stores, Inc. (NASDAQ: ROST) Immune To The Threats Facing Retailers?

Ross Stores, Inc. (NASDAQ: ROST) has had a good run over the past five years given that its stock price has gained 172%, which is way higher than the returns of the SPDR S&P Retail (ETF) (NYSEARCA: XRT), and the SPDR S&P 500 ETF Trust (NYSEARCA: SPY). The retailer has achieved this at a time when most traditional retailers have faced stiff competition from online retailers who offer lower prices leading to declining margins.

The retailer’s business model revolves around buying designer merchandise at a huge discount from manufacturers and passing on the discounts to its customers. The retailer offers huge discounts that range from 20% to 60% of the prices offered by department stores and specialty stores. This gives the company a significant moat against most retailers including Amazon.com, Inc. (NASDAQ: AMZN) whose discounts pale in comparison to the retailer’s deep discounts.

Review Our ROST Trading Plans Here.

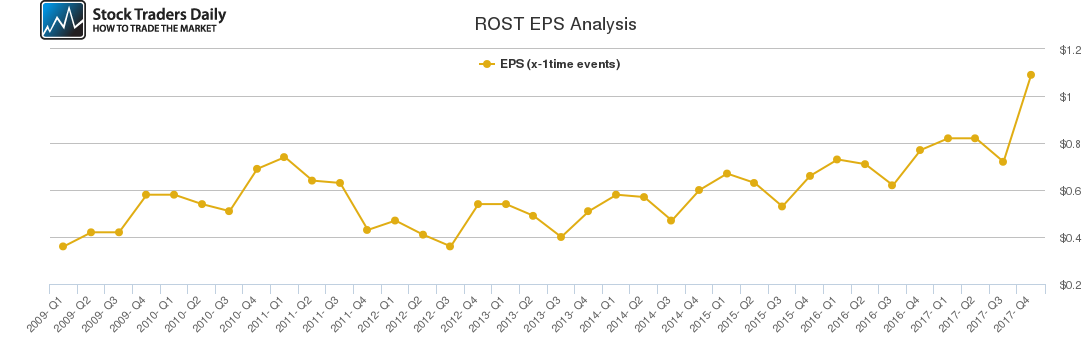

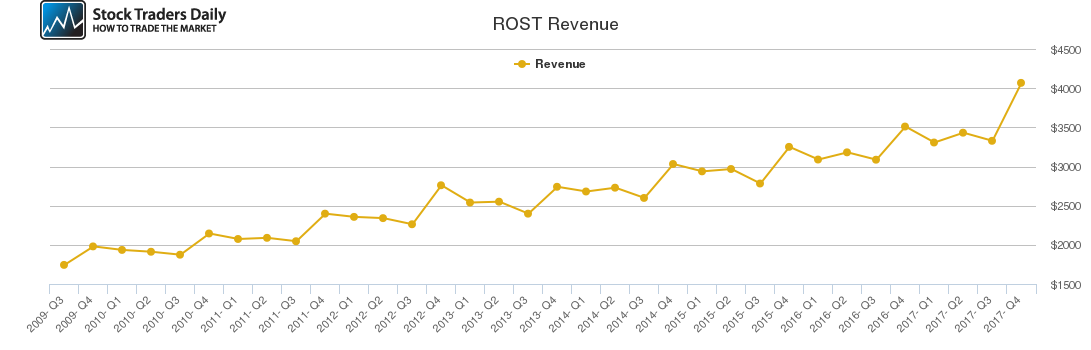

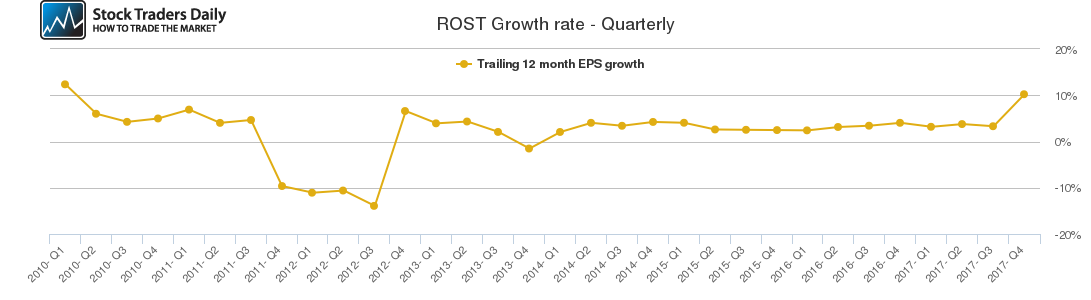

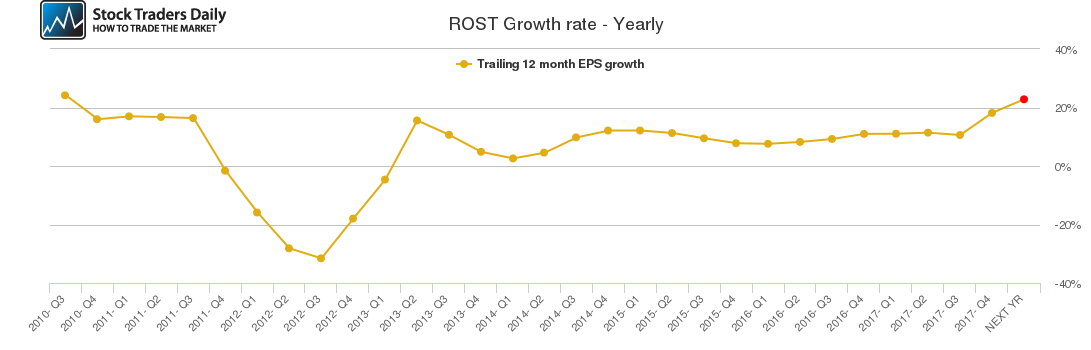

Our combined analysis of the company indicates that its earnings spiked significantly in Q4 2017 following a spike in revenues, which bodes well for its shareholders. However, the company experienced a significant drop after management gave weak guidance for Q1 2018 as well as for fiscal 2018.

According to our analysis, the company’s quarterly growth rate expanded significantly in the latest quarter and although this might not be replicated in the current quarter, we expect the company to continue posting strong sales growth. The company’s annual growth rate also spiked higher in the fourth quarter, but is expected to dip in the current fiscal year due to the weak forward guidance.

The retailer is likely to continue recording positive growth figures given the strong fundamentals that underpin its business model as demand for its products continues to grow. The retailer expects to open up to 90 stores each year in order to get to a total of 2500 stores in the next decade. The company has solid fundamentals and is likely to reward long-term investors handsomely despite the weak short-term guidance.

