pool ads

pool adsThe General Electric Company (NYSE: GE) Is a Long Way Past Its Glory Days

Recent media reports reveled that the former CEO of the General Electric Company (NYSE: GE) Jeff Immelt did not like hearing bad news. According to company insiders, Mr. Immelt always preferred to stay optimistic and talk about opportunities and was reluctant to deliver bad news.

Mr. Immelt’s attitude created a culture that shunned transparency at the massive conglomerate, which was a major reason why the company’s board of directors was largely unaware of the many problems facing the company. The appointment of John Flannery as CEO of the company last year was a decision that was made by the board without them being fully aware of the problems facing the company.

Review Our GE Trading Plans Here.

Many analysts have raised questions as to whether Mr. Flannery can implement the radical changes needed at the company in order to transform its corporate culture given that he worked under Mr. Immelt. At Stock Traders Daily, we focus on trading stocks based on their daily price movements using risk-controlled strategies that help our subscribers profit handsomely, while at the same time limiting their risk exposure.

Our combined analysis of the company indicates that its stock price has been on a downtrend since December 2016 and is at lows last witnessed in Q4 2011. The company’s poor run is likely to persist this year given that it currently undergoing a massive restructuring and divestiture process in efforts to return to profitability.

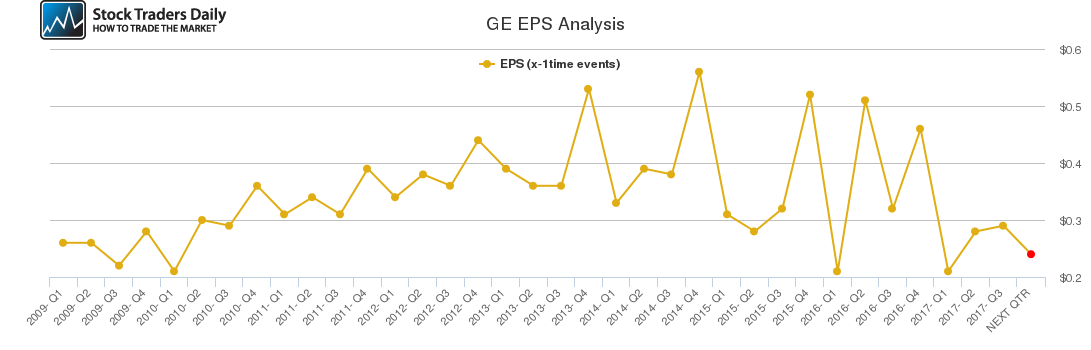

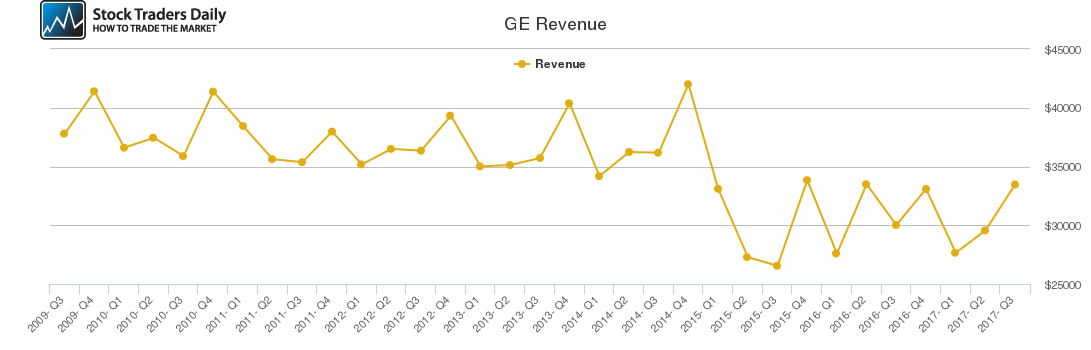

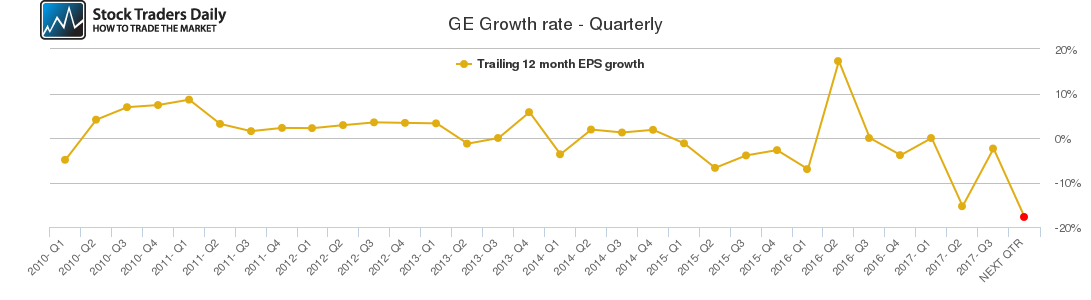

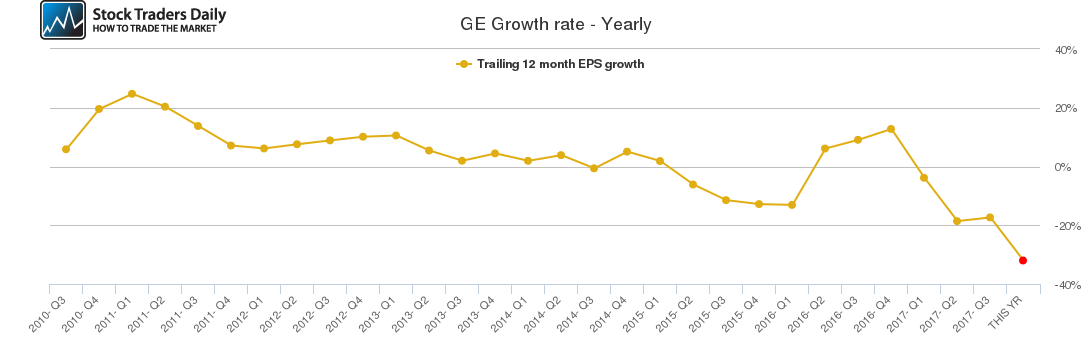

The conglomerate’s quarterly growth metric has been declining since it peaked in Q2 2016 and this trend is unlikely to change given the downward revision of base segment performance in 2017. The annual growth figures have also been declining in line with quarterly revenue and this trend is expected to continue in calendar 2018 despite the company’s management maintaining the forward guidance for this year.

In order for GE to transform, it requires a leader with a different approach to Mr. Immelt’s perpetual optimism, yet it is not clear if Mr. Flannery is the right individual to drive cultural change at GE.

Based on the technical data and associated charts at the time this article was written, Stock Traders Daily has provided detailed trading plans, with integrated risk controls, to its clients. These plans will change in real time as prices move. To receive an update or to review the detailed trading plans associated with this data please review our Real Time Trading Report for GE.

Technical Summary

| Term → | Near | Mid | Long |

|---|---|---|---|

| Rating | Strong | Weak | Neutral |

| P1 | 14.05 | 12.65 | ERR |

| P2 | 14.41 | 14.32 | 0 |

| P3 | 14.72 | 16.05 | 0 |

Support and Resistance Plot Chart for GE

Long Term Trading Plans for GE

March 7, 2018, 12:44 pm ET

The technical Summary and associated Trading Plans for GE listed below will help you make important timing decisions for your trades. This data is based on our proprietary analysis for GE. In addition we offer Market Timing Models and Stock Filters in the links above which may increase the proficiency of the decisions you make.

GE - (Long) Support Plan

Buy over target n/a stop loss @ -0.26.

The technical summary data tells us to buy GE near , but there is no current upside target from the summary table. In this case we should wait until either an update to the summary table has been made (which usually happens at the beginning of every trading day), or until the position has been stopped. The data does tell us to set a stop loss -0.26 to protect against excessive loss in case the stock begins to move against the trade. is the first level of support below 14.45, and by rule, any test of support is a buy signal. In this case, if support is being tested, a buy signal would exist.

GE - (Short) Resistance Plan

NONE .

There are no current resistance levels from the summary table, and therefore there are no Short resistance Plans which tell us to short upon tests of resistance. Resistance levels have broken higher and unless the stock reverses lower and below support levels again short positions look risky.

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial