pool ads

pool adsThe Coca-Cola Co (NYSE: KO) Has To Adapt To Changing Consumer Preferences

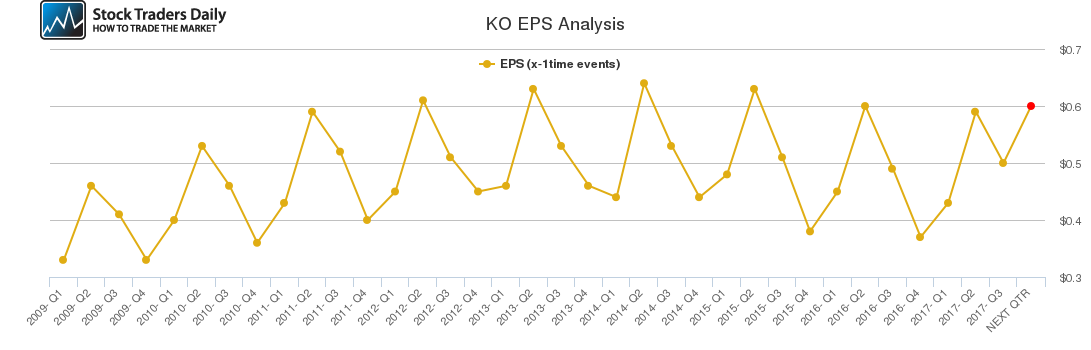

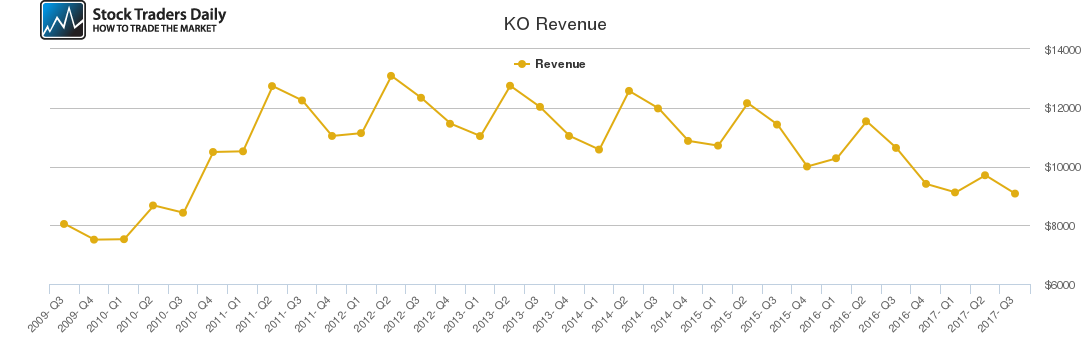

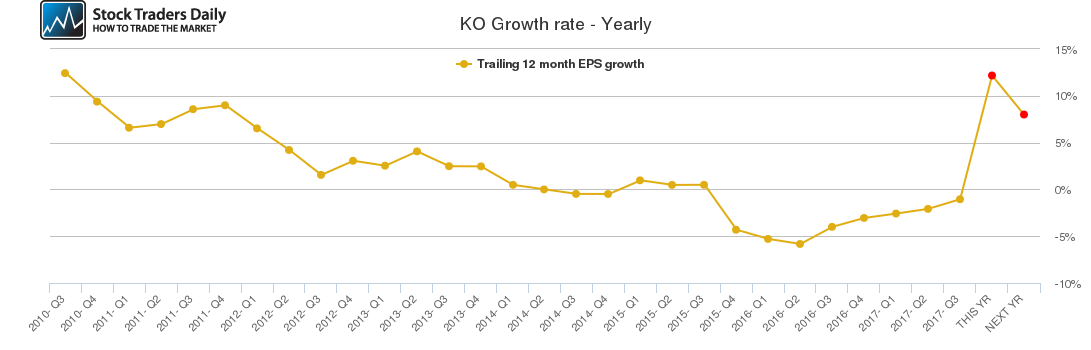

The Coca-Cola Co (NYSE: KO) has had a hard time growing its revenues for the past several years given that the charts below reveal that the company’s revenues have been declining since Q2 2012. The non-alcoholic beverage manufacturer’s declining revenues are largely attributed to declining sales of its popular Coke and Diet Coke drinks as consumers shift towards healthier beverages.

The company has strived to generate sales from its other beverage brands including Sprite and Fanta, but given that the Diet Coke beverage contributes a substantial portion of the company’s sales, the other beverages have not fully filled the gap left by Diet Coke. The declining sales volumes from its most popular drink have had a negative impact on Coca-Cola’s top and bottom lines, which has forced the company to explore other ways of generating revenues.

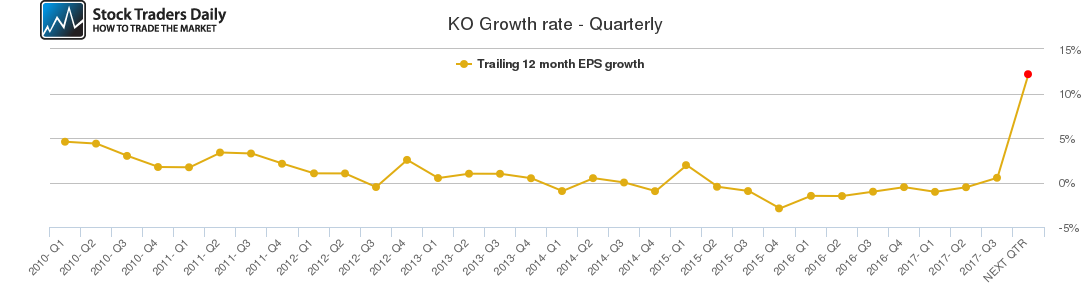

The company’s fourth quarter results are expected to reveal that the company’s growth rate expanded significantly on both a quarterly and annual basis. Some of the major reasons for the growth expansion include the company’s pricing mix, which have allowed the company to raise prices for many of its products in order to generate more revenue.

However, the pricing mix strategy cannot work effectively over the long-term as there is a limit to how much consumers are willing to pay for non-alcoholic beverages. The company refreshed its product mix earlier this year and although this move will not have an impact on Q4 results, it might have a solid impact on 2018 revenues.

Based on the technical data and associated charts at the time this article was written, Stock Traders Daily has provided detailed trading plans, with integrated risk controls, to its clients. These plans will change in real time as prices move. To receive an update or to review the detailed trading plans associated with this data please review our Real Time Trading Report for Coca-Cola.

Technical Summary

| Term → | Near | Mid | Long |

|---|---|---|---|

| Rating | Strong | Neutral | Neutral |

| P1 | 43.82 | 42.97 | 44.23 |

| P2 | 44.60 | 45.72 | 46.18 |

| P3 | 45.45 | 48.26 | 47.99 |

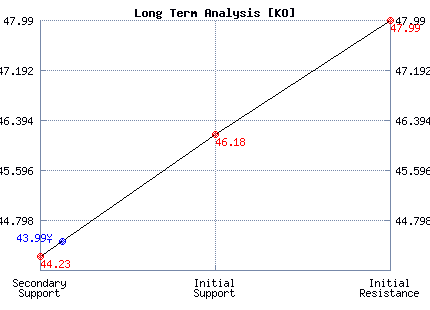

Support and Resistance Plot Chart for KO

Long Term Trading Plans for KO

February 21, 2018, 11:51 am ET

The technical Summary and associated Trading Plans for KO listed below will help you make important timing decisions for your trades. This data is based on our proprietary analysis for KO. In addition we offer Market Timing Models and Stock Filters in the links above which may increase the proficiency of the decisions you make.

KO - (Long) Support Plan

There is no current Support Plan to trigger a buy of this stock at this time. This usually means that there are no clear support levels at this time, so buying the stock as it falls could be considered catching a falling knife. Buy signals only exist if resistance breask higher.

This often is a signal that the stock you are watching is weak. Waiting for a turn higher may be more intelligent than trying to catch a falling knife. In any case, new support levels are usually revised to the database at the beginning of the next trading session.

KO - (Short) Resistance Plan

Short under 44.23, target n/a, stop loss @ 44.49.

The technical summary data is suggesting a short of KO as it gets near 44.23, but the downside target is not available from the current data. This tells us to hold that position if it is triggered until a new downside target has been established (updates occur at the beginning of every trading session) or until the position has been stopped. The summary data tells us to have a stop loss in place at 44.49. 44.23 is the first level of resistance above 43.99, and by rule, any test of resistance is a short signal. In this case, if resistance 44.23 is being tested, so a short signal would exist.

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial