pool ads

pool adsRite Aid Corporation’s (NYSE: RAD) Merger with Albertsons Is Good for Shareholders

Rite Aid Corporation (NYSE: RAD) recently announced a merger with the private US supermarket chain Albertsons in a deal that would see its shareholders get 1 share of Albertsons and $1.83 in cash for every 10 Rite Aid shares. Most analysts believe that this is a raw deal for Rite Aid shareholders as a deeper analysis of the deal reveals that it values each Rite Aid share at about $2.50, which is a slight premium on its current price.

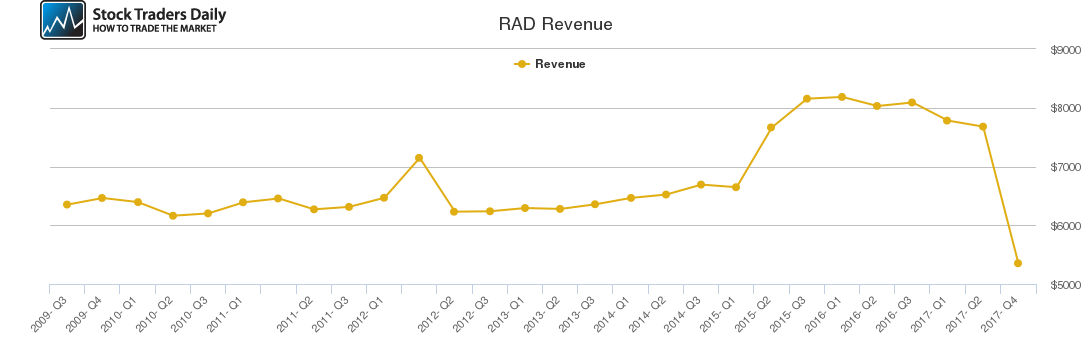

There are several reasons that lead us to the conclusion that the proposed merger with Albertsons in a good deal for Rite Aid shareholders. Firstly, our analysis of the company’s performance indicates that its revenues have been declining since Q3 2016, and that it registered a major decline in revenues in Q3 and Q4 2017, which attests to the drug store chain’s current predicament.

Review Our Rite Aid Trading Plans Here.

The company’s stock price has also been declining since Q2 2015 when it was trading at a high of $8.69 to reach the current price of $2.08. The chances of the company’s stock price recovering to its previous high is highly unlikely given the stiff competition that exists in the US pharmacy industry and the consolidation currently going on in the industry.

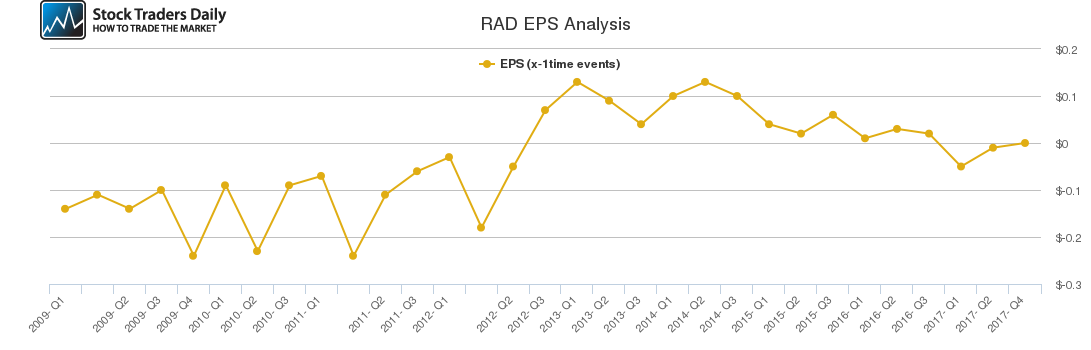

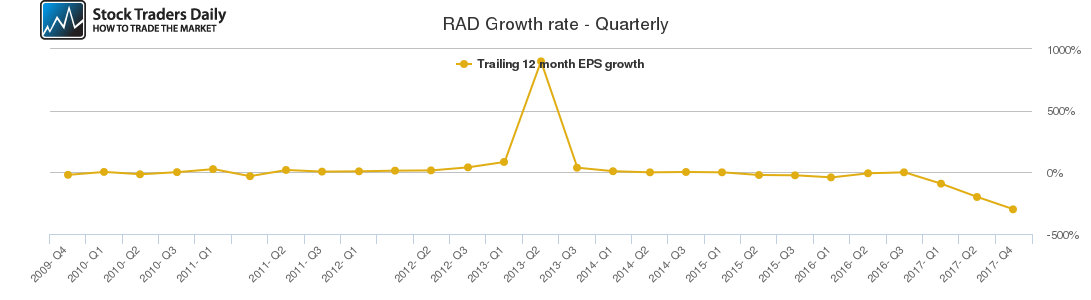

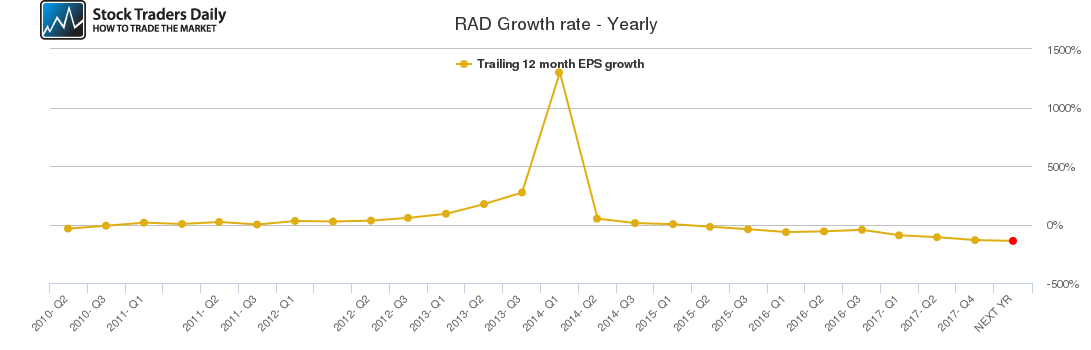

Our analysis also reveals that the drug store chain has not recorded positive quarterly growth since Q3 2016, which marked the start of its current decline, and led to a sustained decline in quarterly growth. The company has recorded negative annual growth rates from Q2 2015 and this trend has persisted to date and is unlikely to change in the near future.

Rite Aid currently performs much poorly than its larger competitors CVS Health Corp (NYSE: CVS) and Walgreens Boots Alliance Inc (NASDAQ: WBA). There is minimal likelihood that the company can reach or surpass the performance of its competitors in the near future by going it alone and rejecting the merger offer. There is also the emerging threat of Amazon.com, Inc. (NASDAQ: AMZN), which recently got regulatory approval to enter the pharmacy business.

Based on the technical data and associated charts at the time this article was written, Stock Traders Daily has provided detailed trading plans, with integrated risk controls, to its clients. These plans will change in real time as prices move. To receive an update or to review the detailed trading plans associated with this data please review our Real Time Trading Report for RAD.

Technical Summary

| Term → | Near | Mid | Long |

|---|---|---|---|

| Rating | Weak | Weak | Neutral |

| P1 | 1.81 | 1.66 | 1.16 |

| P2 | 2.00 | 1.78 | |

| P3 | 0 | 2.36 | 2.51 |

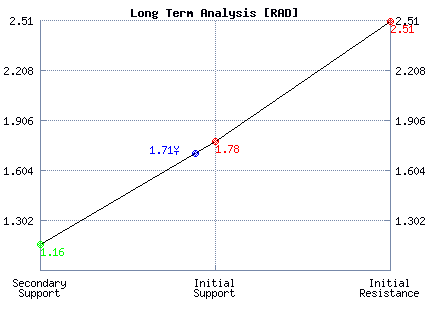

Support and Resistance Plot Chart for RAD

Long Term Trading Plans for RAD

March 14, 2018, 8:40 am ET

The technical Summary and associated Trading Plans for RAD listed below will help you make important timing decisions for your trades. This data is based on our proprietary analysis for RAD. In addition we offer Market Timing Models and Stock Filters in the links above which may increase the proficiency of the decisions you make.

RAD - (Long) Support Plan

Buy over 1.16 target 1.78 stop loss @ 0.9.

The technical summary data tells us to buy RAD near 1.16 with an upside target of 1.78. This data also tells us to set a stop loss @ 0.9 to protect against excessive loss in case the stock begins to move against the trade. 1.16 is the first level of support below 1.71 , and by rule, any test of support is a buy signal. In this case, support 1.16 would be being tested, so a buy signal would exist.

RAD - (Short) Resistance Plan

Short under 1.78 target 1.16 stop loss @ 2.04.

The technical summary data is suggesting a short of RAD as it gets near 1.78 with a downside target of 1.16. We should have a stop loss in place at 2.04 though. 1.78 is the first level of resistance above 1.71, and by rule, any test of resistance is a short signal. In this case, if resistance 1.78 is being tested, so a short signal would exist.

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial