pool ads

pool adsIs Stanley Black & Decker, Inc. (NYSE: SWK) Dividend Secure Despite Trade Tariffs?

Stanley Black & Decker, Inc. (NYSE: SWK) is regarded as a dividend king having increased its dividend payout for the past 50 consecutive years, but the recent tariffs imposed by President Trump have caused jitters among shareholders. China has promised to retaliate by imposing tariffs on US exports including manufactured goods, which means that US manufacturers with a large exposure to the Chinese market are likely to suffer.

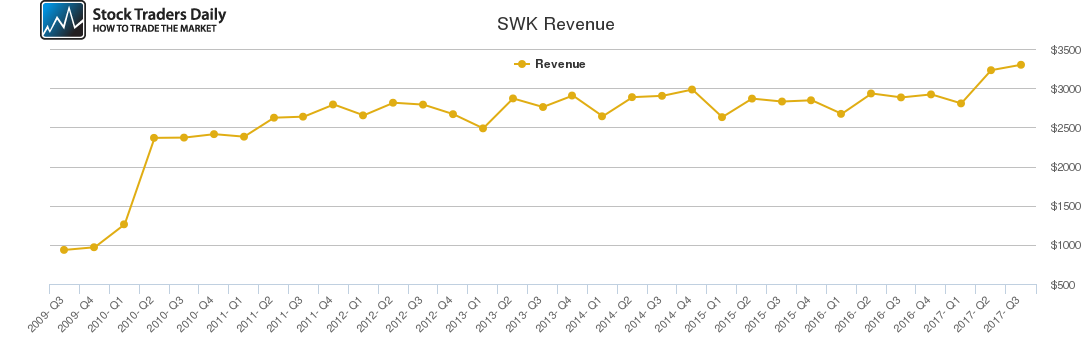

A closer look at the company’s latest investor presentation indicates that over half of its revenues are generated in the United States and it generates over 20% of its revenues in Europe. The company only generates about 14% of its overall revenues from emerging markets, which includes China, hence, it has minimal exposure to the country.

Review Our SWK Trading Plans Here.

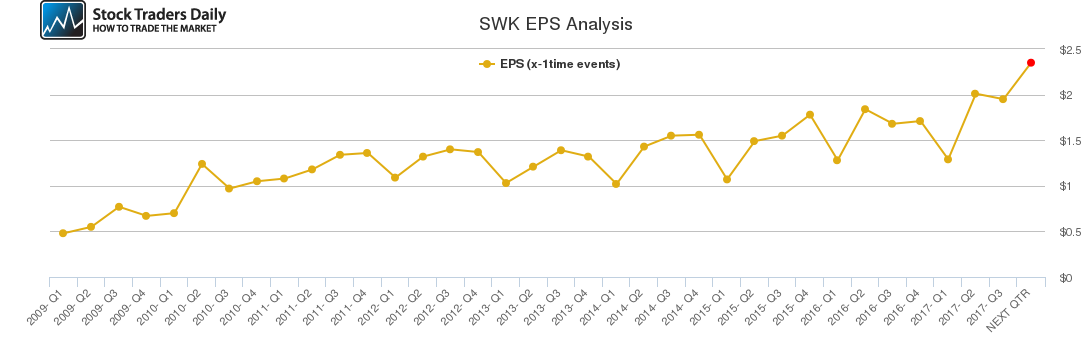

The company has consistently outperformed Wall Street analyst estimates in past years, but its stock has dipped recently following low earnings in the past two months. However, we are not alarmed by the recent decline because the first quarter is historically a weak quarter for the company, hence, it is highly likely that the company’s earnings will improve in future quarters.

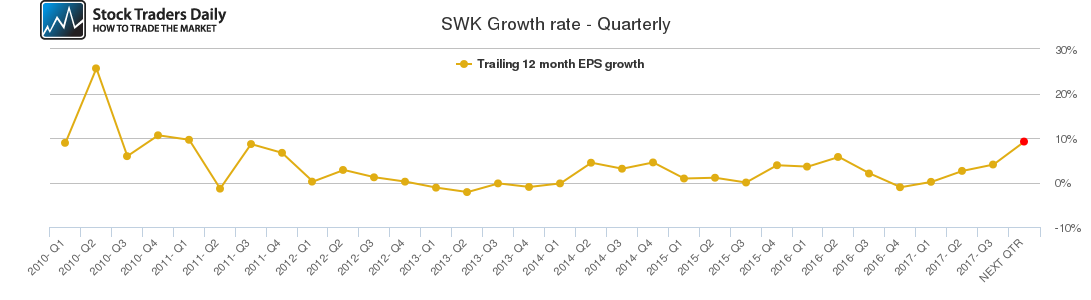

Our combined analysis of the company indicates that it has recorded positive quarterly growth since Q1 2017 and this trend is expected to continue into the upcoming quarter. The company has a solid customer base both in the USA and in Europe with emerging markets, apart from China, recording positive growth due to their growing middle class populations.

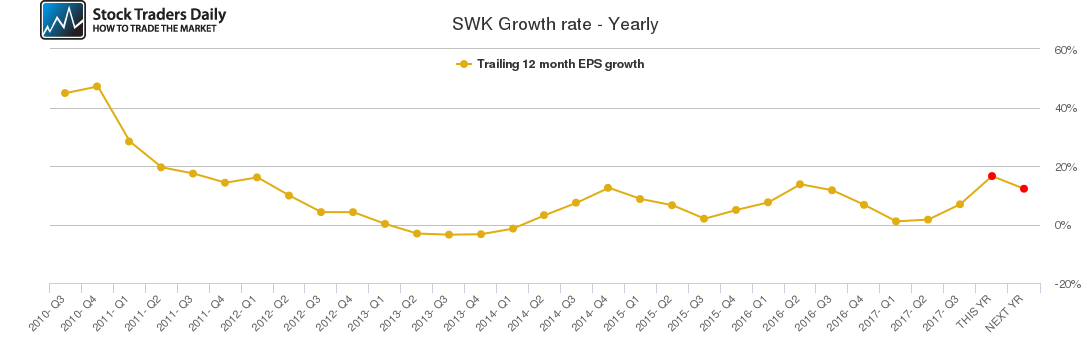

The company’s annual growth rate has risen steadily since Q2 2017 and is expected to rise even higher throughout this year before declining next year. Still, we believe that the company has a promising future given its current cash flows and its expansion into new markets with significant growth potential.

Dividend investors might be worried about the security of the company’s dividend payout, but given that the current dividend payout ratio is below 50%, there is still potential for future growth. The company typically raises its dividend payout in the seasonally strong third quarter and we expect this trend to continue for up to the next five years.

Based on the technical data and associated charts at the time this article was written, Stock Traders Daily has provided detailed trading plans, with integrated risk controls, to its clients. These plans will change in real time as prices move. To receive an update or to review the detailed trading plans associated with this data please review our Real Time Trading Report for SWK.

Technical Summary

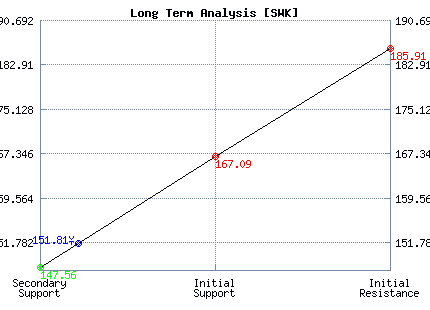

| Term → | Near | Mid | Long |

|---|---|---|---|

| Rating | Neutral | Neutral | Neutral |

| P1 | 147.76 | 139.73 | 147.56 |

| P2 | 150.95 | 150.11 | 167.09 |

| P3 | 154.46 | 159.30 | 185.91 |

Support and Resistance Plot Chart for SWK

Long Term Trading Plans for SWK

April 11, 2018, 9:52 am ET

The technical Summary and associated Trading Plans for SWK listed below will help you make important timing decisions for your trades. This data is based on our proprietary analysis for SWK. In addition we offer Market Timing Models and Stock Filters in the links above which may increase the proficiency of the decisions you make.

SWK - (Long) Support Plan

Buy over 147.56 target 167.09 stop loss @ 147.3.

The technical summary data tells us to buy SWK near 147.56 with an upside target of 167.09. This data also tells us to set a stop loss @ 147.3 to protect against excessive loss in case the stock begins to move against the trade. 147.56 is the first level of support below 151.81 , and by rule, any test of support is a buy signal. In this case, support 147.56 would be being tested, so a buy signal would exist.

SWK - (Short) Resistance Plan

Short under 167.09 target 147.56 stop loss @ 167.35.

The technical summary data is suggesting a short of SWK as it gets near 167.09 with a downside target of 147.56. We should have a stop loss in place at 167.35 though. 167.09 is the first level of resistance above 151.81, and by rule, any test of resistance is a short signal. In this case, if resistance 167.09 is being tested, so a short signal would exist.

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial