Will Home Depot Inc (NYSE: HD) Continue To Outperform Other Retailers?

Home Depot Inc (NYSE: HD) recently reported its Q4 2017 earnings where it beat analysts’ expectations by a good margin, which led to the stock rallying higher. However, the retailer has retraced some of its gains following a widespread sell off in the retail industry triggered by weak Walmart Inc (NYSE: WMT) results.

Our analysis of the company’s stock price indicates that it has been rising for the past five years since Q2 2014 when the stock was trading in the range of $75-$80. The company’s stock price crossed the crucial $200 mark recently, but has since given back some of its gains to trade at $183 at the time of writing, which is still more than double its 2014 price.

Review Our Home Depot Trading Plans Here.

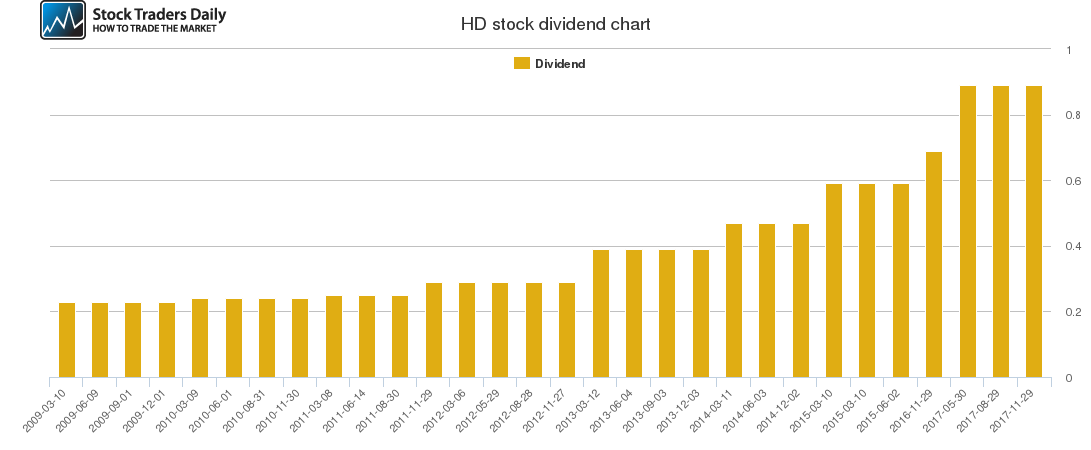

It is easy to argue that the retailer is a mature company operating in a mature industry, which nonetheless has not stopped it from generating an impressive return for investors. The question on most investors’ minds is whether the home improvements supplier has more upside potential.

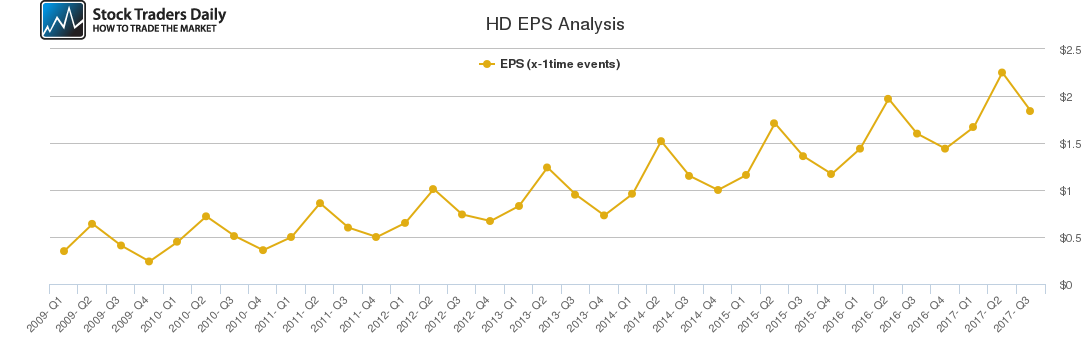

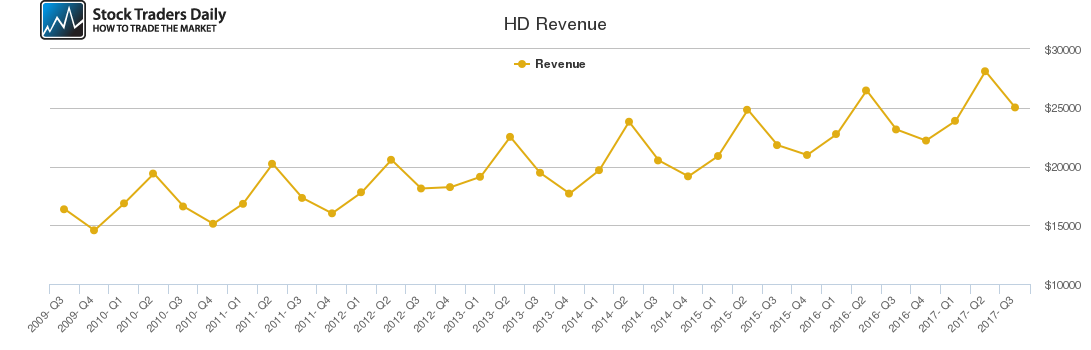

Our charts indicate that the company’s fourth quarter revenues were much lower than the Q3 and Q2 revenues, which was expected. However, Q4 2017 revenues were much higher than revenues for Q4 2016, which is part of the reasons for the stock’s rally. The retailer also reported positive comparable sales growth at its US stores and announced that it would open three new stores this year.

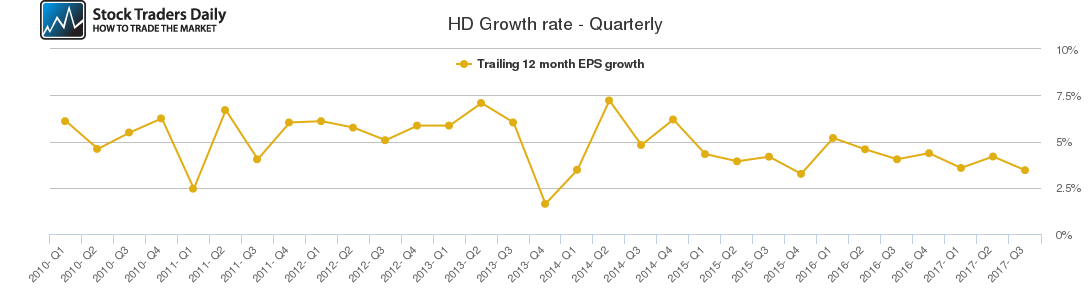

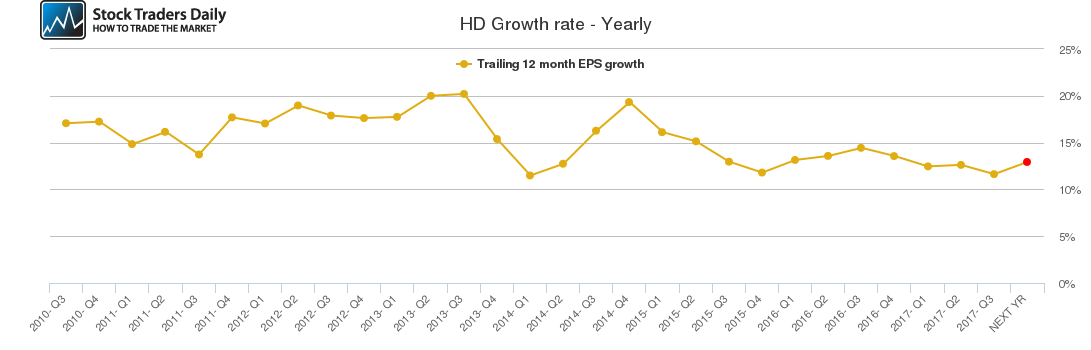

Our combined analysis indicates that the retailer’s annual growth rate is likely to expand this year, which could mean that the retailer is likely to benefit from higher demand for new housing in the USA. The retailer’s quarterly growth rate is likely to expand at a slower pace as compared to previous quarters due to the maturity of the home improvement industry.

Some of the headwinds facing the retailer include the lack of store growth, the quantitative tightening cycle being implemented by the Federal Reserve, the Amazon threat, and a likely change in management.

Based on the technical data and associated charts at the time this article was written, Stock Traders Daily has provided detailed trading plans, with integrated risk controls, to its clients. These plans will change in real time as prices move. To receive an update or to review the detailed trading plans associated with this data please review our Real Time Trading Report for HD.

Technical Summary

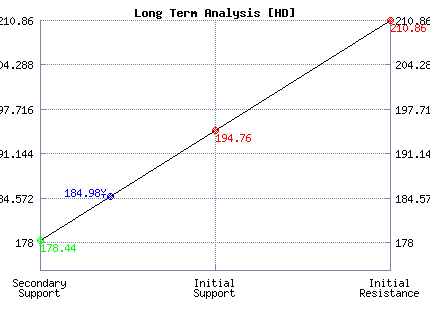

| Term → | Near | Mid | Long |

|---|---|---|---|

| Rating | Neutral | Weak | Neutral |

| P1 | 182.54 | 174.93 | 178.44 |

| P2 | 184.93 | 193.01 | 194.76 |

| P3 | 189.63 | 210.05 | 210.86 |

Support and Resistance Plot Chart for HD

Long Term Trading Plans for HD

March 1, 2018, 12:51 pm ET

The technical Summary and associated Trading Plans for HD listed below will help you make important timing decisions for your trades. This data is based on our proprietary analysis for HD. In addition we offer Market Timing Models and Stock Filters in the links above which may increase the proficiency of the decisions you make.

HD - (Long) Support Plan

Buy over 178.44 target 194.76 stop loss @ 178.18.

The technical summary data tells us to buy HD near 178.44 with an upside target of 194.76. This data also tells us to set a stop loss @ 178.18 to protect against excessive loss in case the stock begins to move against the trade. 178.44 is the first level of support below 184.98 , and by rule, any test of support is a buy signal. In this case, support 178.44 would be being tested, so a buy signal would exist.

HD - (Short) Resistance Plan

Short under 194.76 target 178.44 stop loss @ 195.02.

The technical summary data is suggesting a short of HD as it gets near 194.76 with a downside target of 178.44. We should have a stop loss in place at 195.02 though. 194.76 is the first level of resistance above 184.98, and by rule, any test of resistance is a short signal. In this case, if resistance 194.76 is being tested, so a short signal would exist.

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial