pool ads

pool adsPrudential Financial Inc (NYSE: PRU) Will Benefit From Gradual Interest Rate Hikes

According to the Center for Insurance Policy and Research, insurance companies such as Prudential Financial Inc (NYSE: PRU) are likely to benefit significantly from a gradual increase in rates by the Federal Reserve. The main reason cited by the CIPR was that if interest rates rise quickly many policyholders would try to surrender their policies in exchange for policies with higher crediting rates, or for other higher-yielding financial instruments.

Prudential is well-positioned to deal with policyholders who want to surrender their universal life policies given that surrendering such a policy within the first twenty years incurs a surrender charge. The company is further allowed to subtract any outstanding loans from the value of the policy, which allows the company to keep a large portion of the total value of surrendered policies.

Review Our PRU Trading Plans Here.

The life insurance company is set to benefit from an increase in the value of the cash it holds in an environment with rising interest rates. The company’s clients also hold cash accounts that could benefit from rising interest rates by increasing in value.

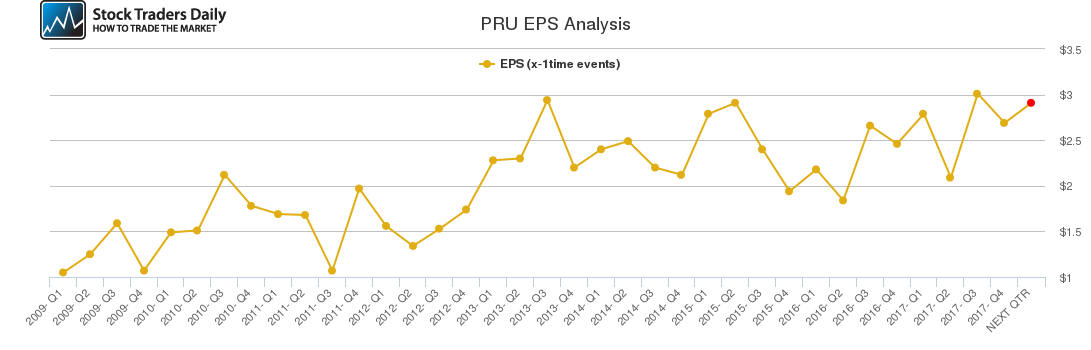

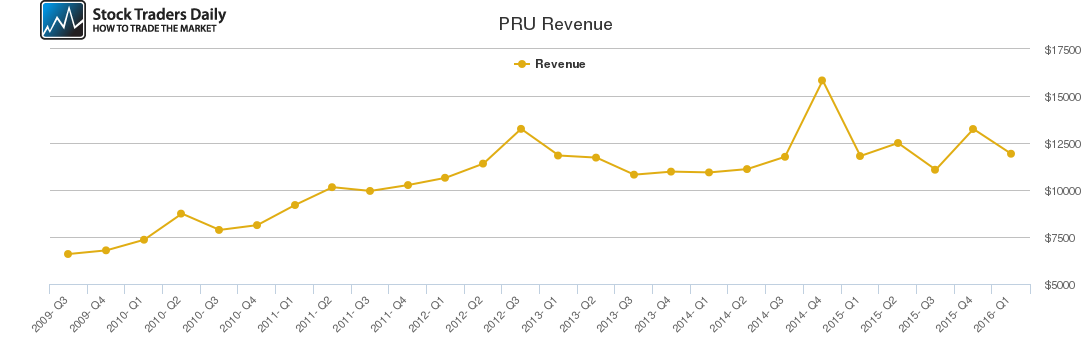

Our combined analysis of the company indicates that the company reported higher earnings per share in 2017, following an increase in overall revenues. Despite the higher revenues the company lost $725 million due to a decrease in policy charges in the form of policies paid to other insurance companies.

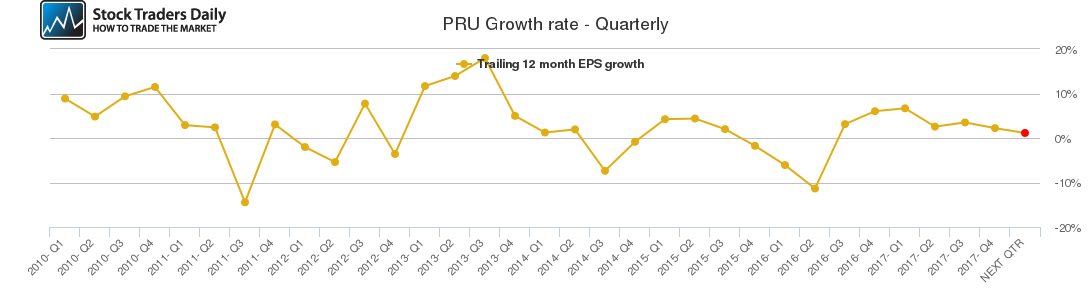

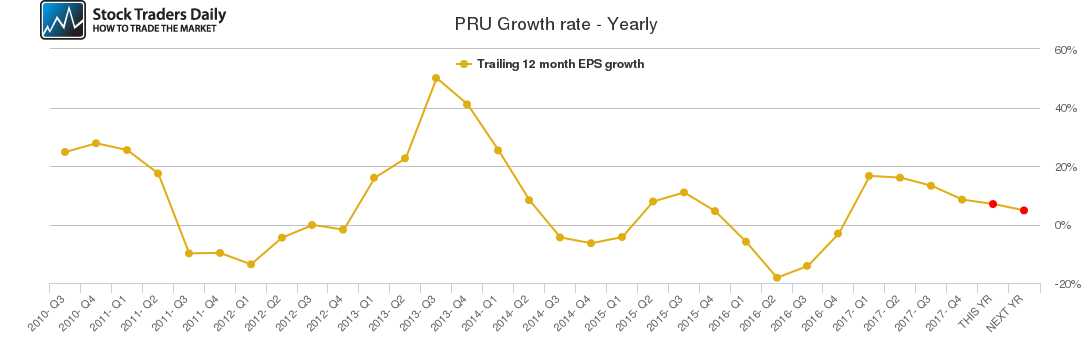

According to our analysis, the company’s quarterly growth rate has risen slightly in the past two quarters, but the company might register higher growth in future quarters. The company’s annual growth figures have been declining in recent years, but this is also likely to change with the gradual implementation of higher interest rates.

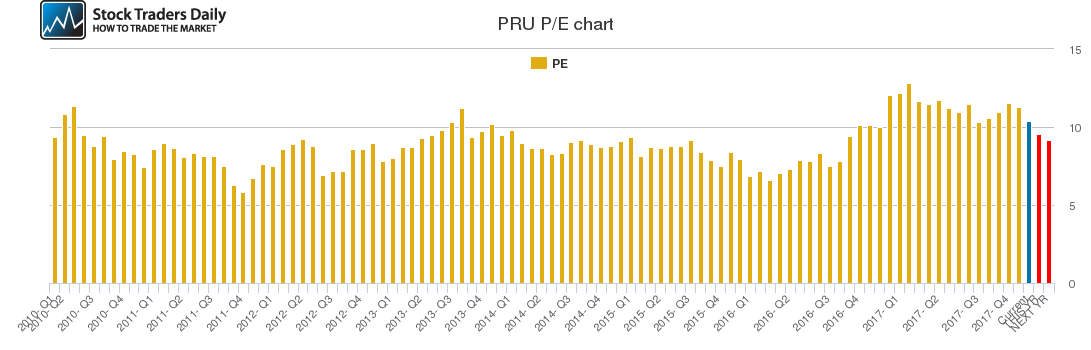

The company is fairly valued when compared to its competitors such as MetLife Inc (NYSE: MET) and Principal Financial Group Inc (NASDAQ: PFG). Prudential has a P/E ratio of 9.58, while MetLife has a P/E ratio of 11.49, and PFG’s P/E ratio is 8.01.

Based on the technical data and associated charts at the time this article was written, Stock Traders Daily has provided detailed trading plans, with integrated risk controls, to its clients. These plans will change in real time as prices move. To receive an update or to review the detailed trading plans associated with this data please review our Real Time Trading Report for PRU.

Technical Summary

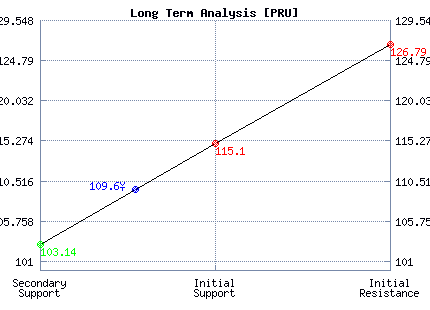

| Term → | Near | Mid | Long |

|---|---|---|---|

| Rating | Strong | Weak | Neutral |

| P1 | 107.66 | 96.36 | 103.14 |

| P2 | 109.62 | 108.27 | 115.10 |

| P3 | 111.61 | 119.63 | 126.79 |

Support and Resistance Plot Chart for PRU

Long Term Trading Plans for PRU

March 14, 2018, 8:40 am ET

The technical Summary and associated Trading Plans for PRU listed below will help you make important timing decisions for your trades. This data is based on our proprietary analysis for PRU. In addition we offer Market Timing Models and Stock Filters in the links above which may increase the proficiency of the decisions you make.

PRU - (Long) Support Plan

Buy over 103.14 target 115.10 stop loss @ 102.88.

The technical summary data tells us to buy PRU near 103.14 with an upside target of 115.10. This data also tells us to set a stop loss @ 102.88 to protect against excessive loss in case the stock begins to move against the trade. 103.14 is the first level of support below 109.6 , and by rule, any test of support is a buy signal. In this case, support 103.14 would be being tested, so a buy signal would exist.

PRU - (Short) Resistance Plan

Short under 115.10 target 103.14 stop loss @ 115.36.

The technical summary data is suggesting a short of PRU as it gets near 115.10 with a downside target of 103.14. We should have a stop loss in place at 115.36 though. 115.10 is the first level of resistance above 109.6, and by rule, any test of resistance is a short signal. In this case, if resistance 115.10 is being tested, so a short signal would exist.

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial