pool ads

pool adsWill Advanced Micro Devices, Inc. (NASDAQ: AMD) Keep Growing Despite Crypto Crash?

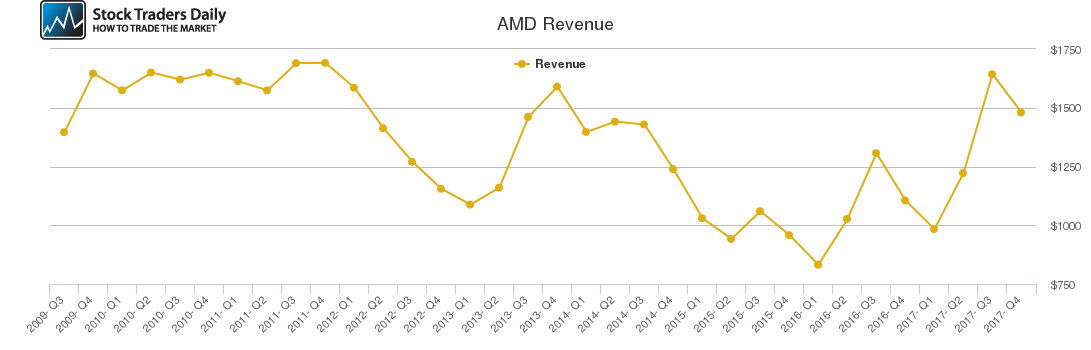

Advanced Micro Devices, Inc. (NASDAQ: AMD) stock has dropped significantly in recent weeks following developments in the cryptocurrency space including massive corrections in Bitcoin. The cryptocurrency market has undergone a massive decline from the highs hit in mid-January with many of the popular cryptos declining significantly and advertising platforms such as Facebook, YouTube, Google, and Twitter banning crypto-related ads.

It is truly a trying time for most cryptocurrency investors and given that AMD generated a portion of its revenues from selling graphics processing units (GPUs) to crypto miners, this is what has caused the recent sell-off in AMD stock. The increasing competition in the GPU market for mining Ethereum and Bitcoin among other cryptos coupled with slowing demand has contributed to the negative investor sentiment towards AMD.

Review Our AMD Trading Plans Here.

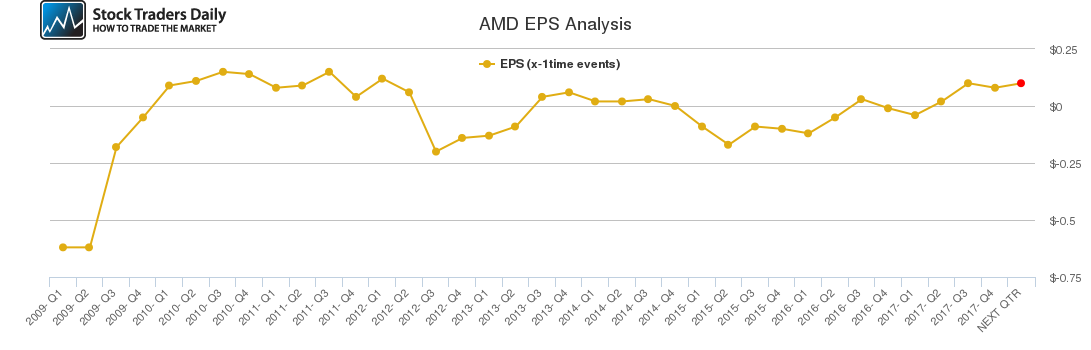

Our combined analysis of the company indicates that earnings and revenues in Q4 2017 declined significantly despite the fourth quarter being one of its traditionally strong quarters. However, the company outlined strong guidance for Q1 2018 and for the full-year results with its gross margins expected to come in above 36%.

Further technical analysis of the company indicates that its quarterly growth rate has risen steadily from Q2 2016 and this trend is expected to continue this year. The same trend applies to its annual growth rate, which is expected to increase this year before declining next year. The company also expects to beat its 2017 full year returns by about 200 basis points, which attests to the management’s belief in the company’s future.

Other factors that could contribute to AMD’s performance this year include the introduction of new products such as Rayzen processors for laptops among others. The company’s management is also keen on reducing operating expenses, which is likely to contribute significantly to the company’s bottom line.

Although the state of the cryptocurrency market is quite unclear at the moment, we believe that even if the company was to lose its entire market share in this market, which is highly unlikely, it would still be profitable.

Based on the technical data and associated charts at the time this article was written, Stock Traders Daily has provided detailed trading plans, with integrated risk controls, to its clients. These plans will change in real time as prices move. To receive an update or to review the detailed trading plans associated with this data please review our Real Time Trading Report for AMD.

Technical Summary

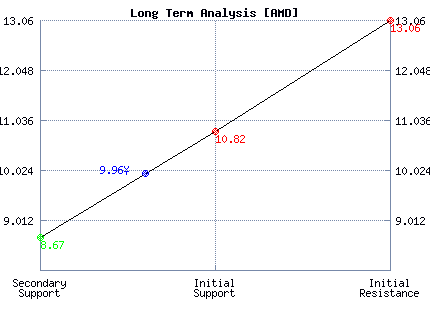

| Term → | Near | Mid | Long |

|---|---|---|---|

| Rating | Strong | Weak | Neutral |

| P1 | 9.36 | 8.85 | 8.67 |

| P2 | 9.78 | 10.29 | 10.82 |

| P3 | 10.16 | 11.75 | 13.06 |

Support and Resistance Plot Chart for AMD

Long Term Trading Plans for AMD

April 11, 2018, 9:53 am ET

The technical Summary and associated Trading Plans for AMD listed below will help you make important timing decisions for your trades. This data is based on our proprietary analysis for AMD. In addition we offer Market Timing Models and Stock Filters in the links above which may increase the proficiency of the decisions you make.

AMD - (Long) Support Plan

Buy over 8.67 target 10.82 stop loss @ 8.41.

The technical summary data tells us to buy AMD near 8.67 with an upside target of 10.82. This data also tells us to set a stop loss @ 8.41 to protect against excessive loss in case the stock begins to move against the trade. 8.67 is the first level of support below 9.96 , and by rule, any test of support is a buy signal. In this case, support 8.67 would be being tested, so a buy signal would exist.

AMD - (Short) Resistance Plan

Short under 10.82 target 8.67 stop loss @ 11.08.

The technical summary data is suggesting a short of AMD as it gets near 10.82 with a downside target of 8.67. We should have a stop loss in place at 11.08 though. 10.82 is the first level of resistance above 9.96, and by rule, any test of resistance is a short signal. In this case, if resistance 10.82 is being tested, so a short signal would exist.

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial