pool ads

pool adsA Head and Shoulders Pattern in ProShares Ultra DJ-UBS Crude Oil (NYSEARCA:UCO)

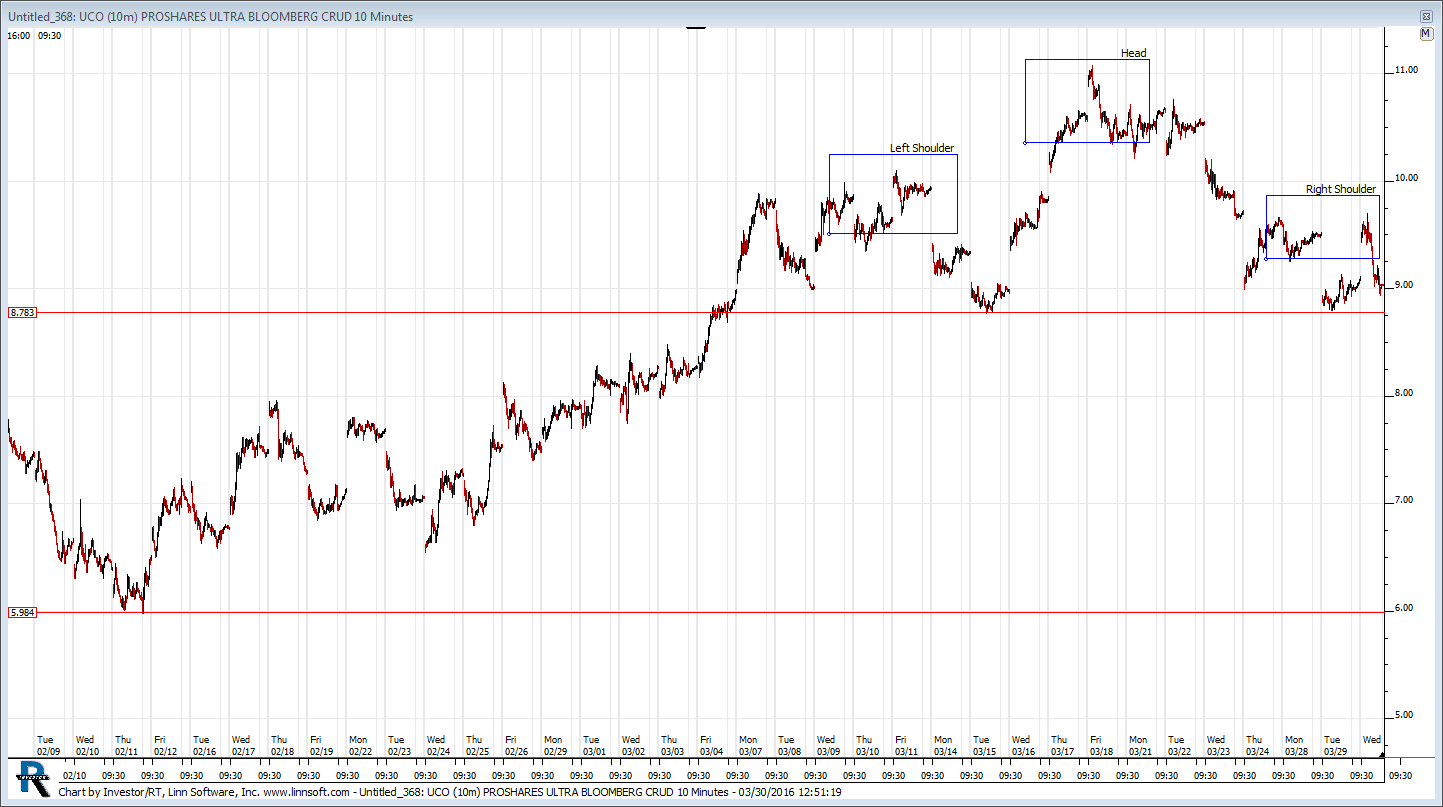

A traditional head and shoulders formation has developed in shares of ProShares Ultra DJ-UBS Crude Oil (NYSEARCA:UCO) and that is important to recognize as it largely parallels the direction of oil prices. I will describe the formation and the actionable trades that have already developed, including the risks that this observation portends.

Before I discuss this traditional head and shoulders formation it is important to understand that head and shoulders formations can come in different shapes and sizes, some are inverted too, but this one is much more traditional in nature.

One could argue that this pattern actually began to develop on February 11, but the left hand shoulder of this pattern surfaced on March 11, illustrated by the blue rectangular box in the graph. This left hand shoulder was followed by a head, which came about one week later, and then a right shoulder which followed about 10 days after that. It's important to notice that the right hand shoulder is lower than the left hand shoulder as well.

In addition, we have a clear neutral support line in shares of UCO, in fact we have two of them, but the first one is much more important to immediate direction. Shares of UCO are very close to the first neutral support line and there is a wide gap between that first support line and the second one, so the risks here are clear. If the first level of support breaks a decline all the way to the second level of support would then be expected.

That illustrates the risk in shares of UCO right now, but the head and shoulders formation that has developed also suggests that a break below the first neutral support line is highly probable. This is extremely important to digest, and risk assessments are therefore equally as important to recognize.

The risks in this head and shoulders formation tell us that if the first level of support breaks, which is just under $9.00 per share, a decline all the way to the second level of neutral support is likely, which is just under $6.00 per share, equating to a material percentage decline.

How to trade this?

In the effort of full disclosure it's important to know that we trade not only UCO, but also Proshares Trust II (NYSEARCA:SCO), which is the inverse of UCO. Therefore, we trade on both sides of the fence from time to time. Recently, we sold UCO near $11.00, bought SCO as a swap, and then we swapped back when UCO was near $9.00 per share. That swap back happened before the second right hand shoulder developed.

With the development of that second right hand shoulder, we are back in SCO.

Ultimately, over longer-term periods of time, we believe that oil prices will continue to increase, and therefore we want to hold UCO, but overbought conditions in oil and our recognition that oil prices are being driven by traders who adhere to technical disciplines suggest that we can be highly profitable in trading these two opposite side ETFs in conjunction with correlated support and resistance levels and in this case a traditional head and shoulders formation.

All of this information has already been distributed to DIY clients at Stock Traders Daily and action has already been taken in the managed accounts managed by Thomas Kee at Equity Logic, and Thomas Kee currently owns shares of SCO, but with the intention of trading it when the technical parameters tell him to do so. Special reports on oil and our macroeconomic assessments can be found on our Home Page

Support and Resistance Plot Chart for

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial

Fundamental Charts for :