Based on the technical data and associated charts at the time this article was written, Stock Traders Daily has provided detailed trading plans, with integrated risk controls, to its clients. These plans will change in real time as prices move. To receive an update or to review the detailed trading plans associated with this data please review our Real Time Trading Report for ROST.

Technical Summary

| Term → | Near | Mid | Long |

|---|---|---|---|

| Rating | Strong | Neutral | Neutral |

| P1 | 75.32 | 70.66 | 75.20 |

| P2 | 78.31 | 75.71 | 84.63 |

| P3 | 79.84 | 80.09 | 93.96 |

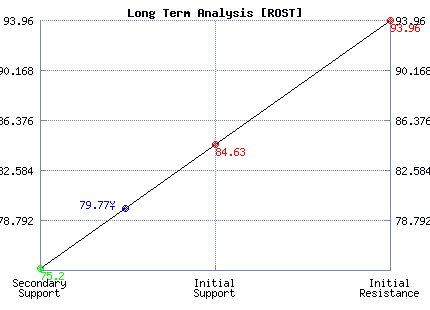

Support and Resistance Plot Chart for ROST

Long Term Trading Plans for ROST

April 6, 2018, 8:45 am ET

The technical Summary and associated Trading Plans for ROST listed below will help you make important timing decisions for your trades. This data is based on our proprietary analysis for ROST. In addition we offer Market Timing Models and Stock Filters in the links above which may increase the proficiency of the decisions you make.

ROST - (Long) Support Plan

Buy over 75.20 target 84.63 stop loss @ 74.94.

The technical summary data tells us to buy ROST near 75.20 with an upside target of 84.63. This data also tells us to set a stop loss @ 74.94 to protect against excessive loss in case the stock begins to move against the trade. 75.20 is the first level of support below 79.77 , and by rule, any test of support is a buy signal. In this case, support 75.20 would be being tested, so a buy signal would exist.

ROST - (Short) Resistance Plan

Short under 84.63 target 75.20 stop loss @ 84.89.

The technical summary data is suggesting a short of ROST as it gets near 84.63 with a downside target of 75.20. We should have a stop loss in place at 84.89 though. 84.63 is the first level of resistance above 79.77, and by rule, any test of resistance is a short signal. In this case, if resistance 84.63 is being tested, so a short signal would exist.

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial